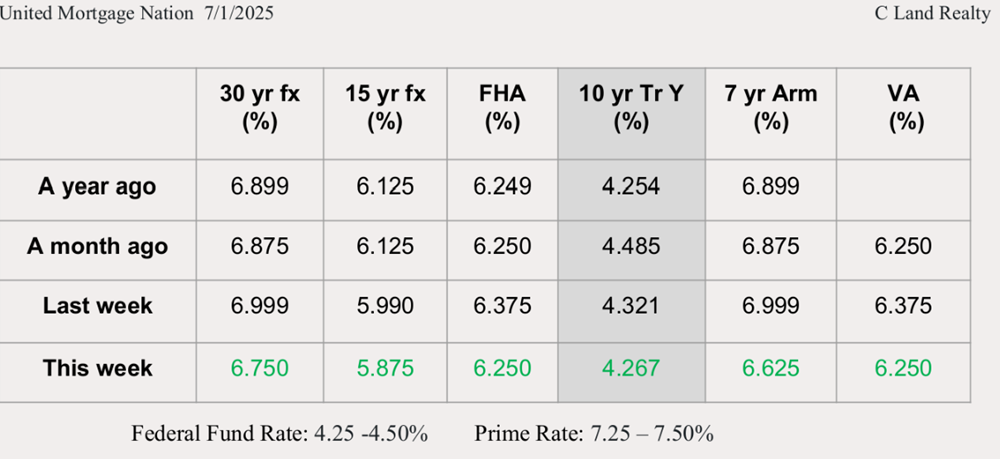

Mortgage Interest Rates Review

Rent Freeze to Chill Office Conversions.

렌트동결이 사무실-주택전환에 찬물

WSJ 6/30/25(Mon)

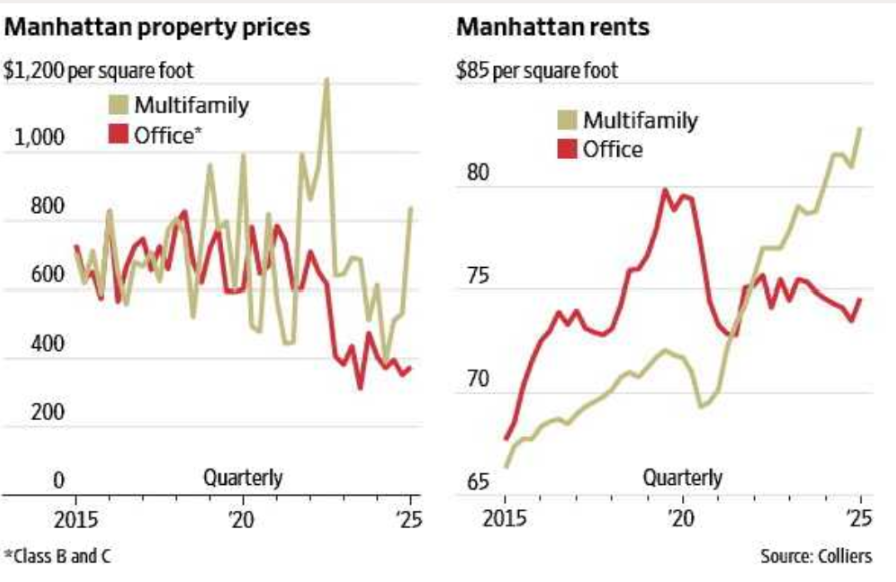

New York City mayoral candidate Mamdani’s policies could hurt a promising source of new housing supply. Turning Manhattan’s unloved offices into apartments is becoming a profitable venture. That potentially unlocks a new source of supply for New York City’s crunched housing market.

A possible hitch: last week’s mayoral primary victory by Democratic candidate Zohran Mamdani, who wants to freeze rents on the city’s roughly one million rent-stabilized apartments.

In theory, that shouldn’t affect office conversions because these are new units coming to market. But the conversions typically take advantage of a tax incentive that gives them a 90% property tax exemption for up to 35 years. To qualify, 25% of the apartments in a conversion have to be rent-stabilized, which would make it much harder to flip converted apartment buildings to investors at that price.

Manhattan Property Prices/Rents

WSJ 6/30/25

U.S. Pending Sales Rose in May.

미국내 계약중인 거래량, 5월에 증가세

WSJ 6/27/25(Fri)

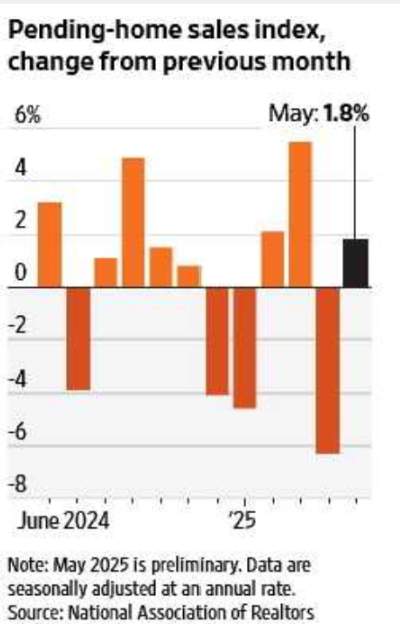

The number of homes going under contract in the U.S. ticked up in May, as job gains and improved wages feed into the market, according to a monthly index.

The pending home sales index, a leading indicator of house sales based on contract signings, increased 1.8% on month in May, compared with a 6.3% decline in April, NAR said Thursday. Pending home sales rose 1.1% on year.

“Consistent job gains and rising wages are modestly helping the housing market,” NAR Chief Economist Lawrence Yun said.

However, mortgage-rate fluctuations are the primary driver of home-buying decisions and impact housing affordability more than wage gains, Yun noted.

Pending-home Sales Index

WSJ 6/27/25(Fri)

More Homewners Slip Underwater.

집값이 수면 이하로 침수하는 집들이 늘어

WSJ 6/25/25(Wed)

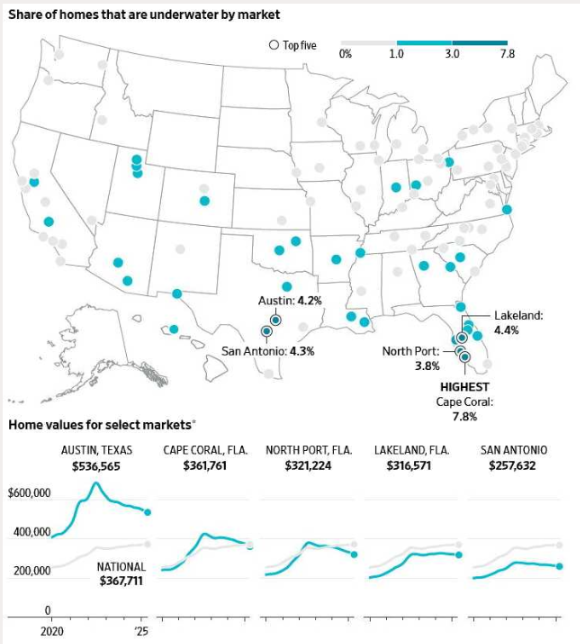

Homeowners who bought around the peak of the market are increasingly finding they owe more on their mortgages than their properties are worth.

The number of owners who are underwater is small but growing, and they have recently been concentrated in pandemic boomtowns such as Austin, Texas, and Cape Coral, Fla. A rapid rise in prices in these areas was followed by drops

of nearly 20% in some of them. Those who bought at the top have seen value slip out of their homes since then.

Even people who find themselves underwater on their mortgages generally don’t have a major cause for alarm, provided they can consistently make payments and keep their jobs, said Chen Zhao, an economist at Redfin.

Zhao expects a slight national home price drop of 1% by the end of the year, which might lead to more people being underwater. But she said that a surge in foreclosures was unlikely. The more stringent lending practices ensure that

homeowners are typically able to handle financial fluctuations.

Share of homes that are underwater by market

WSJ 6/25/25

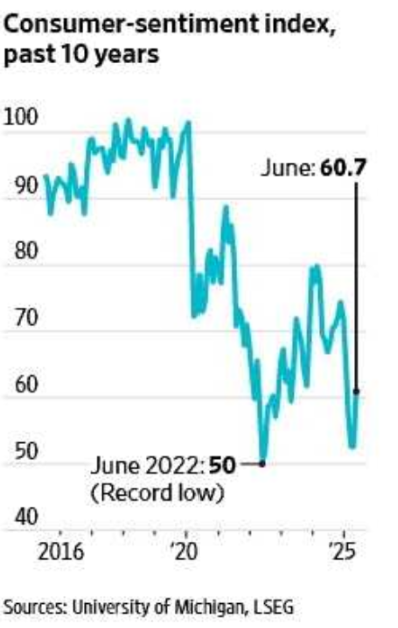

American Consumers Felt Better in June

미국 소비자, 6월에자신감 회복

WSJ 6/28/25(Sat)

American households felt more optimistic about the economy in June, though confidence remains lower than it was at the start of the year.

The University of Michigan said Friday its index of consumer sentiment for June was 60.7, above a May reading of 52.2.

Economists polled by The Wall Street Journal had forecast a June reading of 60.5.

Economists say the initial shock of Trump’s aggressive tariffs announcements has worn off for consumers, particularly given the on-again, off-again nature of the White House’s trade war. Earlier this year, the index fell for four months before stabilizing in May.

Consumer sentiment remains 18% lower than it was in December 2024.

The June reading remains low by historical standards. Before the pandemic, for example, the index hovered close to 100.

Consumer-sentiment index

WSJ 6/28/25(Sat)

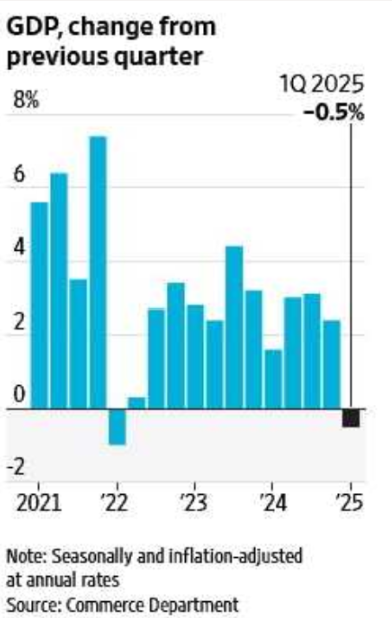

GDP Shrank More than Estimated.

미국 GDP가 예상보다 저하: -0.5%

WSJ 6/27/25(Fri)

The U.S. economy contracted more than previously estimated in the first quarter, new government data showed.

Gross domestic product—a broad measure of goods and services produced across the U.S.—contracted at a 0.5% seasonally and inflation-adjusted annual rate in January through March, the Commerce Department said.

Imports subtract from the GDP calculation, since they represent spending on foreign made goods and services.

The first-quarter reading was the first contraction in three years, as companies rushed to get ahead of President Trump’s tariffs.

GDP, change from the previous quarter

WSJ 6/27/25(Fri)

Banks Turn to AI-Powered ‘Digital Workers’.

은행들, 벌써 ‘디지탈 직원’을 사용시작

WSJ 7/1/25(Tue)

Bank of New York Mellon said it now employs dozens of

artificial-intelligence-powered ‘digital employees’ that have company logins and work alongside its human staff.

Similar to human employees, these digital workers have direct managers they report to and work autonomously in areas like coding and payment instruction validation, said Chief Information Officer Leigh-Ann Russell. Soon they will have access to their own email accounts and may even be able to communicate with colleagues in other ways like through Microsoft Teams, she said.

“This is the next level,” Russell said. While it is still early for the technology, Russell said, “I’m sure in six months’ time it will become very, very prevalent.”

What the bank, also known as BNY, calls “digital workers,” other banks may refer to as “AI agents.” And while the industry lacks a clear consensus on exact terminology, it is clear that the technology has a growing presence in financial services.

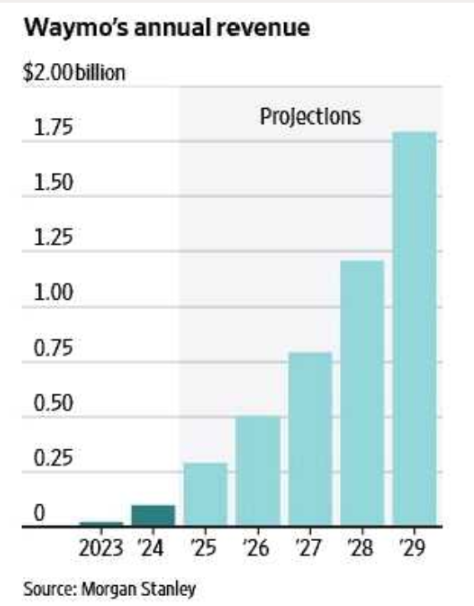

Tesla’s Robotaxi shows Waymo is Undervalued

테슬라 로보택시 서비스가 와이모의 저평가를 드러내

WSJ 6/27/25(Fri)

The Google service was last valued at $45 billion, while autonomous technology drives most of the EV maker’s $1 trillion value.

Tesla’s long-awaited robotaxi service has finally hit the road. But rather than help justify the electric-car maker’s sky-high valuation, it really highlights how underappreciated Google parent Alphabet might be for its own, much more advanced self-driving venture.

That design represents a major bet by Tesla Chief Executive Elon Musk, who has shunned the use of self-driving systems that include the more expensive Lidar technology that uses laser beams like radar to sense its surroundings.

Tesla’s autonomous system is based on cameras and software, which is cheaper to deploy but adds potential for new problems, such as cars getting blinded by sunlight.

Waymo’s annual revenue

WSJ 6/27/25(Fri)

Ndivia Threatens Giants with Cloud Move.

Ndivia 사, 클라우드 사업으로 대기업 위협

WSJ 6/26/25(Thu)

Cloud computing generates big profits for Amazon.com , Microsoft and Google. Now that cash cow faces a nascent threat with the rise of artificial-intelligence cloud specialists and a new industry power broker: Nvidia

AI-chip maker Nvidia launched its own cloud-computing service two years ago called DGX Cloud. It also nurtured upstarts competing with the big cloud companies, investing in AI cloud players CoreWeave and Lambda.

Those moves have yet to make an enormous dent, but a competitive shift is easy to imagine if computing demand continues to shift toward AI and Nvidia remains the sector’s principal arms dealer.

DGX Cloud is already growing fast. UBS analysts estimated when it launched that it could grow into a more than $10 billion annual revenue business. And CoreWeave, which listed shares on the Nasdaq in March, is forecasting around $5 billion of revenue this year.