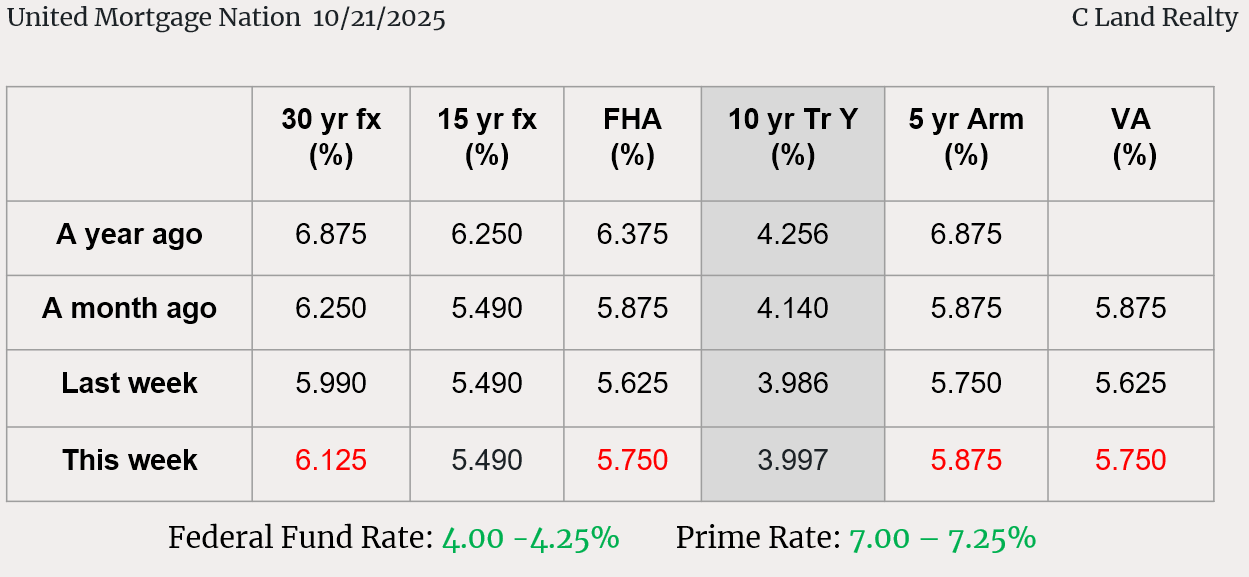

Mortgage Interest Rates Review

Mortgage- Rate Drop Lifted September Home Sales.

모기지 이자률 감소에 9월 주택판매 증가

WSJ 10/24/25(Fri)

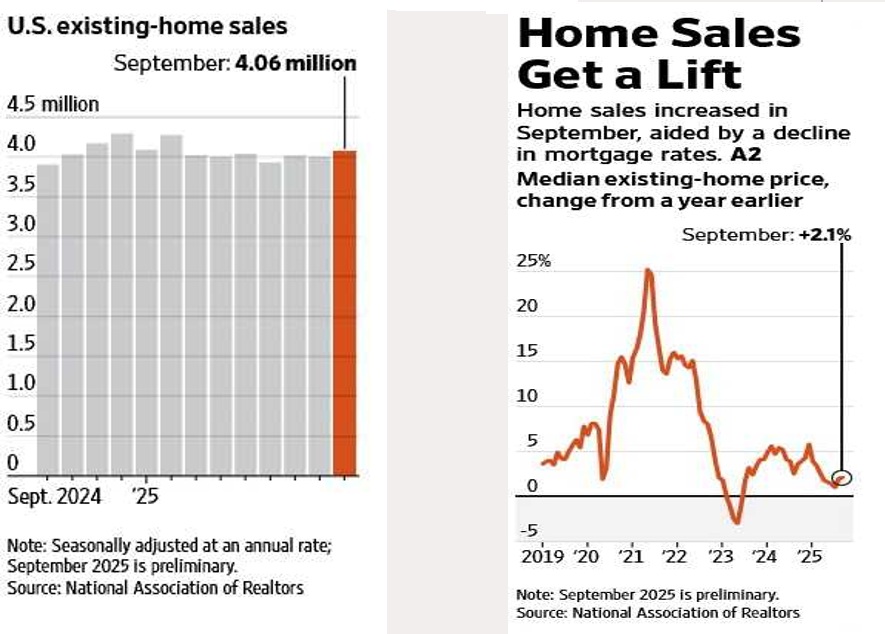

- Sales of existing homes rose 1.5% from the prior month to a seasonally adjusted annual rate of 4.06 million, the highest level since February, the National Association of Realtors said Thursday. That was in line with economist forecasts for the month and a reversal from August’s slight decline in sales.

- “A lower mortgage rate is a major influence for home sales,” said Lawrence Yun, NAR’s chief economist.

- Still, many home buyers see the market as too expensive. With the Federal Reserve expected to continue cutting short-term rates, these buyers are waiting for mortgage rates to come down further, real-estate agents say. The typical monthly mortgage payment for a home buyer in the four weeks ended Oct. 12 was $2,564, down about $300 from May but still up from a year earlier, according to real-estate brokerage Redfin.

U.S. existing home sales / Median home price

Parents, Grads Face Split-Screen Economy.

부모와 자녀들, 전혀 다른 경제 상황

WSJ 10/27/25(Mon)

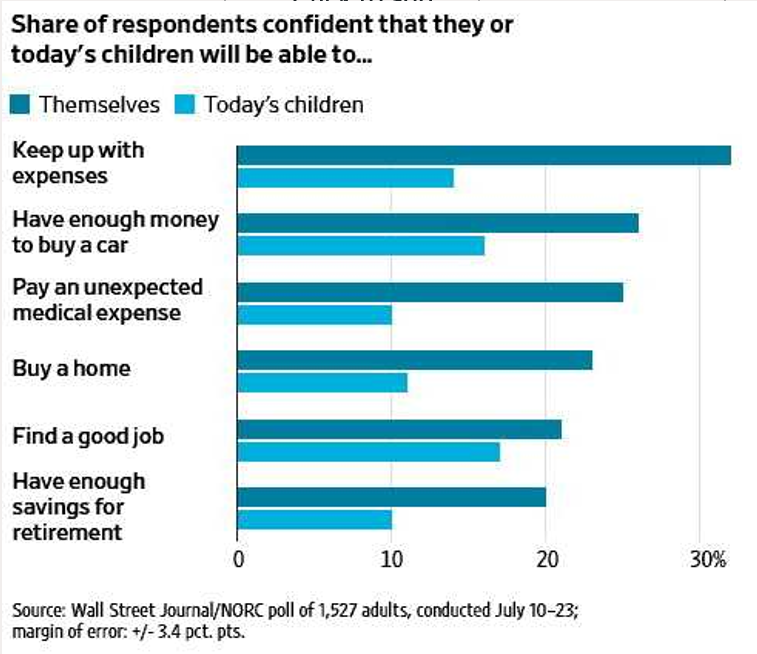

- Older people are faring financially and they’ll tell you they are comfortable. Their houses and 401(k)s have soared in value and they’re looking forward to secure retirements. Yet many are brimming with pessimism about the economy because they see how their children are struggling—to find jobs, to afford mortgages or even rent, to pay for healthcare and child care.

- In a July WSJ poll that examined Americans’ economic views, nearly 70% said they believe the American dream no longer holds true or never did, the highest level in nearly 15 years of surveys. Nearly 80% weren’t confident that life for their children would be better.

- Some economists blame AI for replacing entry-level roles. Others say companies have slowed hiring because they are uncertain how tariffs and other regulatory changes will affect their costs. Recent grads report submitting hundreds of applications through LinkedIn and other portals and barely ever getting a response.

Parents vs. Children.

Another Pain Point: Housing Prices.

또하나의 큰 문제 — 집가격.

WSJ 10/27/25(Mon)

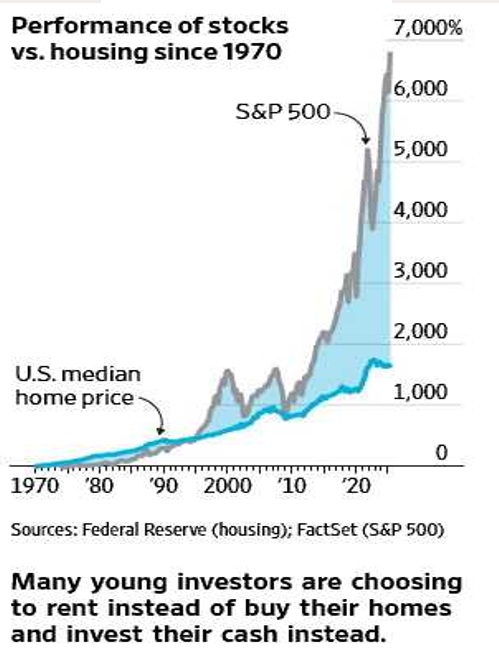

- A 50% leap in home prices since the beginning of the pandemic is another sore spot.

- Young Americans have typically had to save to buy a home, but many of today’s young adults have given up the idea of ever affording one.

- In the WSJ-NORC poll, about 23% of respondents said they were extremely or very confident that they could afford to buy a home, but only 11% felt the same about today’s children’s generation.

- About 32% were confident they could keep up with their expenses but less than half that share were confident of the next generation’s ability to do so.

Performance of stocks vs. housing since 1970

Seniors possess homes and hold them.

시니어소유 많아, 주택시장 정체 주장

Korea Daily 10//25(Sat)

- According to Financial Times report, seniors possess 54% of the U.S. homes, up from 44% in 2008, and they are the most influential group in the residential market.

- Meanwhile 79% of retired residence own homes, and among them 3/4 of don’t have mortgage balance, and enjoy flexibility of financing.

- The financial times vice president said that the expansion of Home Equity Line of Credit(HELOC) would be a main theme for the next 3 -5 years in the home mortgage industry.

- Consequently, they don’t sell homes and it affects to low inventory in the residential market.

- Even worse, due to Trump’s tariff policy, new construction is shrinking further.

Tame Inflation Leaves Many Scraping By.

인풀레이션을 잡을려는 노력이 많은 부수럼을…

WSJ 10/27/25(Mon)

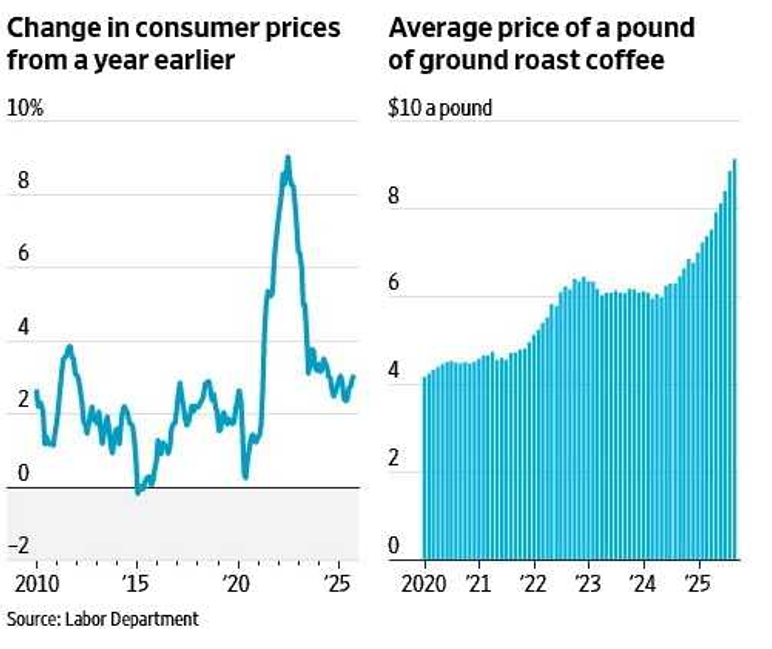

- Inflation had ticked up, but it wasn’t the disaster many forecast earlier in the year when President Trump launched his trade war.

- Annual inflation came in at 3% in September compared with a year earlier, better than the most recent expectations.

- Wealthy Americans, whose finances are buoyed by a rocket-fueled stock market, absorb the sting and keep spending. But wage increases have slowed for middle- and working-class Americans, leaving many households struggling to pay their bills.

- Natural gas and electricity saw some of the biggest annual price increases in September, and food costs also rose slightly faster than overall inflation. Coffee prices surged 18.9% over the past year and the price of beef rose 14.7% to a record. Middle- and workingclass households tend to spend a bigger share of their income on food and utilities than their wealthier counterparts, meaning these price increases hit them harder.

Change in Consumer Prices/Average Coffee price

Amazon to Lay Off Up to 30,000

아마존, 3만명 감원

WSJ 10/28/25(Tue)

- Amazon.com plans to lay off as many as 30,000 employees starting as early as Tuesday, the latest cost-cutting move for the tech giant that is seeking to slim down and conserve cash.

- The job cuts, which won’t all happen this week, would amount to roughly 10% of the online giant’s corporate workforce, the people said.

- Amazon’s job cuts come as large companies in the U.S. are looking at ways to reduce or slow the growth of their head count, including by employing artificial intelligence. Rising prices, a tighter labor market and the ebb and flow of President Trump’s trade war have led corporate leaders to look at ways to tighten belts without hurting growth.

- The company said its capital expenditures rose to $31.4 billion for the period, most of which went to AI and cloud computing investments. At the time, Amazon said the figure was “reasonably representative” of its planned spending for the rest of the year.

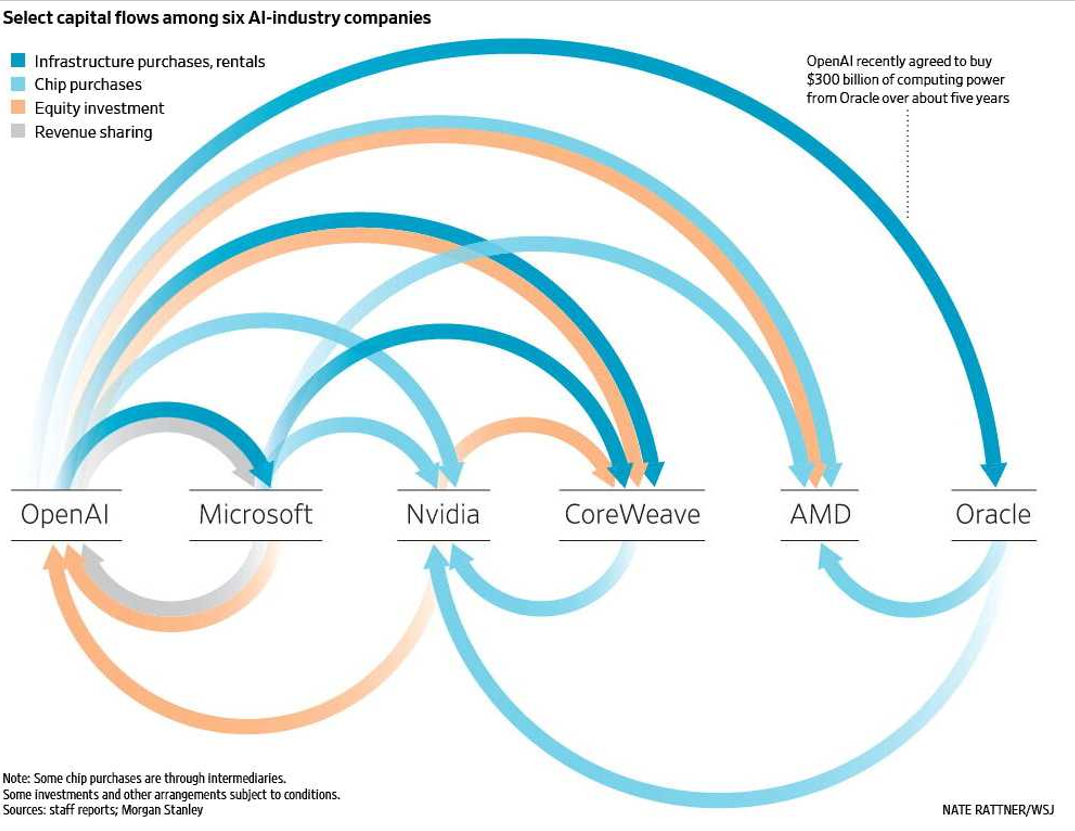

Circular AI Deals Spark Worries of a Bubble.

AI 회사끼리의 재투자가 금융 붕괴의 우려를

WSJ 10/23/25(Thu)

- “Circularity” has become a buzzword in artificial-intelligence deals. Some investors have drawn comparisons between the megadeals of today and some excesses of the original dot-com bubble.

- Today the dollars at stake are exponentially bigger, the deals are more complex, and the money trail is often harder to follow. But some similarities are real. One risk is if enthusiasm for spending money on data centers wanes, companies such asNvidiaand Microsoft could be hit twice—with less revenue coming in and declining values for their equity investments in customers.

- That is when the AI ecosystem conceivably could hit a wall, and where the parallels may lie with the original internet bubble and the circular deals of that era. Circularity can be virtuous on the upside, and vicious on the downside. The deals can work fine, until they don’t.