How Trump’s Megabill will Change Your Taxes

Now, individual taxpayers want to know what difference this makes to their own returns and how changes could affect tax planning for this year and next. The short answer is that—unlike with the tax overhauls of 1986 and 2017—most of the changes for individuals aren’t radical.

Instead, the legislation makes permanent many key changes from 2017 that were set to expire at the end of 2025. These expirations would have raised taxes and disrupted planning for many filers.

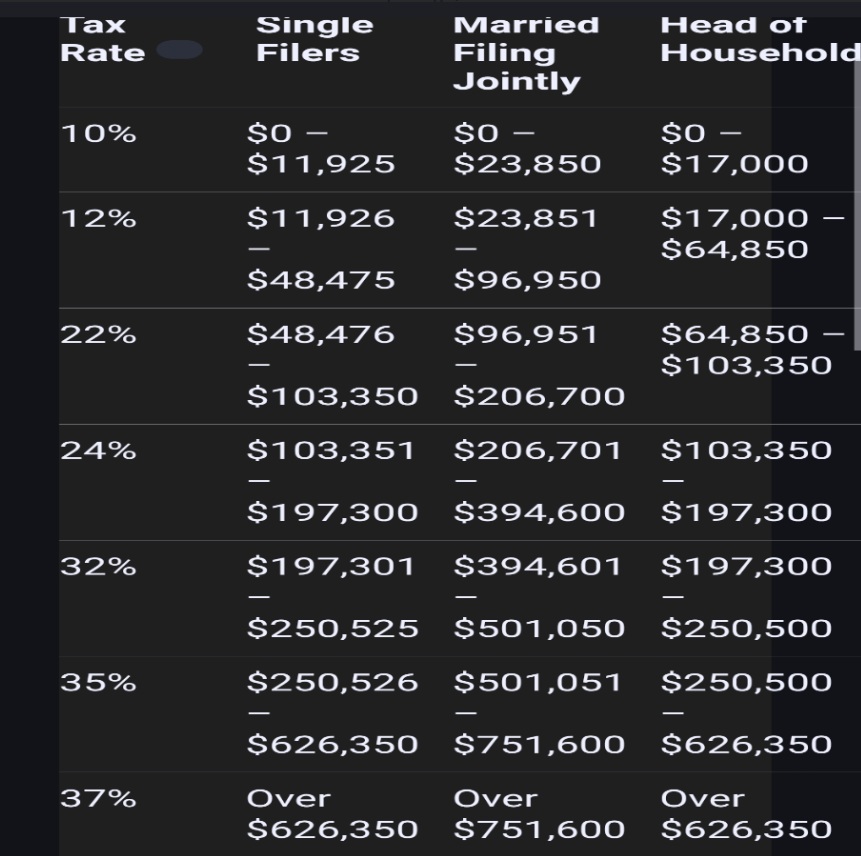

1. Current Tax Bracket

Notably, the tax brackets individuals have gotten used to won’t change. The rates set in 2017 will stand at 10%, 12%, 22%, 24%, 32%, 35% and 37%. Many filers especially value the 22% and 24% brackets, which stretch from about $100,000 to $400,000 for married joint filers and half that for single filers.

2. Standard Deduction for non-itemized

The standard deduction for 2025 will be $15,750 for single filers and $31,500 for married joint filers and rise with inflation after that, according to the Tax Foundation. This fundamental change has simplified taxes for many and reduced the number of itemizers from about 30% of individual filers to less than 10%.

3. SALT Deduction for itemized

The new law expands the Schedule A deduction for state and local property, income or sales taxes from $10,000 per return to $40,000 for taxpayers with income up to $500,000 and phases down to $10,000 after that. The provision takes effect for tax year 2025 and expires at the end of 2029.

4. Child Tax Credit

The bill also makes permanent the $2,000 child tax credit enacted in 2017—and raises it a bit. Starting in 2025, the base amount will be $2,200 per child. It will be indexed for inflation going forward.

5. Estate and Gift Tax

It has new clarity as well. For 2025, the exemption is $13.99 million per individual, but that was set to drop to about $7 million in 2026. The new law sets a permanent base of $15 million per person starting in 2026, with inflation adjustments after that.

6. Charitable Donation

The new law has two key changes, and both take effect for tax year 2026. Starting next year, donors will be allowed to deduct $1,000 (single filers) and $2,000 ( joint filers) if they don’t itemize on Schedule A. A new limit on charitable donations for itemizers will also take effect next year. It disallows a portion of the deduction equal to 0.5% of a filer’s modified adjusted gross income. So a filer with $300,000 of MAGI would get no deduction for the first $1,500 of charitable donations on Schedule A. Givers who want to avoid it should consider accelerating donations into 2025.

7. Green energy provisions for individuals.

The new law ends several of these early. Taxpayers who want tax credits on new or previously owned “clean” vehicles must now place them in service by Sept. 30, 2025—not the end of 2032.

The deadline for qualifying for the energy-efficient home improvement credit is now Dec. 31, 2025, not the end of 2032, and the deadline for qualifying for the residential clean energy credit is now Dec. 31, 2025, not the end of 2034.

8. 529 education-savings plans.

The legislation expands tax-free withdrawals from these popular accounts to include more K-12 expenses, plus expenses for certifications and licenses such as HVAC work. This expansion takes effect in 2026.