Gold Price is increasing. Why?

“금” 갑이 왜 올라가고 있나?

AI Overview 10/7/25(Tue)

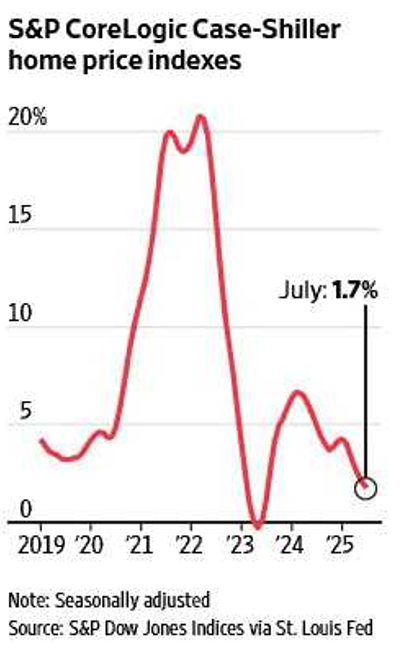

- The price of gold is increasing:, having recently hit a record high, largely due to growing global geopolitical uncertainty, a weaker U.S. dollar, aggressive central bank buying, and expectation of lower U.S. rates.

- Investors are flocking to gold as a safe-haven asset to hedge against economic risks, inflation, and currency devaluation.

- Geopolitical Instability: Events like the collapse of France’s government and other global political turbulence increase investor demand for gold as secure asset.

- Weaker dollar: A depreciating dollar makes gold more attractive to investors, as it provides a hedge against the declining value of paper currency.

- Central Bank Buying:Banks are purchasing large quantity of gold to deversify their reserves and protect against currency instability, especially after sanction of Russian central bank funds.

- Interest Rate Outlooks & Inflation and Debt concerns.

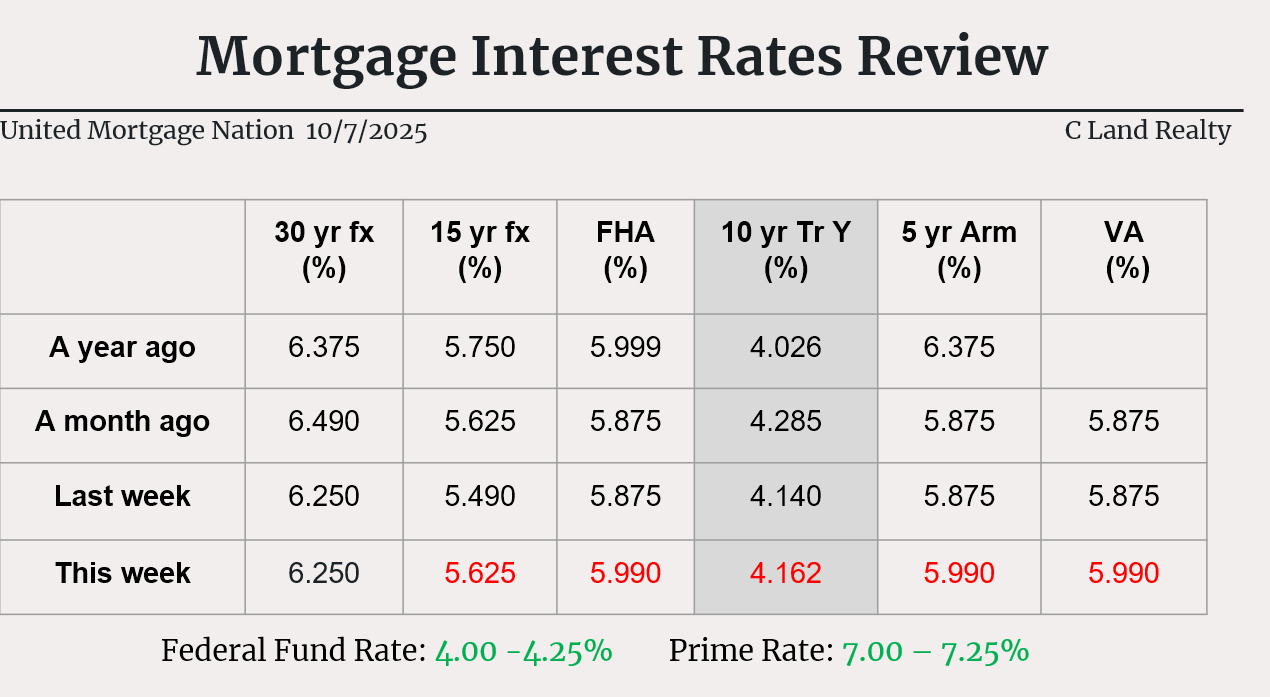

Gold performance, YTD

Home Prices Cooled Ahead of Fed Rate Cut.

기준 금리 감소하며, 집값 상승 다소 열기를 잃어가

WSJ 10/01/25(Thu)

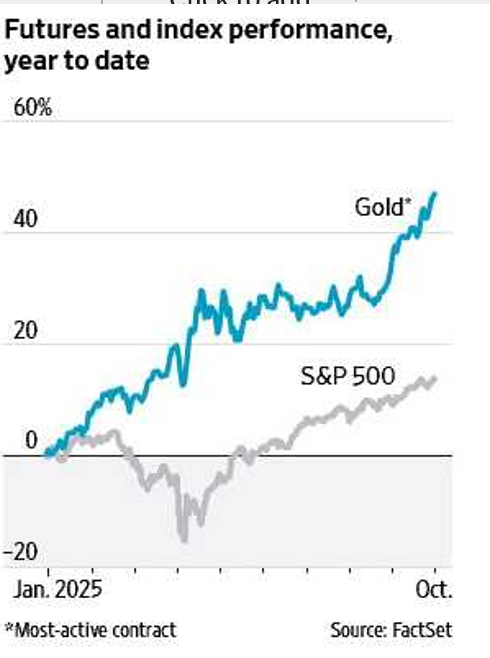

- U.S. home prices continued to rise at a slower pace in July in a fresh sign of summer weakness in the housing market.

- The S&P Case-Shiller National Home Price Index, which measures home prices across the country, rose 1.7% in the 12 months through July, down from 1.9% on year in June, and continuing a run of the weakest price rises since July 2023.

- Of 20 metropolises surveyed in a separate index, New York City continued to lead the pack, with an average 6.4% on-year rise in home prices in July. Chicago and Cleveland booked the next-highest increases.

- “By contrast, several Sunbelt and West Coast markets that were recently red-hot are now faring far worse,” Godec said. Prices in Tampa, Fla., fell 2.8% on year, coming in at the bottom of the list of 20, while Phoenix also recorded lower prices for homes compared with the same month a year earlier.

Case-Shiller Home Index

Georgia Housing Market Overview.

GA 주택 시장 상황

AI Overview 10/7/25(Tus)

Key Statistics (as of January-September 2025)

- Median Home Price:

- $359,600 (January 2025)

- $382,000 (September 2025)

- Year-over-Year Growth:

- 2.3% (January 2025)

- 0.8% (September 2025)

- Inventory:

- Up by 11% year-over-year (January 2025).

- Increased by 15.1% year-over-year (September 2025).

- Months of supply have increased to approximately 4.6 months, approaching a balanced market.

- Sales Activity: June 2025 saw 5,277 homes sold in metro Atlanta, an 8% increase compared to June 2024, indicating robust buyer demand despite higher mortgage rates.

- Homes Selling Above List Price: 15.8% of homes sold above the list price in January 2025, though this percentage has decreased by 2.9 points.

- Price Drops: 26.7% of listings saw a price drop at a growing rate of 3.9 points year-over-year.

- Mortgage Rates: The average 30-year fixed mortgage rate in Georgia was around 6.42% as of September 9, 2025, with forecasts suggesting rates will end 2025 between 6.0% and 6.5%. Lower interest rates can make homeownership more accessible.

Regional Highlights (September 2025)

- Atlanta: Median home price of approximately $445,000, up 6% year-over-year.

- Augusta: Median price of $245,000 (up 5.5%), benefiting from strong military demand.

- Savannah: Median home price of $398,000 (up 4.2%).

- Athens: Median home price of $359,000 (up 3.9%).

- Macon: Median price of $211,500 (up 7.4%), offering high rental yields.

- Columbus: Median home price of $234,000 (up 8.1%), with a steady military and healthcare job market.