1031 Exchange program

IRS Code Section 1031

IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free.

Terminology

-Relinquished Property

-Replacement Property

-(Qualified) Intermediary

-Identification Period : 45 Days

-Exchange Period : 180 Days

-Reverse Exchange

-Step-up base

Rules

– The exchange must be set up before a sale occurs

– The exchange must be for like-kind property

– The exchange property must be of equal or greater value

-The property owner must pay capital gains and/or depreciation recapture tax on “boot”

-The taxpayer that sold and acquired the exchange property must be the same

-The property owner has 45 days following the sale to identify replacement properties

-The property owner has 180 days following the sale to complete the exchange.

Boots

– Cash: Any cash received in the exchange.

–Debt reduction: If the mortgage or debt on the property you acquire (replacement property) is less than the mortgage or debt on the property you sold (relinquished property), the difference is considered “boot.”

–Other non-real estate assets: This could include things like personal property, vehicles, or anything else that is not real estate.

Types of 1031 Exchange Properties

There are many different types of 1031 Exchange properties for an investment property owner to consider. The IRS requires 1031 Exchange properties be “like-kind”, meaning investment property for investment property and includes all property types such as residential, industrial, commercial, etc.

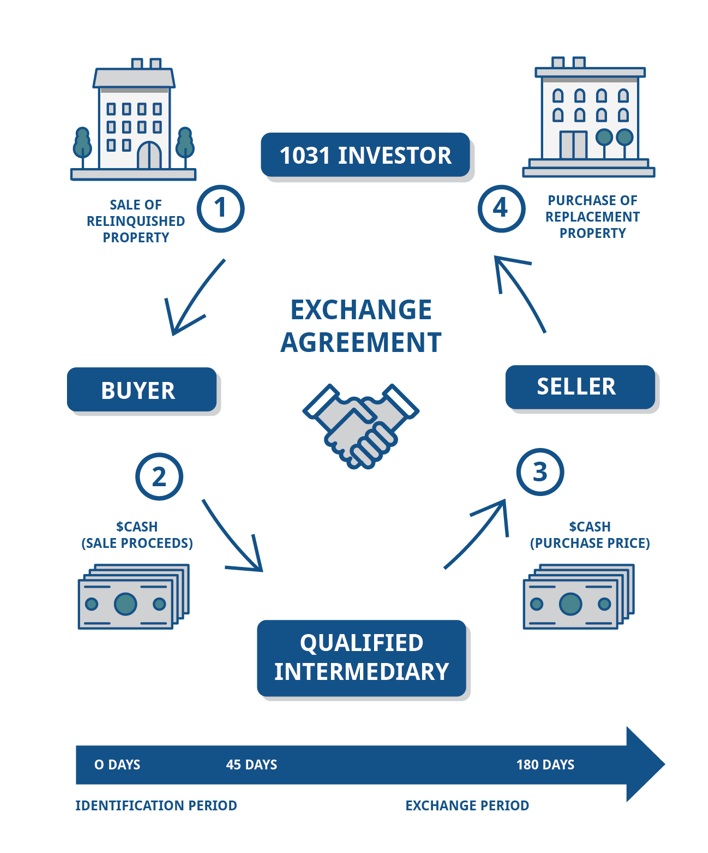

How to Do a 1031 Exchange

Understanding the tax liability on your relinquished property is generally the first step with a 1031 Exchange. It’s also important to understand the rules and timeline for an Exchange before getting started. IRS exchange rules are very rigid, and the 1031 exchange timeline must be strictly followed to qualify for tax deferral.

Three very important dates must be considered to successfully complete an exchange. From the day the relinquished property closes, the exchanger has 45 days to identify their potential replacement properties and a total of 180 days to acquire the replacement property.

Timeline

DAY 0: Sell Existing Property

Close on your existing property and start looking for a replacement property.

DAY 45: Identify Replacement Property

Within 45 days after closing on your relinquished property, you must identify your replacement property.

DAY 180: Close on Replacement Property

Within 180 days after closing on your relinquished property, you must close on your replacement property.

Step-up basis

“Step-up in basis” is a tax provision in the United States that allows the cost basis of an inherited asset to be adjusted to its fair market value on the date of the decedent’s death. This means that when you inherit an asset, like real estate or stocks, its value for tax purposes is “stepped up” to its current market value, rather than the original purchase price of the person who passed away.

(Capital Gain = Selling Price – Cost Basis)