Home Sales Log December Rise Amid ’25 Slump

2025 주택판매 저조한 가운데, 12월 주택 판매 증가세

WSJ 1/15/25(Thu)

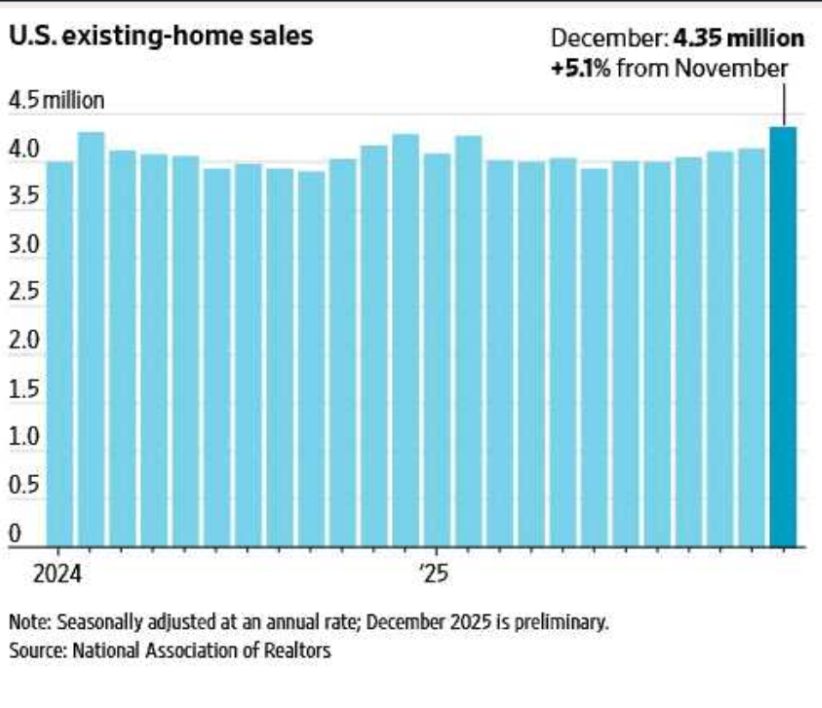

- Despite a surprise lift last month, the full year downturn is one of worst in

decades. - Home sales finished 2025 with surprisingly strong momentum, rising 5.1% in December for the biggest gain in nearly two years. But even with last month’s

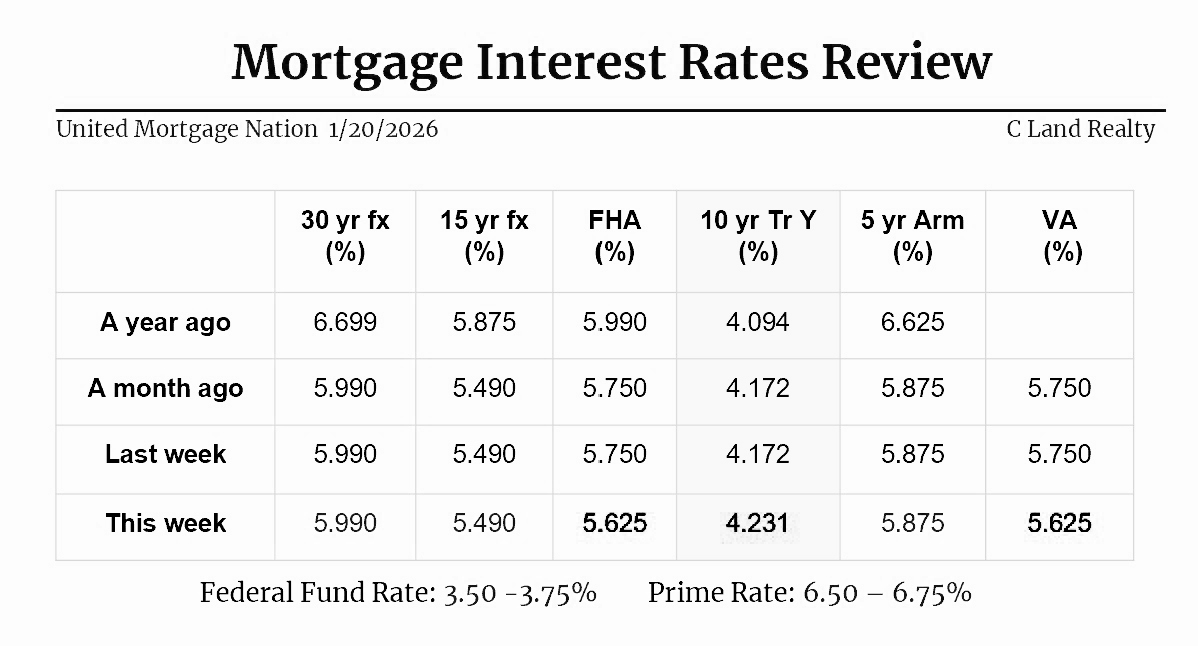

boost, the year as a whole still ranks as one of the worst sales slumps in decades. - The increase in sales, which was more than double what economists surveyed by The Wall Street Journal had expected, reflected easing mortgage rates and slower growth in home prices.

- The typical monthly payment for a buyer purchasing a median-priced home with a 20% down payment was $2,365 in the four weeks ended Jan. 4, the lowest level since early 2024, according to the real-estate brokerage firm Redfin. The median existing-home price in December was $405,400

U.S. existing-home sales

Home Prices Maintain Slow Rate of Gain.

주택가격, 완만하게 올라…

WSJ 12/31/25(Wed)

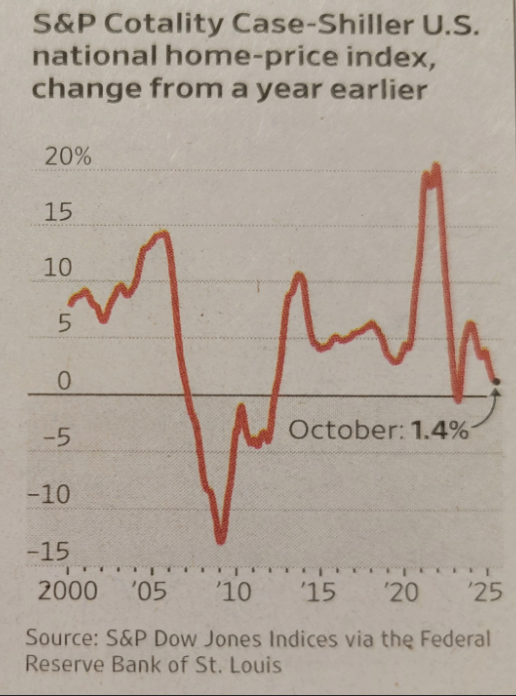

- The pace of U.S. home prices increases kept a slow pace in October, as elevated mortgage rates curb demand.

- The S&P Cotality Case-Shiller National Home Price Index rose 1.4% in the 12 months through October, compared with 1.3% increase in September. This resents weakest performance since mid-2023, partially blamingmortgage rates around 6%. This October reading represents less than 1/3of the 5.1% average home price increase recorded in 2024. When inflationis taking in to account, home values have had a slight decline in 2025.

- Chicago now leads all major market with 5.8% annual price gain, followed by New York at 5% and Cleveland at 4.1%.

- Tampa home prices are down 4.2% year over year, he steepest drop among the 20 major cities.

- In Bergen County, NJ, home price increased 4.5% – 7.1%. Sold price is 102 – 103% of the listing price, indicating stable seller market.

S&P Cotality Case-Shiller Index, change

from a year earlier

WSJ 12/31/25(Wed)

Condo market hit the worst in a decade slump.

콘도 시장 10년만에 최악 침체

AI/Gemini(WSJ) 1/20/26(Tue)

- WSJ reported recently that condo prices in the U.S. have turned negative year-over-year for the first time in 13 years.

- Key drivers of the slump: 1) The HOA Trap – HOA fees have skyrocketed. In some areas, these monthly fees have doubled or tripled due to rising insurance premiums and need for structural repairs. ( Triggered by 2021 Surfside collapse, Fannie Mae Blacklist) 2) Inventory Glut – While single-family market suffers from a shortage, the condo market is seeing a

surge in listings as owners try to offload units. 3) Buyer reference – The shift toward remote work continues to favor larger, suburban single-family. - The most influenced region is Austin & San Antonio(TX), Cape Coral(FL), San Francisco(CAL), Portland(OR)

Builders Turn Their Focus To Data Centers.

건축사업이 데이타 센타 건설에 집중

WSJ 1/20/26(Tue)

- Commercial real-estate construction is poised for little or no growth this year. Data centers are the notable exception.

- Higher interest rates, steeper material prices and a tight labor force provide significant headwinds to new construction this year. Spending to build offices, hotels, apartment buildings and warehouses is projected to fall in 2026, according to estimates from FMI, a Raleigh, N.C.,-based construction consulting company.

- Data centers cost more because of the electrical infrastructure needed to support them, such as power substations and generators, that these firms also build out.

- Many construction firms say they are starting to feel the effects of a tighter immigration policy on labor.

- One-third of construction firms said their operations were affected by immigration enforcement actions in the past six months.

Bowman Says Rates Have More Room to Fall.

준비위원회 가버너 Bowmen는 기준금리 더 내릴 가능 있다

WSJ 1/20/26(Tue)

- Federal Reserve governor Michelle Bowman said Friday that given fragility in the labor market, it is too soon for policymakers to signal that interest rates are on hold.

- Bowman argued that inflation, while elevated, appears on track to cool further, while the job market risks weakening substantially if the economy shifts into a lower gear. With the looming risk of higher unemployment ahead, the Fed shouldn’t rule out the possibility of further rate cuts, Bowman said.

- Traders broadly expect the central bank to hold rates steady at 3.5% to 3.75% at its first meeting of 2026, on Jan. 28. Inflation remains above the Fed’s 2% target, and, in an assessment that differs from Bowman’s, some officials believe that rates are no longer high enough to push back firmly on

price increases, making them wary of further cuts.

Voters Are Unhappy About Trump’s Economy

유권자들, 드럼프 경제정책에 행복해 하지 않는…

WSJ 1/17/26(Tue)

- It’s President Trump’s economy now, and voters are increasingly unhappy with

how he’s handling it. - About half of voters said the economy has gotten worse in the past year, compared with 35% who see improvement. That finding continues a yearslong disconnect between traditional measures of inflation and economic growth, which are relatively positive, and a negative public outlook.

- Those are among the warning signs for the president and the Republican Party in the poll, which finds voters think Trump is focusing on foreign affairs and other matters at the expense of their most pressing concerns—rising prices and the overall economy.

- The poll was conducted Jan. 8-13 and included 1,500 registered voters. The margin of error for the full sample is plus or minus 2.5 percentage points.

Inflation Kept Falling in ’25 But Consumers Still

Strained.

인프레이션 숫자 감소되지만, 소비자는 못 느켜

WSJ 1/20/26(Tue)

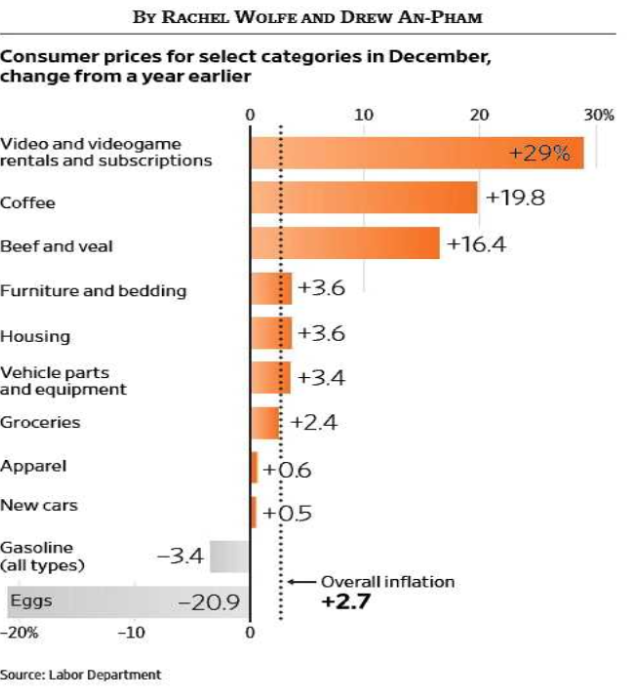

- Gasoline prices are down and tariff impact was muted, while rising grocery bills hurt. Overall inflation decelerated over the course of 2025, from 2.9% year-over-year in December 2024 to 2.7% last month. Core inflation, a measure that excludes the more volatile food and energy prices, fell even more steeply, from 3.2% to 2.6%.

- In a few categories, like gasoline, cellphone service and tickets to sporting events, prices actually dropped.

- Grocery prices are among Americans’ biggest gripes, with food-at-home prices up 2.4% from a year earlier in December, an acceleration from 2024’s increase of 1.8%.

- Inflation in rental housing has been slowing, and analysts expect that to continue into 2026. But rents still remain high compared with historic averages. Home prices, too, are near record levels.

Consumer prices in Dec, change from a year earlier

WSJ 1/20/26