4-Alarm Fire Destroys Korean Restaurants in Palisades Park.

- A massive four-alarm fire ripped through a mixed-use commercial building on Broad Avenue early Sunday morning, February 8, 2026, leaving popular local businesses destroyed and two residents hospitalized.

- The blaze was reported at approximately 2:15 AM at 337-339 Broad Avenue, a building housing several Korean businesses. Officials confirmed that the building housed Ahjae Gookbap (아재국밥) and Totowah(또또와) Restaurant. The fire also caused minor damage to the adjacent Anthony’s Pharmacy.

- Firefighters from multiple towns, including Fort Lee, Ridgefield, Leonia, and Englewood, battled the flames for over four hours. The operation was severely hindered by sub-zero temperatures and frozen fire hydrants.

- Palisades Park Mayor Chong Paul Kim stated that two residents living in the apartments above the restaurants were treated for smoke inhalation. Both were reported to be in stable condition as of Sunday night.

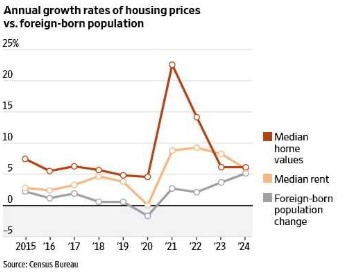

Can Deportations Lower Housing Prices?

- The Trump administration says its aggressive deportation push is central to its plan to lower housing costs for Americans. So far, there is little evidence that it is working.

- White House officials say that fewer immigrants means less demand for housing, which will compel landlords to cut their prices. DHS says that three million immigrants have left the country since Trump took office last year, including 675,000 forced deportations over the past year, though those numbers are difficult to verify and could be overstated.

- Rents had already been declining in cities that immigration officers have targeted. The White House cited deportations as the reason home listing prices are dropping in some U.S. cities like Austin, Texas, San Diego and San Jose, Calif.

- Economists and housing industry analysts largely attribute price declines in those and other markets to oversupply and fewer people moving there from other states. Immigration, they say, is less correlated to housing prices.

H Mart Expands Footprint in U.S. F&B Market with

Nationwide Franchise Push.

- H Mart, the largest Asian supermarket chain in the United States, has officially announced a major expansion of its food and beverage (F&B) division. Through its franchise-specialized subsidiary, BK Franchise, the company is aggressively recruiting franchise partners for two of its premier brands: the specialty coffee powerhouse ‘Ten Thousand’ and the premium bakery-cafe ‘L’AMI Bakery & Café.’

- H Mart aims to transform from a traditional grocer into a cultural lifestyle destination. The company plans to establish these brands as core fixtures in major U.S. commercial districts.

- Ten Thousand (Specialty Coffee): * Originating from Sydney and gaining massive popularity in New York, this brand is known for its “high-quality, high-efficiency” model. L’AMI Bakery & Café (K-Bakery): * A premium brand that modernizes traditional Korean baking sensibilities with a contemporary flair.

CoStar Faces New Shake-Up Push.

- Hedge fund D.E. Shaw is pushing for a board shake-up and other big changes at Co-Star Group, a major commercial real-estate information provider that is already facing pressure from Third Point. D.E. Shaw believes CoStar’s shares have underperformed because of its “high-risk, money-losing” investment in Homes.com, a consumer-facing platform that aggregates home listings, according to a letter to CoStar’s board of directors that D.E. Shaw.

- Founded in the 1980s by Andrew Florance, CoStar has become the dominant force in commercial real-estate data. It became a go-to source for office-market data on building dimensions, sales and other statistics, then later pushed into other areas, providing data for hotels, apartments and other property types.

- About five years ago, Florance began expanding CoStar into the single-family housing market, long dominated by Zillow Group and Realtor.com, which is operated by News Corp, parent of The Wall Street Journal. CoStar did this through Homes.com.

Many Factors Plague Current Labor Market

- The pace of hiring in America has dropped precipitously, and there isn’t a single reason why.

- Uncertainty over tariff policy has made it difficult for many companies to plan ahead, leading them to hold off on hiring. For some—particularly small businesses— tariffs have raised costs, making it more difficult to take on new employees.

- High short-term interest rates are another pressure, particularly for smaller firms, which often rely on credit card borrowing to meet financing needs. Tech companies that hired heavily in the wake of the pandemic are still dealing with an overhang of workers.

- Still, there is some evidence that AI is having an effect. In a recent analysis, Stanford University economists Erik Brynjolfsson, Bharat Chandar and Ruyu Chen found that young people’s employment prospects in jobs that are highly exposed to AI, such as software development, have been hurt.

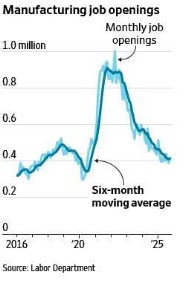

U.S. Manufacturing Is in Retreat.

- Factories cut jobs as president’s promised boom from tariffs hasn’t occurred.

- The manufacturing boom President Trump promised would usher in a golden age for the U.S. is going in reverse. After years of economic interventions by the Trump and Biden administrations, fewer people work in manufacturing than any point since the pandemic ended.

- In the long term, tariffs could achieve their desired effect of making some manufacturers more competitive with overseas producers. Economists believe lower interest rates and deregulation could also provide support. But in the shorter run, tariffs have boosted many companies’ costs on materials sourced abroad, pushing firms that buy foreign parts to raise prices or scramble for supplies.

Inside Musk’s AI and Space Megamerger.

- Elon Musk took a gulp of water on stage at the World Economic Forum in Switzerland last month and started talking up one of his latest passions: data centers orbiting Earth.

- “The lowest-cost place to put AI will be space,” Musk said. “That will be true within two years, maybe three.”

- Within days, bankers from Morgan Stanley provided an estimated valuation of both companies that could be used to structure a merger, according to people familiar with the matter and investor disclosures viewed by The Wall Street Journal. SpaceX’s board decided as of Jan. 30 that it was worth $1 trillion, and xAI’s board decided it was worth $250 billion, the documents show.

- Behind the scenes, SpaceX had been studying how orbital data centers could work and had a breakthrough associated with the technology last fall.

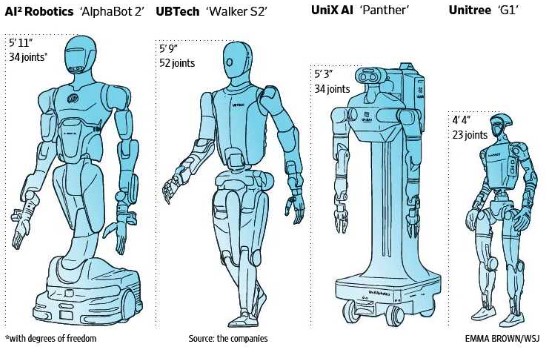

China Masters the Humanoid Robot.

- Elon Musk has been telling investors for months that Tesla Optimus humanoid robot will revolutionize the world and create a new megaindustry. But most of it could belong to China, he has warned.

- China is moving quickly to try to dominate the industry. Humanoid-robotics companies are sprouting up from Shenzhen to Suzhou, with more than 140 and counting. Tapping a vast ecosystem of parts suppliers and engineering talent, they are starting to produce humanoid robots at scale.

- The industry is still in its early days, and it may take years to take off—if it ever does. Skeptics say humanoid robots are a bubble and may never find a true use case.

- In Shenzhen, home to Tencent, Huawei Technologies and EV maker BYD , a “Robot Valley” is emerging, with around 15 robotics firms. Shenzhen has said it was setting up a roughly $1.4 billion fund focused on AI and robotics industries and another valued at around $640 million focused on AI models.