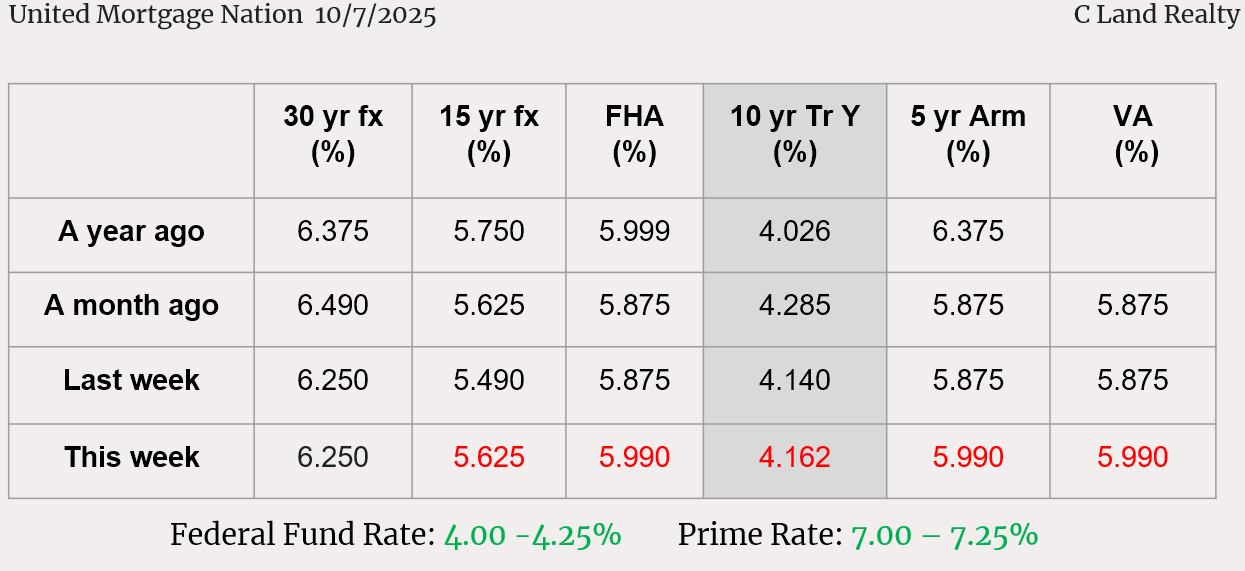

Mortgage Interest Rates Review

Home Prices Cooled Ahead of Fed Rate Cut.

기준 금리 감소하며, 집값 상승 다소 열기를 잃어가

WSJ 10/01/25(Thu)

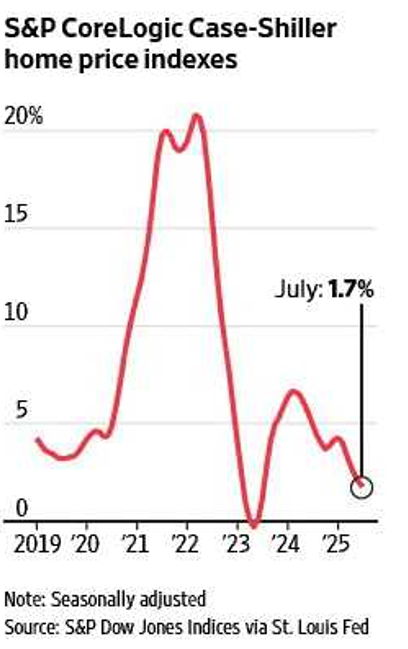

- U.S. home prices continued to rise at a slower pace in July in a fresh sign of summer weakness in the housing market.

- The S&P CoreLogic Case-Shiller National Home Price Index, which measures home prices across the country, rose 1.7% in the 12 months through July, down from 1.9% on year in June, and continuing a run of the weakest price rises since July 2023.

- Of 20 metropolises surveyed in a separate index, New York City continued to lead the pack, with an average 6.4% on-year rise in home prices in July. Chicago and Cleveland booked the next-highest increases.

- “By contrast, several Sunbelt and West Coast markets that were recently red-hot are now faring far worse,” Godec said. Prices in Tampa, Fla., fell 2.8% on year, coming in at the bottom of the list of 20, while Phoenix also recorded lower prices for homes compared with the same month a year earlier.

Case-Shiller Home Index

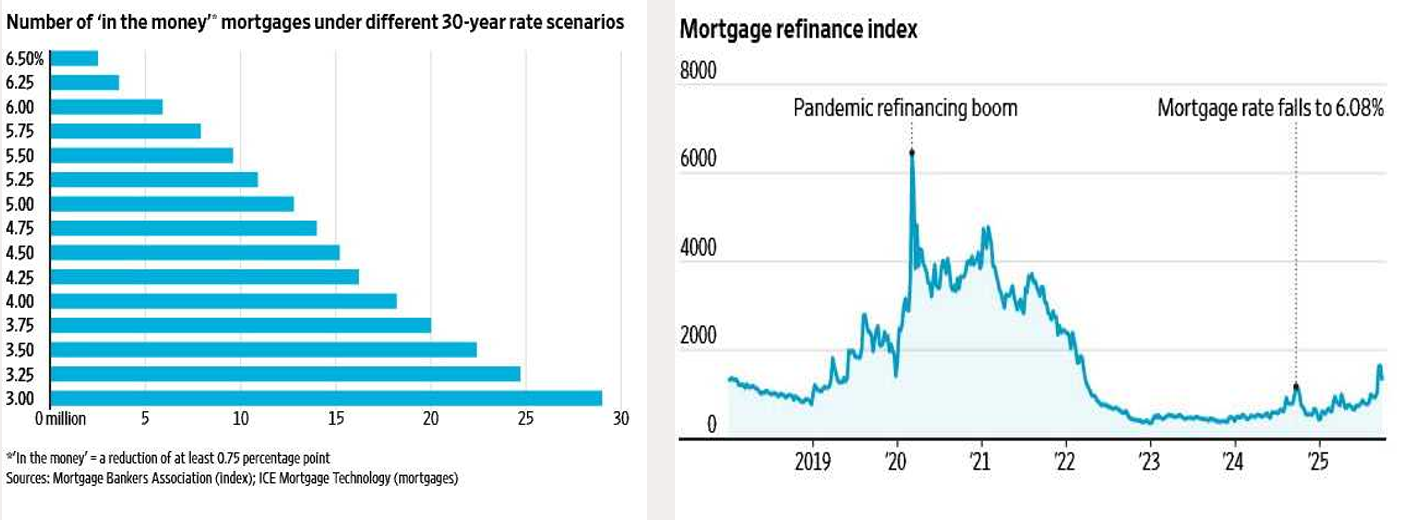

Homeowners Leap on Mortgage Rate Dips.

주택주유주들, 모기지 이자률이 내려가면서 움직이기 시작..

WSJ 10/9/25(Thu)

- Blink and you will have missed the recent refinancing boom. The rush to lock in a cheaper mortgage was still a hopeful sign for lenders.

- A minor move in mortgage rates triggered a strong reaction from borrowers. The cost of a 30-year home loan fell 0.3 percentage point to 6.26% over the three weeks through Sept. 17, which was the lowest rate in 11 months. Refinancing activity jumped 80% over the period, data from the Mortgage Bankers Association show, but fizzled once mortgage rates rose again.

- Borrowers are moving faster to lock in even small reductions in their housing costs. The financial incentive to refinance was actually higher back in September 2024, when rates fell to 6.08%, but fewer people took action then. They may have been waiting for costs to drop further and wound up frustrated when mortgage rates climbed instead. It has taken almost a year to get another opportunity.

Moving to even smaller reduction in housi

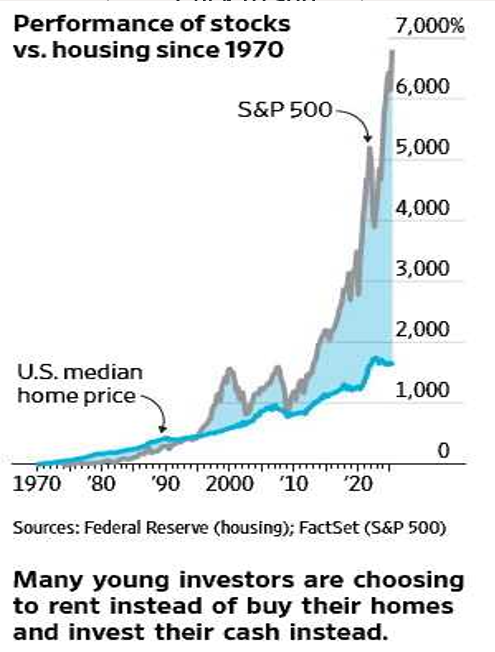

Young Investors Pick Stocks Over Homes.

Z 세대, 집보다 주식에 더 투자.

WSJ 10/13/25(Mon)

- The rent vs. buy debate has taken on new meaning for Gen Z thanks to soaring share prices and more investment options

- A record stock market might have a link to the unaffordable housing market, based on how younger Americans are thinking about their finances.

- Owning a home has traditionally been the way for U.S. households to build wealth. But today’s high property prices mean younger people either can’t afford to get on the property ladder or think they can earn a better return elsewhere.

- Many younger investors only know a time when stocks have returned on average about 14% a year, well above historical norms. And the stock market today is anything but a bargain: The S&P 500 is almost as expensive today, based on its price/earnings ratio, as it was on the eve of the dot-com bust.

Performance of stocks vs. housing since 1970

Gold Price is increasing. Why?

“금” 갑이 왜 올라가고 있나?

AI Overview 10/7/25(Tue)

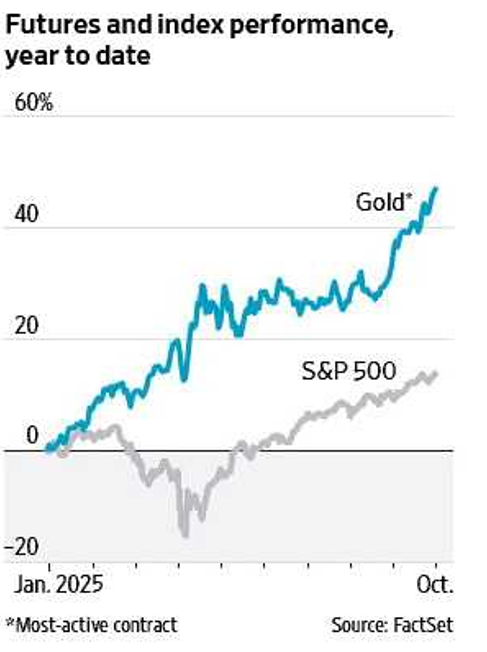

- The price of gold is increasing:, having recently hit a record high, largely due to growing global geopolitical uncertainty, a weaker U.S. dollar, aggressive central bank buying, and expectation of lower U.S. rates.

- Investors are flocking to gold as a safe-haven asset to hedge against economic risks, inflation, and currency devaluation.

- Geopolitical Instability: Events like the collapse of France’s government and other global political turbulence increase investor demand for gold as secure asset.

- Weaker dollar: A depreciating dollar makes gold more attractive to investors, as it provides a hedge against the declining value of paper currency.

- Central Bank Buying:Banks are purchasing large quantity of gold to deversify their reserves and protect against currency instability, especially after sanction of Russian central bank funds.

- Interest Rate Outlooks & Inflation and Debt concerns.

Gold performance, YTD

Silver Sets First Record Since 1980, 70% up This Year.

은 값이 치솟아, 올해 70% 상승.

WSJ 10/14/25(Tue)

- Silver prices set an all-time high Monday, eclipsing a 45year-old record from 1980 when the Hunt brothers tried to corner the market for the precious metal.

- Silver futures rose 6.8% Monday to settle at $50.13 a troy ounce, topping the longstanding record of $48.70, set in January 1980 during one of the 20th century’s biggest commodity-trading scandals.

- Although gold has fewer practical applications than silver, investors are piling into both precious metals as a haven from inflation, geopolitical concerns, expensive stocks and declining interest rates.

- It’s one of those very clear cases of a supply-demand imbalance. The imbalance has been exacerbated by stockpiling at metals warehouses around the world because of the threat of a silver tariff.

Silver price

Car Buyers Fall Behind on Payments.

자동차 할부금 지불이 늦어지는 현상.

WSJ 10/13/25(Mon)

- Portion of auto loans 60 or more days overdue hits record of over 6% —

- One of the cylinders in the U.S. economic engine is causing some sputtering.

- Now, more are falling behind on their loans, signaling that lower-income consumers are struggling to afford payments as wages stagnate and unemployment ticks higher. While the economy has remained strong, and Wall Street has kept buying subprime auto loans, the auto market is evidence that not all is well under the hood.

- And the portion of subprime auto loans that are 60 days or more overdue on their payments hit a record of more than 6% this year, according to Fitch Ratings, while delinquency rates for other borrowers have remained relatively steady. An estimated 1.73 million vehicles were repossessed last year, the highest total since 2009, according to data from Cox Automotive, an industry research firm.

White House Starts Federal Layoffs.

셧다운 장기화에 공무원 4100명 해고 준비

WSJ 10/11/25(Sat)

- The White House said Friday that it began conducting mass layoffs of federal employees in response to the government shutdown, an unprecedented step that follows through on weeks of threats meant to increase pressure on Democrats.

- “It will be a lot and it will be Democrat-oriented,” Trump said in the Oval Office. “They started this thing.”

- More than 4,000 employees at agencies across the federal government were issued layoff notices, such as in the Departments of Health and Human Services, Energy, Homeland Security, Education, Treasury, Commerce, and Housing and Urban Development.

- Hundreds of thousands of government workers are currently furloughed, while others deemed essential are working without pay. But layoffs hadn’t been part of past shutdowns, and Democrats said the White House had no reason to fire employees, while also questioning their legality.