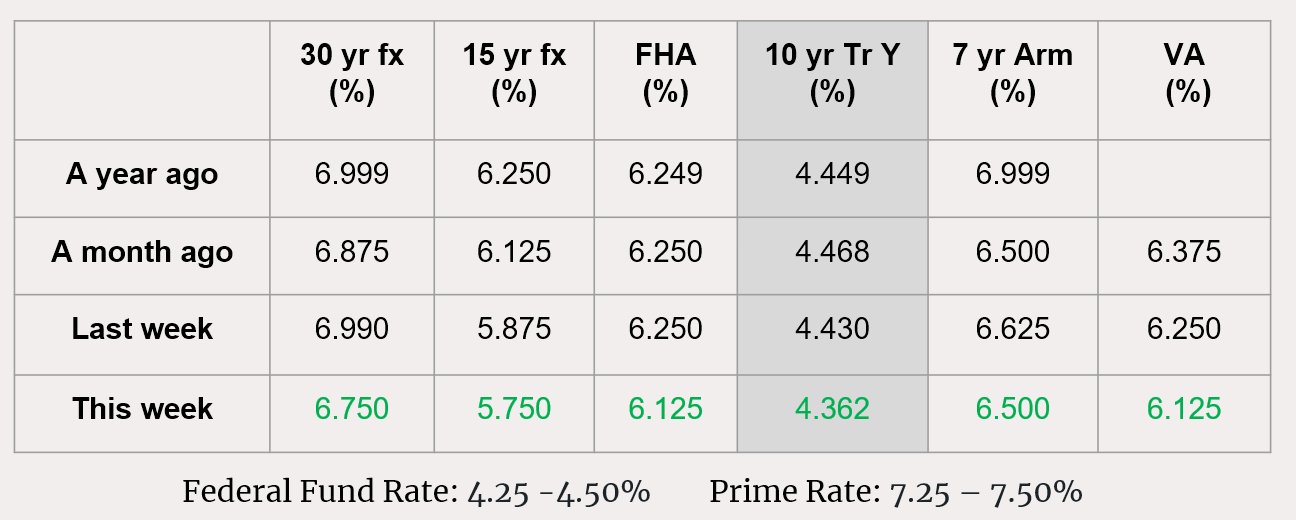

Mortgage Interest Rates Review

In NYC, ADU regulation announced.

뉴욕시, 추가주거시설 규정 발표

Korea Daily 7/22/25(Wed)

- According to Cranes NY, DOB has announced the detailed regulation and guidelines for ADU ( Ancillary Dwelling Unit) as a part of “City of Yes” package:

– Two exits are needed

– Zoning must be a single house or 2 –family house

– Less than 800 sf

– Basement, attached space, detached space, attics, etc

– Owner must lives in the house

– Sign must be displayed ( White background with Red lettering/5 inch

high)

- NYC anticipates providing additional 82,000 living units for the next 15 years.

- Online : rules.cityofnewyork.us/rule/proposed-rule-rules-relating-to-ancillary-dwelling-units-in-1-and-2-family-dwelling

Saudi Invest in Skyscraper Project

사우디 아라비아, 뉴욕에 마천루 프라젝에 투자

WSJ 7/8/25(Tue)

- Saudi Arabia’s government fund is taking a two-thirds stake in a site for a planned Manhattan skyscraper, the latest sign that foreign investors are flocking back to New York’s rapidly recovering real estate market.

- The Kingdom’s Public Investment Fund is teaming with Related Cos., which has said it is planning to build a 1,200-foot tower on the site. The New York developer and the Saudis own this site one block from Central Park, which was purchased last year for more than $600 million. The overall cost for the site and development is expected to be more than $1 billion.

- Foreign investors have been returning this year to New York City’s commercial-property market, which is the largest, most liquid and among the top performers in the U.S.

- The Saudi Public Investment Fund has assets of about $1 trillion, making it one of the world’s largest investors. It is one of the major overseas funds returning to New York.

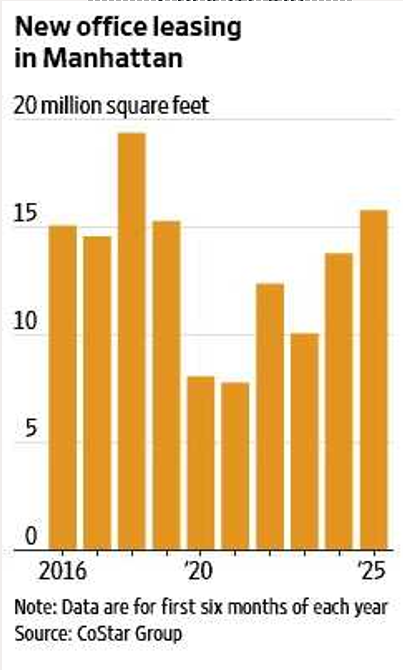

New Office Building in Manhattan

Metro Atlanta Shows Signs Of Cooling Off.

메트로 아틀란타, 열기가 식는 조짐…

WSJ 7/21/25(Mon)

- Since the invention of air conditioning, Atlanta has known one constant: growth. The region is finally cooling off.

- Census data show more people from within the U.S. left metro Atlanta than moved to it during the 12 months that ended in mid-2024. It was a modest decline, about 1,330 people. But it heralds a significant moment for the longtime growth magnet: This is the first time metro Atlanta lost domestic migrants since the Census Bureau started detailing these numbers three decades ago.

- There are other signs the city is losing its edge, including weak hiring among local employers and higher-than-average office vacancies. A 623-unit apartment complex in the city’s Buckhead neighborhood—a building once famous for an electronic sign that counted Atlanta’s expanding population— went into foreclosure last year.

- Since 1950, the region’s population has mushroomed almost 10-fold to 6.3 million and sprawled across 29 counties. The region averaged a net gain of about 33,000 domestic newcomers in the five years before Covid hit.

- The latest census metro-area estimates, which cover the 12 months ended June 30, 2024, still show a growing Atlanta region overall. That is because births outnumber deaths there, and because of what had been surging international immigration before President Trump took office.

- Whether that big-metro slowdown continues remains to be seen. But census data also indicate many smaller regions in the South—places like Huntsville, Ala., Wilmington, N.C., and Knoxville and Chattanooga in Tennessee—are picking up the slack. Their metros are all running ahead of pre-Covid trends.

Warehouse Vacancies Hit a Record.

웨어 하우스 공실률 최대

WSJ 7/10/25(Thu)

- More U.S. warehouse space is vacant than at any time in the past 11 years as companies hold off leasing new space amid rapidly changing trade policy.

- The average warehouse vacancy rate across the U.S. ticked up to 7.1% in the second quarter from 6.9% the previous quarter and 6.1% a year earlier, according to a new report from commercial real-estate services firmCushman & Wakefield.

- That marked the first time the vacancy rate surpassed 7% since 2014, as businesses rushed extra inventory into their existing warehouses earlier this year and then paused decision-making during the Trump administration’s on again, off-again tariff rollout.

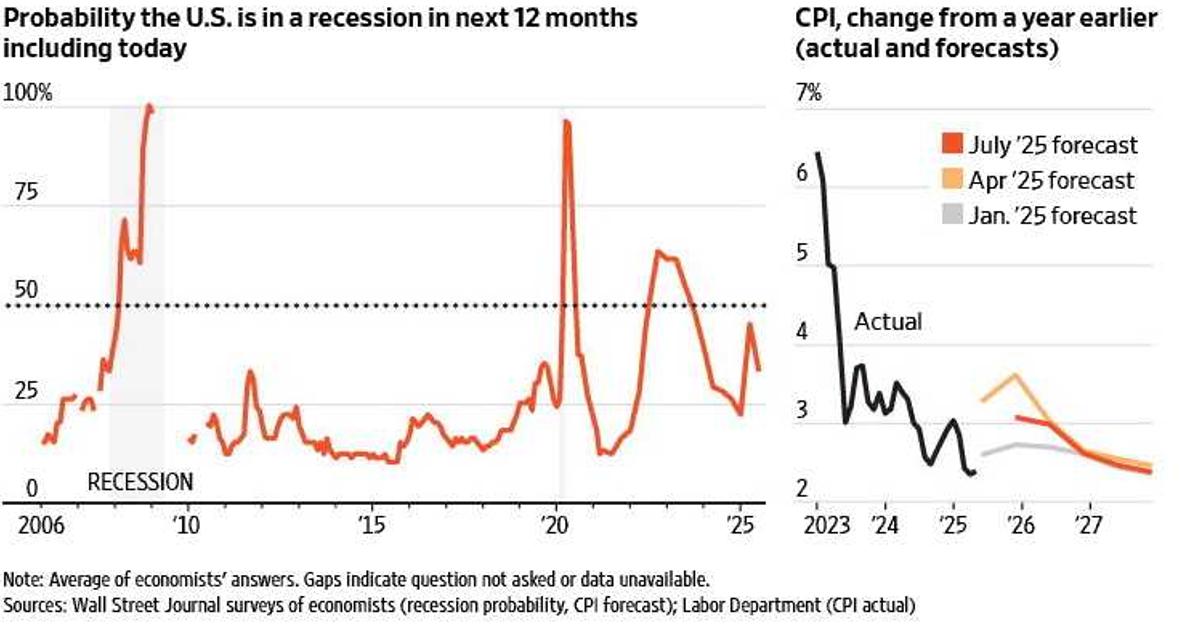

Recession Risk Seen Cooling Even Amid Turmoil on Tariffs

무역 전쟁속에서도, 경기침체 가능성은 약해짐

WSJ 7/14/25(Mon)

- The economic fallout from President Trump’s policies may prove less dire than feared. Economists expect stronger growth and job creation, lower risk of recession and cooler inflation than they did three months ago, according to The Wall Street Journal’s quarterly survey of professional forecasters.

- On average they put the probability of recession in the next 12 months at 33%, down from 45% in April, but higher than January’s 22%.

- “Despite numerous headwinds, the U.S. economy is proving stubbornly resilient,” said Chad Moutray, chief economist at the National Restaurant Association. “Consumers are continuing to spend, but the mood has clearly shifted from bold to careful.”

Recession Probability & CPI

WSJ 7/14/25

Challenger to FICO Scores Approved for Use in Mortgages.

모기지 이자률, FICO 점수외에 다른 점수도 기준?

WSJ 7/9/25(Wed)

- Shares ofFair IsaacCorp., the company behind the FICO credit score, sank nearly 9% on Tuesday after a federal agency greenlighted the use of its biggest rival in mortgage underwriting.

- Mortgage lenders can now use theVantageScore4.0 model when originating loans backed by Fannie Mae and Freddie Mac, which amount to nearly half of recent mort-gage originations.

- Lenders can now choose to use the VantageScore 4.0 model or the FICO 10T model when issuing loans that get sold to Fannie and Freddie, according to their regulator, the Federal Housing Finance Agency. The two mortgage giants package loans into bonds that get sold to investors with government backing, and their underwriting models are widely followed in the $13 trillion mortgage market.

- FHFA chief, Bill Pulte also prefers to VantageScore and favor to privatization of Fenie Mae and Freddi Mac. He is known as Little Trump.

The Inflation Risks of Firing Powell.

연준 의장을 축출에 따르는 인플레 위험

WSJ 7/21/25(Mon)

- The U.S. has endured inflationary shocks in the past few years: pandemic disruptions, massive fiscal stimulus, Russia’s invasion of Ukraine, an immigration clampdown, tariffs and soaring projections of national debt.

- Yet investors have expected that in a few years’ time inflation will be around 2%. The reason: They instinctively assume that no matter the shock, the Fed is there to keep inflation low, like the brakes on a car.

- If Trump succeeds in forcing out Fed Chair Powell,the Fed would no longer be an independent check on the government with inflation subordinated to other priorities, such as the cost of U.S. debt.

- The real consequences of a subservient Fed would show up gradually, once inflation pressures emerge and the Fed, fearful of crossing the president, fails to act. Investors and the public would no longer assume low inflation will prevail in the long run. And because expectations are self-fulfilling, inflation itself would grind higher.

Marekt-implied inflation rate in 3 – 4 years

Inflation Picks Up To 2.7% As Tariffs Seep In.

관세장벽 현실화 되면서 인플레이션, 2.7%

WSJ 7/16/25(Wed)

- Inflation picked up in June, a potential sign that companies are starting to pass tariff costs on to consumers.

- Consumer prices in June were up 2.7% from a year earlier, the Labor Department said Tuesday, accelerating from May’s 2.4% pace. That was in line with the expectations of economists surveyed by WSJ.

- Core inflation, which exclude volatile food and energy prices, was 2.9%, also in line with forecasts. Prices of furniture, toys and clothes— items that tend to be sensitive to tariffs—posted larger increases in June. At the same time, car prices unexpectedly fell. One possible explanation for the monthly drop in car prices, House said: Consumers moved planned purchases ahead to avoid expected tariffs, leading to lower demand and lower prices in June.

- “The more we keep adding things to the mix that make it hard to figure out—‘Are prices going to be rising or not?’— the more it’s just throwing more dirt back in the air,” Goolsbee said.