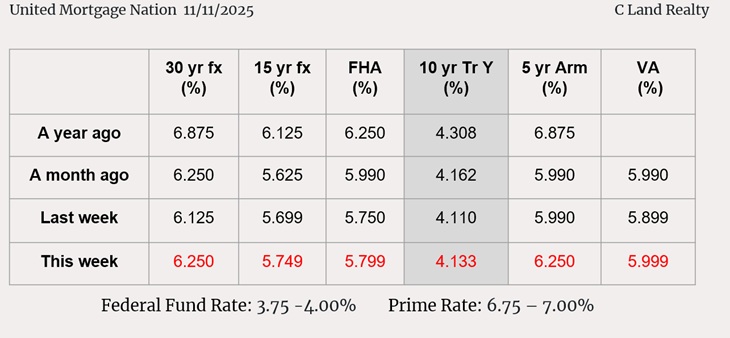

Mortgage Interest Rates Review

The Fixer-Uppers Of the Market Offer A Certain Appeal.

집 고쳐 팔기업계 주식시장에 매력있는 투자분야

WSJ 11/12/25(Wed)

- The old saw about making money in real estate is that you should buy the ugliest house on a nice block. A smart strategy for buying stocks can be “Pick the strongest companies in a tough-looking sector”.

- Trex ,the company that pioneered composite decking. Trex’s return on invested capital (ROIC), a measure of how well a company creates value, has averaged more than 30% in the past five years, according to FactSet.

- James Hardie,a supplier of high-end siding that recently expanded into decking with a big acquisition, is sagging almost as badly as Trex, down 44% this year.

- Builders First-Source, a distributor of construction materials praised for its financial discipline, has had to adapt to lower demand per new dwelling.

- Retail and wholesale supplierHome Depotstands out for its bottom-line focus. Its 33% average ROIC in the past five years is nearly twice what it was during the housing bubble. Shares outstanding have halved since 2007.

‘Little Trump’ Rankles White House Top Brass.

리틀 트럼프(풀티) 백악관을 시끄럽게…

WSJ 11/17/25(Mon)

- Pulte, a 37-year-old heir to a home-building fortune, has emerged as one of the most polarizing figures in the Trump administration. Referred to by some as “Little Trump,” his job is to oversee mortgage-finance giantsFannie Maeand Freddie Mac, which back nearly half the mortgages in the country.

- Pulte has also taken aim at Federal Reserve Chairman Jerome Powell, whom Trump has sharply criticized for his handling of interest rates, and Fed governor Lisa Cook.

- Pulte has also caused friction over his handling of agency business. Rocket,one of the country’s largest mortgage lenders, complained to the White House that Pulte, whose agency needed to sign off on the acquisition, was slow walking the process, people familiar with the situation said.

- Pulte has made an aggressive push for swift public offerings of Fannie and Freddie, a move Trump has said he would consider, and imagined a new entity.

Central-Bank Official Hedges on a Rate Cut.

중앙은행, 기준금리 감소 입장에 불분명

WSJ 11/18/25(Tue)

- Federal Reserve officials face a challenge resolving differences over how to set interest rates with little new economic data to guide tricky judgment calls.

- Expectations that the Fed will reduce rates Dec. 9-10 have fallen steadily, an unusual development for a period with no major economic indicator releases. Market-implied odds of a rate cut stood at around 45% early Monday, down from 60% a week ago and 90% at the time of the Oct. 28-29 meeting, according to CME Group.

- Fed Vice Chair Philip Jefferson offered a case study in the central bank’s predicament on Monday, acknowledging the risk of stubborn inflation and weaker employment conditions— dueling threats that call for opposing prescriptions.

Boston Fed’s Collins Sees A ‘High Bar’ For More Cuts.

보스톤 중앙은행입장, 금리 인하의 높은 벽 인식

WSJ 11/13/25(Thu)

- Boston Fed President Susan Collins said Wednesday there should be a “high bar” for further easing by the Federal Reserve in the months ahead, projecting that the Fed should likely “keep policy rates at the current level for some time.”

- While tariffs haven’t hit the economy as hard as many economists expected, inflation has remained stubbornly above target, and could remain elevated for reasons beyond White House trade policy, she said at a banking conference in Boston.

- Given the Fed has already cut rates to a range of 3.75% to 4%, a level that Collins called “mildly restrictive,” further reductions would risk undermining the central bank’s mission of getting inflation back down to its 2% goal, she said.

XPeng Narrows Quarterly Loss

Xpeng 분기별 손실액 줄여

WSJ 11/18/25(Tue)

- XPengsignificantly narrowed its net loss in the third quarter thanks to robust sales and margins, bringing the Chinese carmaker within striking distance of profitability.

- The Guangzhou-based company on Monday reported a net loss of 380.9 million yuan, equivalent to $53.7 million, narrowing sharply from 1.81 billion yuan a year earlier. Revenue doubled to 20.38 billion yuan as the carmaker delivered a record 116,007 units during the period.

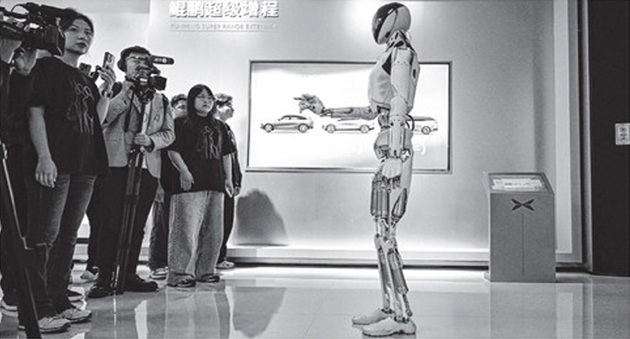

- Once an emerging brand for electric vehicles, XPeng has made forays into cutting-edge segments beyond cars, including investments in flying vehicles, humanoid robots and robotaxis. The company earlier this month unveiled its humanoid robot, IRON, with plans for mass production by the end of next year. It also said it plans to release three robotaxi models in 2026 for ride-hailing services.

Unveiled its humanoid robot, IRON, with plans for mass production by the end of next year.

WSJ 11/18/25

AI Boom Is Looking More and More Fragile.

AI 붐이 점점 약점이 드러나…

WSJ 11/13/25(Thu)

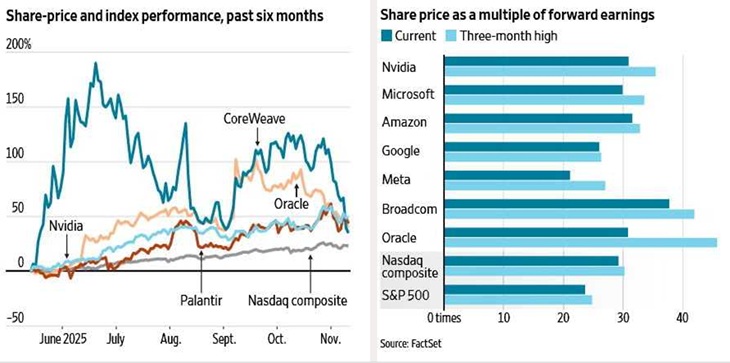

- Perfect isn’t good enough, and any sign of weakness is a disaster: Justified or not, that’s the current mood in the markets about the artificial- intelligence boom.

- Recent history suggests that the gloom won’t last. But the shake-up serves as a strong reminder that the early years of AI pose a challenge for investors accustomed to measuring returns on a 12-month time horizon.

- Nvidialost 7% last week and slipped another 3% between Tuesday and Wednesday— leaving it well shy of its $5 trillion market-cap milestone last month.

- Meta Platformsshed nearly 19% since its solid third-quarter report two weeks ago that included another plan for blowout capital spending.Palantir , the AI software company that soared to a price-to forward- earnings ratio above 250, is down more than 11% since its respectable earnings last week.

Share-price and index performance for 6 months

WSJ 11/13/25