H-Mart opens the biggest market in US.

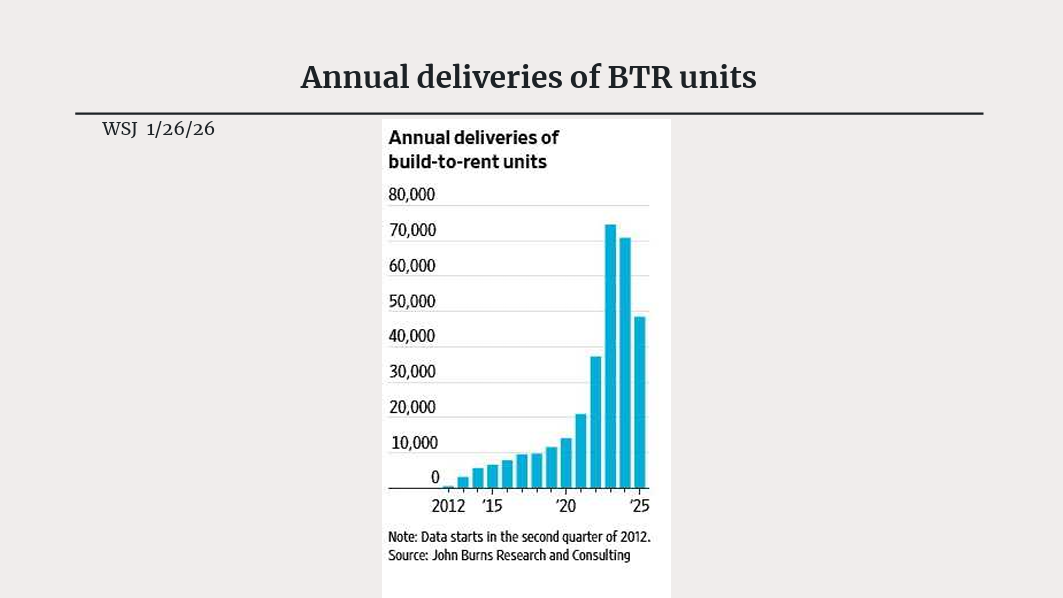

• The build-to-rent business is exempt from Trump’s executive order to restrict large investors from purchasing homes. So-called BTR developers build neighborhoods of new single-family homes specifically for the purpose of renting them out, either on their own or by selling the homes to institutional investors.

• It is a small but growing corner of the single-family rental industry. Build-to-rent has generally avoided American politicians’ ire because it allows institutional investors to own homes without competing against individual home buyers for the existing housing stock, like Invitation Homes and Pretium Partners.

• With members of the Senate preparing legislation to restrict investor activity in the housing market, many companies are pausing on new single-family rental deals until new rules are codified. But at least for now, BTR developers and investors are breathing a sigh of relief.

Housing-Investor Crackdown Helps Builders

• The build-to-rent business is exempt from Trump’s executive order to restrict large investors from purchasing homes. So-called BTR developers build neighborhoods of new single-family homes specifically for the purpose of renting them out, either on their own or by selling the homes to institutional investors.

• It is a small but growing corner of the single-family rental industry. Build-to-rent has generally avoided American politicians’ ire because it allows institutional investors to own homes without competing against individual home buyers for the existing housing stock, like Invitation Homes and Pretium Partners.

• With members of the Senate preparing legislation to restrict investor activity in the housing market, many companies are pausing on new single-family rental deals until new rules are codified. But at least for now, BTR developers and investors are breathing a sigh of relief.

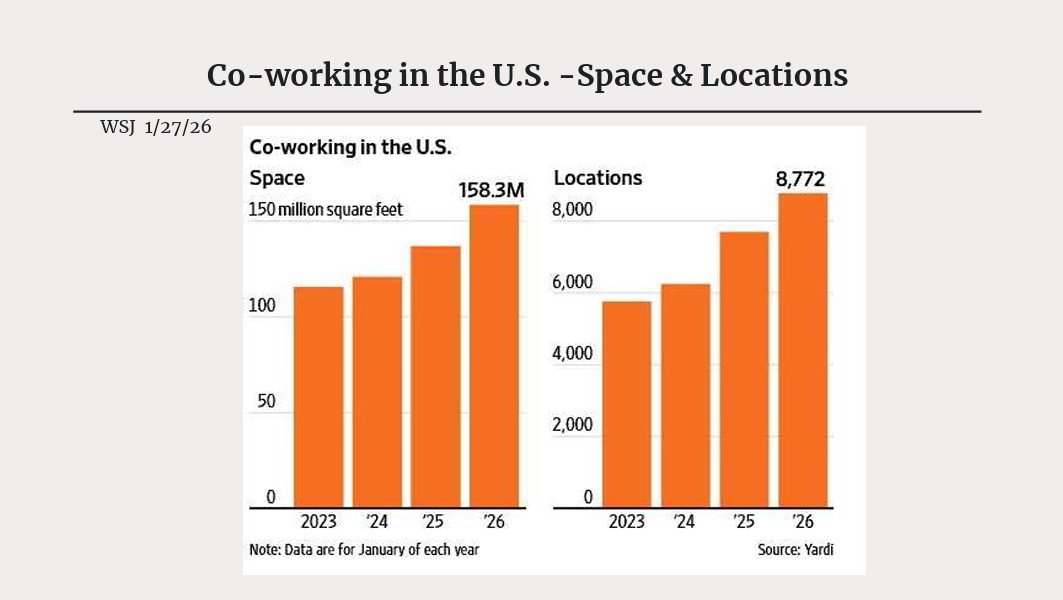

New Breed of Shared Offices Revitalizes CoWorking Market.

• By 2018, the industry leader WeWork occupied more Manhattan office space than any other company.

• Then co-working got leveled by the office market’s downturn when the pandemic upended demand for corporate space. Some of the industry’s largest players were forced to seek bankruptcy protection, including WeWork in 2023.

• Now, as companies adopt a mix of office and remote work, co-working is again one of the fastest-growing segments of the office market. Economic uncertainty and the rise of artificial intelligence are compelling more companies to embrace flexibility for their workspace.

• This time, it isn’t only smaller firms or entrepreneurs flocking to these shared conference rooms and cubicles. Some of the world’s largest companies are jumping on the coworking bandwagon, including Pfizer , Amazon.com , JPMorgan Chase, Lyft and Anthropic .

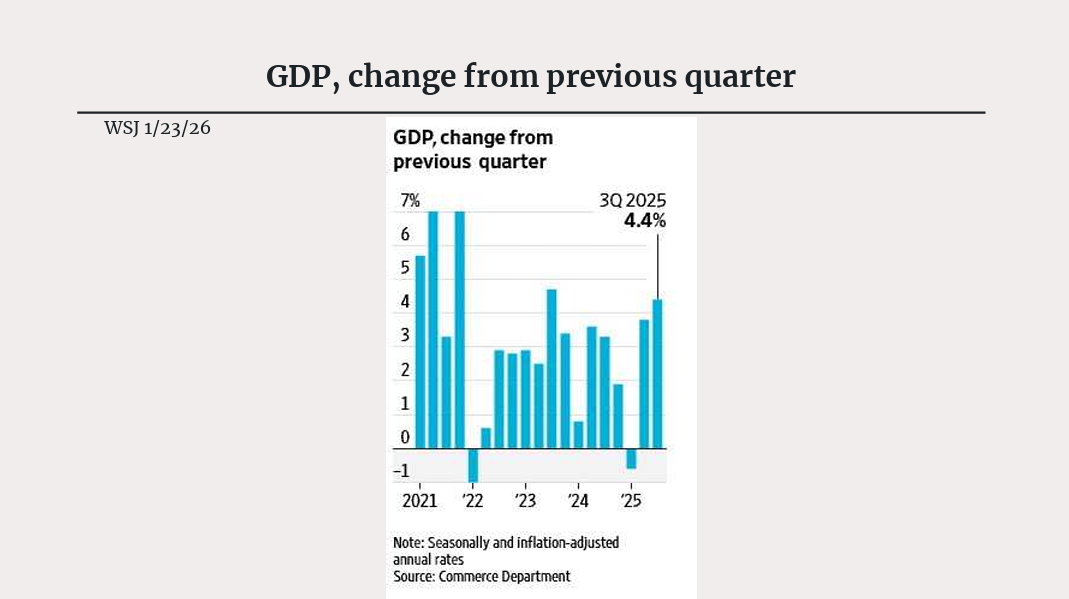

Updated GDP Confirms Strong 3Q Growth.

• A revised set of figures continued to show that U.S. economic growth powered ahead last summer, confirming an upswing that had surprised analysts in December.

• Gross domestic product grew at a 4.4% annualized rate between July and September, the Commerce Department said Thursday. That marked an acceleration from 3.8% in the three months prior, and from a slight economic contraction that began 2025. Initial numbers published in December had shown 4.3% third-quarter growth, which shows 0.1% increase from the forecast.

• New unemployment application was 201,500 and continued unemployment application ( more than 2 weeks) was 1,849,000.

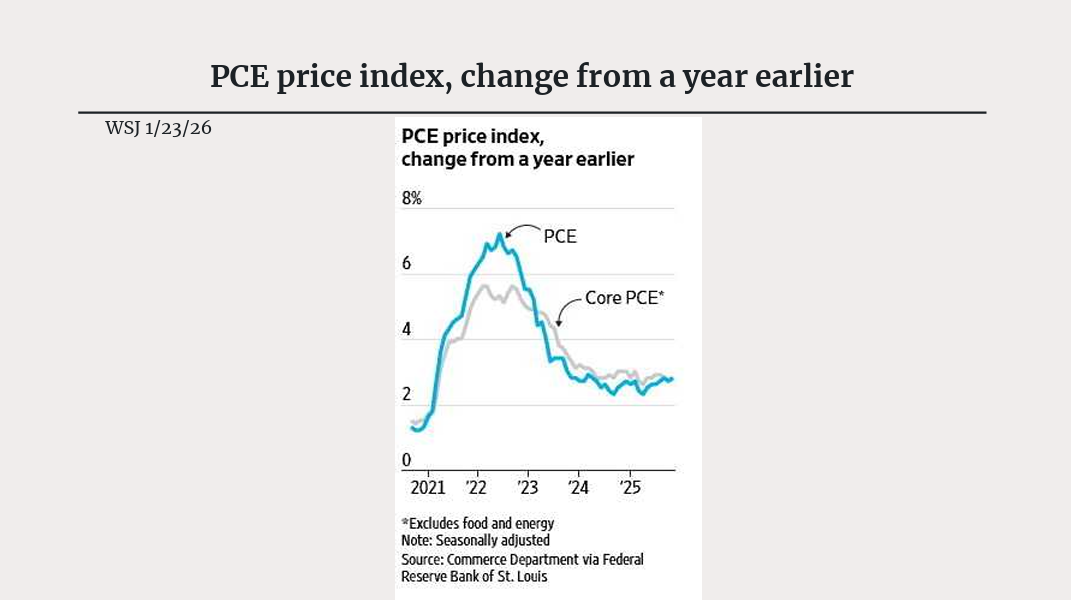

Inflation Gauge Holds Steady.

• The inflation gauge tracked by the Federal Reserve held steady between September and November last year, showing that price increases remained mildly elevated as 2025 wound down.

• The personal-consumption expenditures price index increased 0.2% in October and by another 0.2% in November, contributing to annual inflation of 2.8% in the 12 months through November, the Commerce Department said Thursday.

• Annual core PCE inflation, excluding volatile food and energy prices, also was 2.8% in November.

Gold Soars Past $5,000 for First Time

• Risk of government shutdown adds momentum to rally in precious metal.

• Gold broke past the $5,000an-ounce barrier, crossing the key level for the first time on Monday as worries about a U.S. government shutdown added fresh fuel to the metal’s red-hot rally.

• Just three months after hitting the once-unthinkable price of $4,000 a troy ounce, gold broke past the $5,000-anounce barrier, settling above the key level for the first time on Monday as worries about a U.S. government shutdown added fresh fuel to the metal’s red-hot rally. Gold settled up 2.1% to 5,079.70 a troy ounce.

• Goldman Sachs analysts last week raised their forecast for gold to reach $5,400 an ounce by the end of the year, up from $4,900 an ounce previously, citing central-bank buying and private-sector diversification into gold.

• Investors are worried lower bond yield, expensive stocks, President’s tariffs…

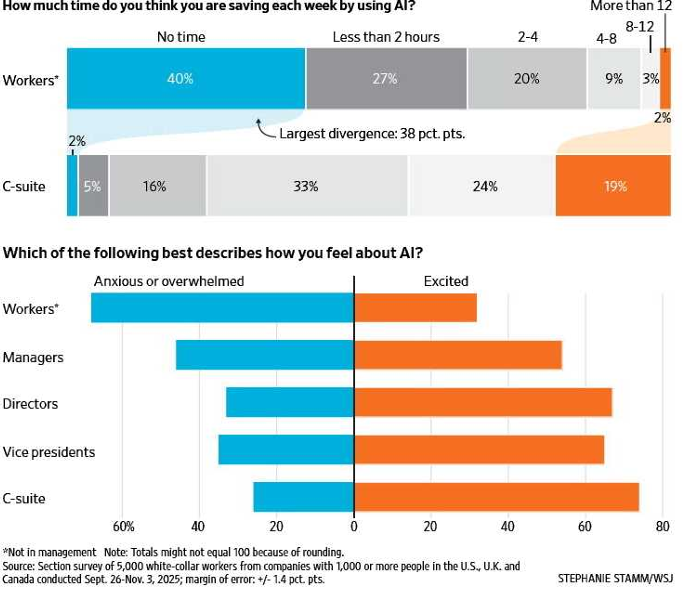

CEOs & Workers are sharply Divided on the benefits of AI.

• Employees say AI isn’t saving them much time in their daily work so far, and many report feeling overwhelmed by how to incorporate it into their jobs. Companies, meanwhile, are spending vast amounts on artificial intelligence, betting that the technology’s power to speed everything from sales to backoffice functions will usher in a new era of efficiency and profit growth.

• The gulf between senior executives’ and workers’ actual experience with generative AI is vast, according to a new survey from the AI consulting firm section of 5,000 white-collar workers.

• Two-thirds of nonmanagement staffers said they saved less than two hours a week or no time at all with AI. More than 40% of executives, in contrast, said the technology saved them more than eight hours of work a week.