C Land News Brief

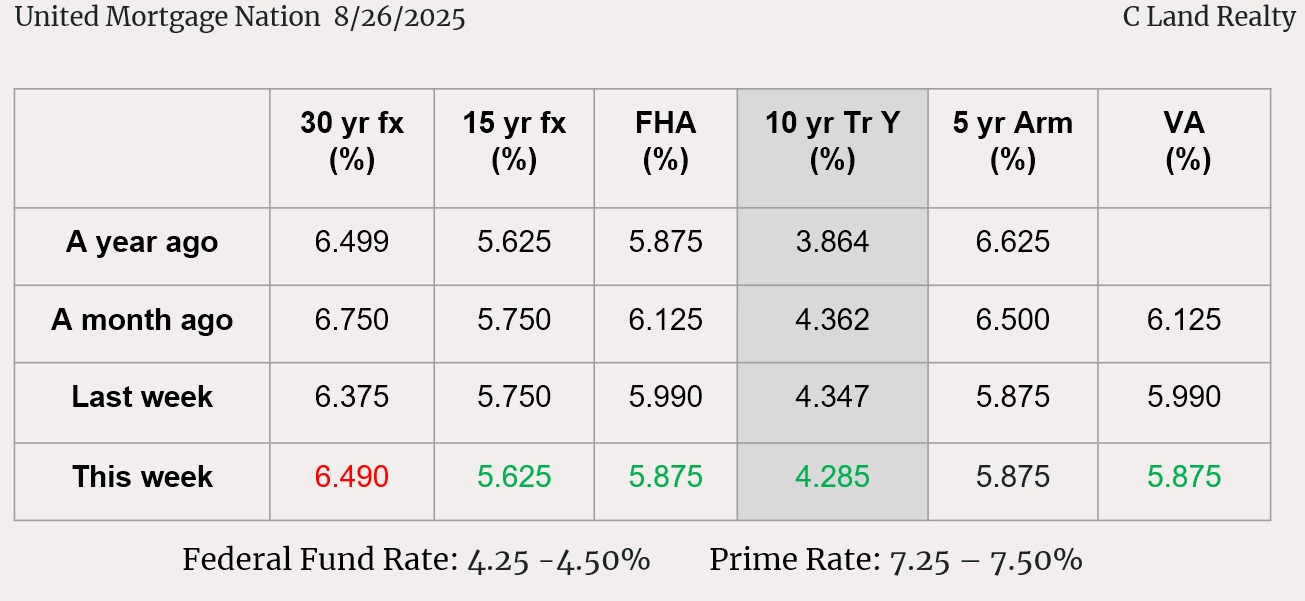

Mortgage Interest Rates Review

De-listing Increasing Sharply.

주택시장에서 매물회수 급증

Korea Daily 8/25/25(Mon)

- According to Realtor.com’s recent report, de-listed homes is up by 47%, compared to the same month of the year earlier. Also the number of de-listed homes between Jan and May is up by 35%, compared to the same period last year.

- This phenomena is related to the increased inventory in general. In June, the inventory increased 28% from a year ago and newly listed homes increased 8.8%, while increasing rate remains the same for last two months.

- The reason is the sellers have expected higher prices unrealistically, and then many disappointed home sellers have de-listed their homes, watching over the market.

- In June, the inventory increased 30% in the South, 38% in the West. Among the biggest 50 metro areas in U.S., Las Vegas increased th einventiry by 77.6% and 63.6% in Wasington D.C.

Residential Investors are Soaring.

주택시장 투자자 비중 27% 로 급등

Korea Daily 8/25/25(Mon)

- According to Batch Data’s recent report, investors in residential market takes up 26.9% in the 1st Qt. 2025 which is the highest for the last 5 years.

- Investors in residential market have purchased 265,000 homes in the 1st . Qt. which is 1.2% up from a year ago. The number of homes purchased didn’t increase much, but the market share of investors has increased sharply which means many real buyers has exited from the market.

- Among the total of 86M of single homes, it is estimated that 20% are owned by residential investors.

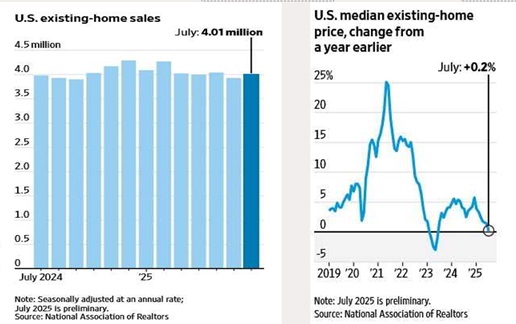

Home Sales Edge Up.

주택 판매 실적, 살짝 증가

WSJ 8/22/25(Fri)

- Sales of existing homes rose unexpectedly in July, raising hopes that the longstalled housing market may be improving and that activity can gain more momentum in the fall.

- Home sales were up 2% from the prior month to a seasonally adjusted annual rate of 4.01 million, the National Association of Realtors said Thursday.

- The pickup in July reflects that the pace of home-price growth has been slowing. Prices are falling in much of the country, and mortgage rates are easing.

- The housing market is stuck in its third straight year of depressed sales, but some analysts say the fall season could see sales accelerate to some degree.

Existing home sales and U.S.median prices

WSJ 8/22/25

Housing Starts Rise More than Expected.

주택 착공, 예상보다 좋아

WSJ 8/20/25(Wed)

- Housing construction in the U.S. jumped much more than expected last month, reflecting a recovery in the multifamily market as developers respond to demand for rental housing.

- Housing starts, a measure of home construction, were 12.9% higher in July compared with a year earlier, according to Census Bureau data on Tuesday. Economists surveyed by The Wall Street Journal had expected a 2.8% increase.

- Rental housing drove the big increase. Construction of projects with five units or more was 27.4% higher in July compared with last year, while starts of single-unit projects were 7.8% higher.

- Some of that growth is merely a return to normalcy after an abnormal pause in construction last summer when many builders were waiting for a potential rate cut in the fall.

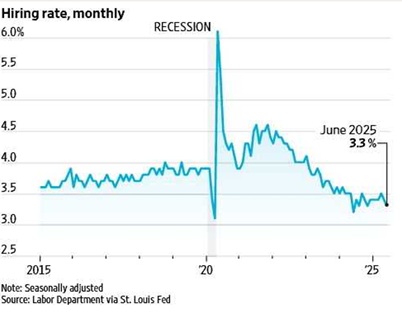

Stagnant Hiring is Rising Economic Hazard

정체된 고용이 경제 위기를 조장

WSJ 8/25/25(Mon)

- The good news is that unemployment remains low, and employers haven’t been all that interested in laying people off. The bad news is that companies haven’t been all that interested in hiring, either.

- This precarious situation means even a relatively small increase in layoffs could lead the economy to start shedding jobs—a process that can be difficult to reverse once it starts.

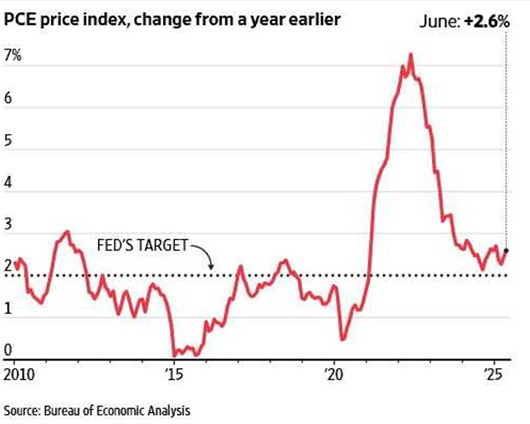

- This is why, while inflation is above the Fed’s 2% target, Fed Chair Jerome Powell on Friday signaled the central bank’s policymakers could cut rates when they meet in September.

- The pace of hiring has slowed markedly. In June, the hires rate—the number of hires as a share of overall U.S. employment—was just 3.3%, according to the Labor Department. That was below its level of 3.9% in February 2020, on the cusp of the Covid-19 pandemic, and much less than the 4.6% registered in November 2021, when the job market was surging back.

Hiring Rate, monthly

Powell Raises Hopes for a Rate Cut.

연준의장, 이자률 내리는 방향에 희망을…

WSJ 8/23/25(Sat)

- Federal Reserve Chair Jerome Powell opened the door for rate cuts next month when he said the labor market might be softening enough to rein in inflation that is being pushed up by tariffs.

- Throughout the year, Powell and his colleagues have held rates steady, pointing to a solid labor market and uncertainty over the inflation outlook, given large tariff hikes. But in a widely watched address at a conference in Wyoming on Friday, Powell suggested the outlook was changing in a direction that could justify resuming rate cuts.

- Markets cheered Powell’s speech, which blessed investor expectations of a September rate cut that had accumulated after disappointing downward revisions to payroll gains earlier this month. The Dow Jones Industrial Average, the S&P 500 and the Nasdaq composite all finished Friday with gains of roughly 1.5% to 2%.

PCE Price Index, change from a year ago

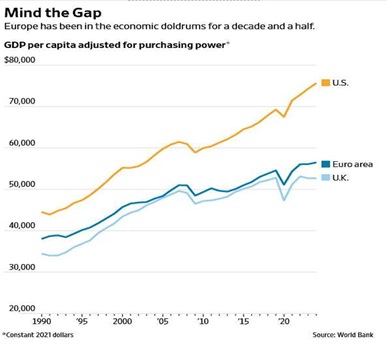

Europe is Losing.

- On May 13, Elon Musk’s SpaceX launched 28 satellites into orbit in a single day, one of over 100 successful U.S. orbital launches this year. China has sent more than 40 rockets into space since January. Russia, bogged down by war in Ukraine, has launched ten rockets.

- Europe, by contrast, has launched four. Even that is an improvement: For over a year, the continent relied on SpaceX to launch critical infrastructure.

- Falling behind in the space race is just one example of how Europe has lost its way. This extraordinary continent occupies just 4% of the planet’s landmass (not including Russia), yet it has shaped human history, for good and ill, more than any other region in the past 500 years. European nations conquered and administered as much as 80% of the planet, often violently. Their wars killed millions and redrew the global map. Europe was also the birthplace of modern capitalism and the industrial revolution, giving us cars, trains and penicillin. Its art and music still fill museums and concert halls around the world.

- ‘America innovates, China imitates, Europe regulates.‘

- Meanwhile, the current strategy of financing welfare spending with taxes and debt is running out of road. Tax revenue as a share of economic output is already around 38% in Germany, 43% in Italy and 44% in France, compared with 25% in the U.S., according to OECD data. The U.K.’s annual debt interest bill stands at nearly $150 billion, twice as much as defense. Borrowing costs have already risen in the U.K. as debt approaches 100% of yearly economic output.

GDP per capita