Gen M got pressure between house and retirement plan.

내집마련, 은퇴 준비중 택일 압박

Korea Daily 12/28/25(Fri)

- According to Harris’ poll research, 58% of Gen M got pressure to make a choice between purchasing a house and planning stable retirement plan. The reason that they have to make one choice is sky-rocketing house prices.

- For a while, owning house is considered one of major tools to establish individual assets throughout life time. However, youngsters are no longer with that belief. More than a half of respondents answered they go with retirement accounts such as 401K and IRA, and 20% answered they opened a brokerage accounts, and 28% said they will increase company’s retirement savings accounts.

- While most Gen M thought housing cost is the most pressing problem, only 9 % of financial professionals see the housing cost as a major risk.

Retailers Feel a Chill From Gen Z Shoppers.

Z 세대, 지갑들 닫아…

WSJ 12/1/25(Mon)

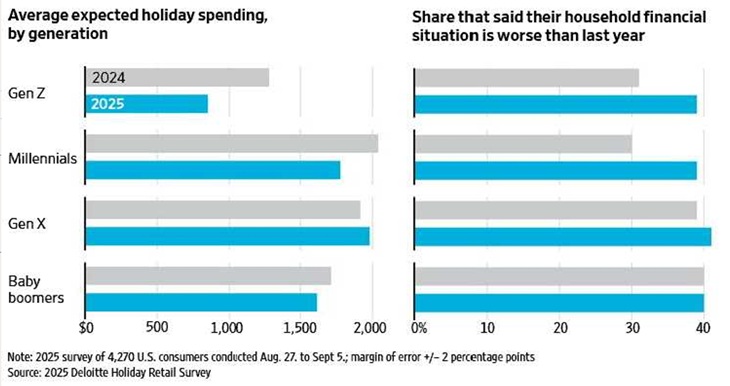

- More than any other generation, young adults are tightening their year-end spending budgets and shelling out less for gifts, survey data show. That is a problem for retailers and brands that look to Generation Z—a group that runs from teens to late-20-somethings—to drive shopping trends and boost spending steadily as they earn bigger paychecks.

- Gen Z shoppers recently said they expected to cut holiday spending by an average of 34%, sharply more than other age groups, according to a Deloitte survey of more than 4,200 U.S. adults. (Gen X consumers, those between 45 and 60 and in their peak earning years, were the only cohort to say they planned to spend more.) A separate, PricewaterhouseCoopers survey found that in addition to spending less on gifts, Gen Zers are pulling back on travel, dining out and clothes shopping.

Expected holiday spending by generations

WSJ 12/1/25

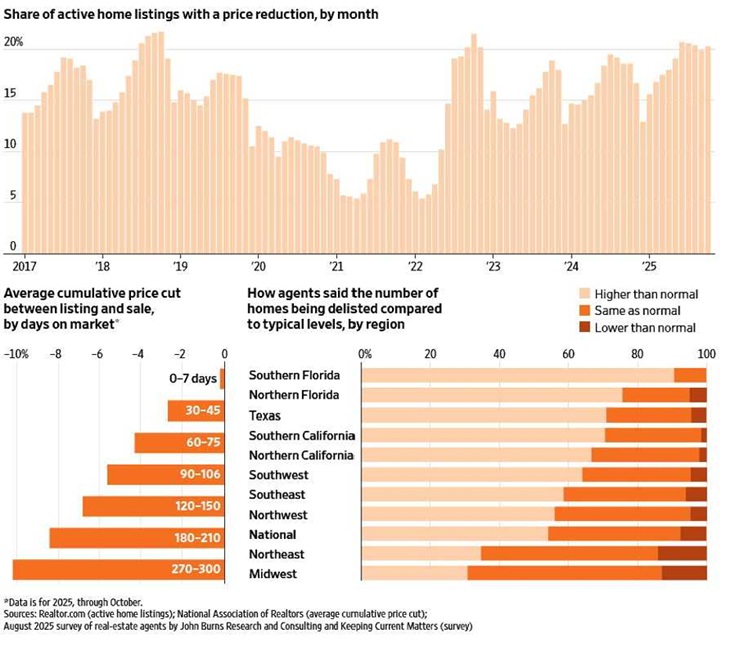

Overpricing Houses Leaves Home Sellers High and Dry.

과도히 높은 가격으로 내논 집들 힘들어…

WSJ 12/1/25(Mon)

- If you’re serious about selling your home, you might need to drop the price. Overpriced houses are languishing on the market as buyers continue to be deterred by elevated mortgage rates and persistent economic uncertainty.

- Just over 20% of active listings in October had a price cut, according to Realtor.com, which is operated by News Corp, parent of The Wall Street Journal. That share is generally higher than in the past couple of years, and about twice what it was when prices soared during the Covid-19 pandemic.

- Homes priced correctly from day one tend to sell more quickly and get nearly 100% of their asking price, according to NAR. After three months, sellers usually trim prices by more than 5%, and after a year, by more than 12%.

- If a listing has been on the market for a month or more, home buyers might sense an opportunity to negotiate a discount.

DOJ to Settle Apartment Rent Suit.

법무부, 아파트 렌트가 독점 조절 소송에 판결

WSJ 12/25/25(Tue)

- The Justice Department on Monday said it would settle its lawsuit against apartment pricing company RealPage, which it had accused last year of enabling landlords to illegally coordinate rental-price increases.

- The settlement, which requires court approval, would close one of the biggest antitrust cases that enforcers filed during the Biden administration, marking one of the first complaints against technology middlemen blamed for playing a role in price increases that pinch consumers.

- The resolution limits how RealPage can use nonpublic data to propose rents that corporate landlords should charge to optimize occupancy and maximize revenue.

- The Justice Department had alleged that Real-Page allowed c o m p e t i n g landlords to share competitive data in real time, giving them confidence to raise prices or eliminate discounts without fearing they would be undercut.

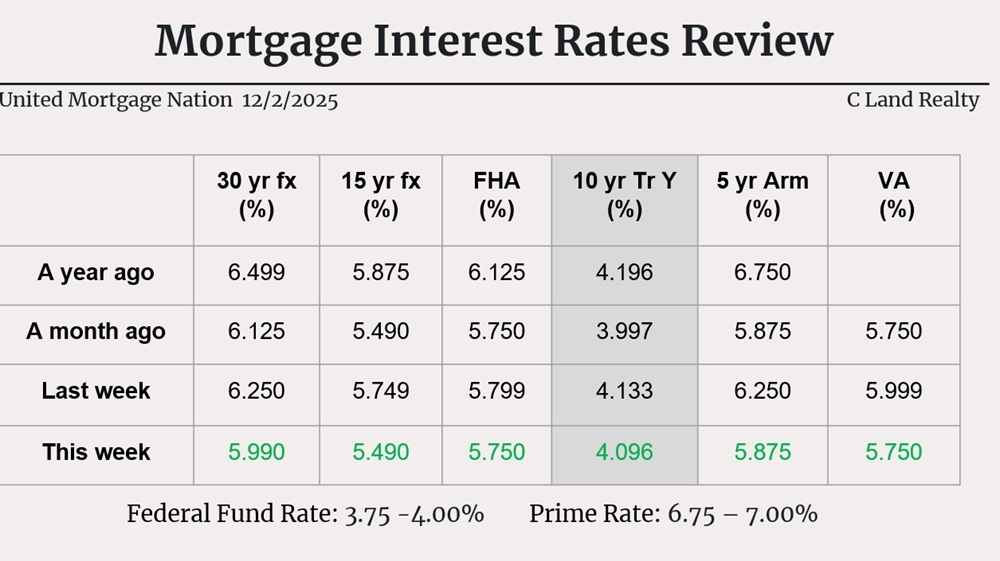

Powell Ally Backs December Rate Cut

연준 의장과 가까운 팀, 12월 이자률 감소에 지지쪽…

WSJ 11/25/25(Tue)

- San Francisco Fed President Mary Daly said she supports lowering interest rates at the central bank’s meeting next month(12/9 ~ 12/10) because she sees a sudden deterioration in the job market as both more likely and harder to manage than an inflation flare-up.

- “On the labor market, I don’t feel as confident we can get ahead of it,” she said in an interview Monday. “It’s vulnerable enough now that the risk is it’ll have a nonlinear change.” An inflation breakout, by contrast, is a lower risk given how tariff-driven cost increases have been more muted than anticipated earlier this year, she said.

- The decision to cut rates or pause rates next month requires “a judgment call about where the risks of not moving are, and where the risks of moving are,” she said. “And so, for me, I put the risks of moving [rates down] a little bit lower than others, and I put the risk of not moving a little bit higher than others.”

Google is Defying Fears of an AI Bubble.

구글, AI 버불론을 잠식시켜…

WSJ 12/26/25(Wed)

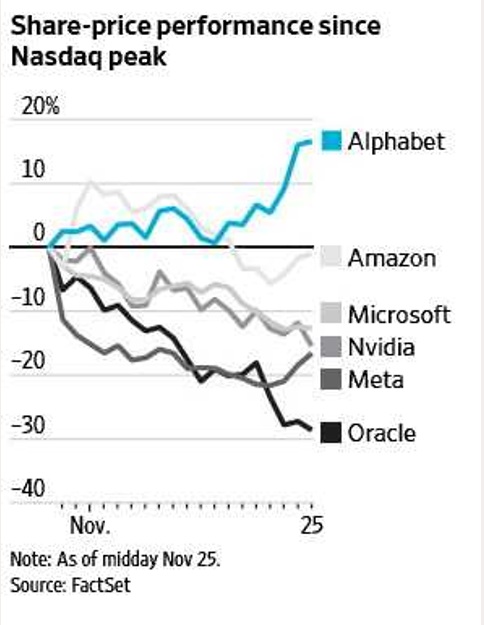

- While other big tech stocks have fallen, its parent’s market value is approaching $4 trillion. ParentAlphabet’s stock jumped about 16% since the Nasdaq peaked on Oct. 29, adding to a run that began in early September when the company won a court ruling that effectively ended worries about a government- imposed breakup. Meanwhile, Microsoft , Oracle, Nvidia and Meta Platforms have seen double-digit declines.

- Google is making important strides in the AI race while keeping its core business humming. Its parent still makes the bulk of its $385 billion in annual revenue from advertising. At the same time, the company offers a level of AI vertical integration that even the other big tech companies can’t quite match. The recently launched Gemini 3 is a perfect example. Google trained its own frontier AI model on its networks using its TPU(Tensor Processing Unit) chips that it designed in-house.

High tech performance since Nasdaq peak

WSJ 12/26/25