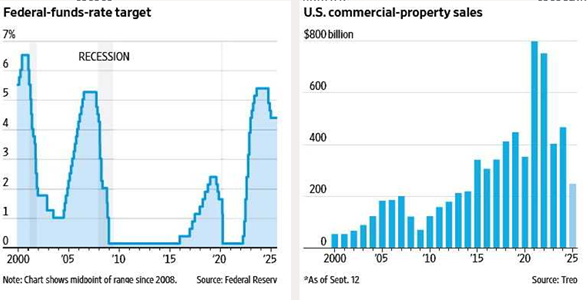

Rates to Juice Commercial Property.

이자률 감소가 상업용 건물에 활기를…

WSJ 9/24/25(Wed)

- The Federal Reserve’s rate cut last week is unlikely to help many Americans soon buy a home. But for the businesses involved in buying, selling and financing offices, apartment buildings and malls, the benefits could show up much more quickly.

- Office buildings are still struggling with post pandemic vacancies. But central business- district office building sales prices rose close to 2% in July compared with a year earlier, after recording a 25% decline during the same month last year

- The recent cut to the FFR is only 0.25%, but more cuts could be on the way. A majority of officials have penciled in two additional rate cuts before the end of this year, Powell said in a Wednesday meeting with reporters.

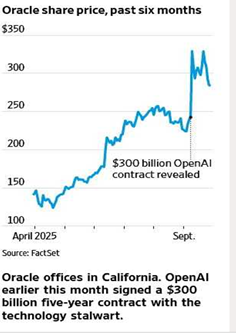

FFR target & Commercial Property Sales

Zillow nears First Year in Black since 2012.

질로 사, 13년만에 처음으로 흑자로 접근…

WSJ 9/29/25(Mon)

- The online home-buying and rental platform, which launched in 2006 and went public in July 2011, expects to report full-year profit. That progress is occurring as the housing market remains sluggish, with high prices and economic uncertainty deterring buyers.

- Zillow has focused on boosting revenue from services such as rentals and mortgages, while slowing head count growth. “Even if the housing market were to stay where it is, we think there’s a lot of growth to come,” Hofmann said.

- Zillow’s revenue in the mortgages business was up 41% in the latest quarter from a year earlier, primarily from higher volume of loan originations. Revenue for the residential business, which centers on agent advertising and software, climbed 6%, in part because of greater adoption of software services by sellers and listing agents, as the housing market stayed essentially flat.

KB Home Lowers Outlook Amid Slow Market.

빌더, KB Home 저조한 시장하에 예상을 하향조절

WSJ 9/25/25(Tur)

- KB Home, based in Los Angels who is specialized in first home buyers, recorded lower third-quarter profit and cut its full-year outlook again as a wobbly housing market pushed down home prices. KB Home’s average sales price fell to $475,700 in the third quarter from $480,900 the year prior.

- The home builder reduced its full-year sales guidance to $6.1 billion to $6.2 billion, down from its previous forecast of $6.3 billion to $6.5 billion.

- Mortgage rates have recently fallen, but builders have said that hasn’t led to higher sales activity. “I wouldn’t say that we’ve seen the uptick that we would expect to see from such a change in mortgage rates,” KB Home Chief Operating Officer Robert McGibney said on the company’s earnings call. “And I think to some extent, buyers are in maybe a bit of a wait-and-see mode.” A weakening labor market has raised concerns that the housing market may remain stubbornly slow.

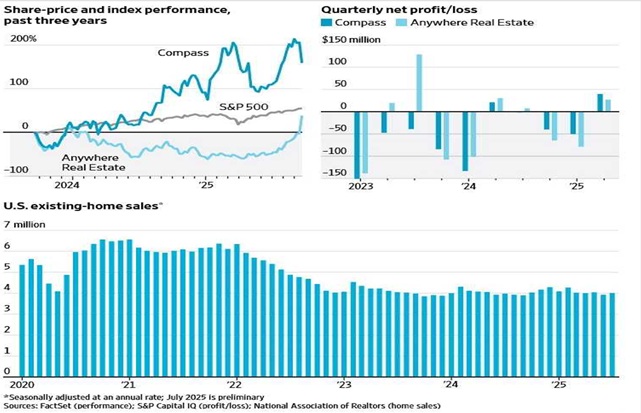

Real-Estate Broker Compass to Buy Rival Firm Anywhere for $1.6 Billion.

부동산 Compass사, 경쟁사 Anywhere 를 $1.6B 에 인수

WSJ 9/23/25(Tue)

- Leading real-estate brokerageCompasssaid it has agreed to acquire rival Anywhere Real Estate for $1.6 billion, the clearest sign yet that a long stretch of lackluster home sales is sparking industry consolidation.

- The all-stock transaction would create a new industry giant with an enterprise value of about $10 billion, including debt, in one of the largest deals ever in the residential brokerage industry.

- Compass and Anywhere were already the first- and second-biggest brokerages by volume in 2024, respectively, according to Real Trends. Compass has about 40,000 agents, while Anywhere has about 51,000 agents at brokerages it owns and another 250,000 agents at its franchises.

- Even with this acquisition, the combined firm will control less than a quarter of the country’ s home-sales volume. The real estate brokerage industry is highly fragmented among many small firms that specialize in individual markets, and more than 100,000 real-estate firms operate in the U.S.

August, PCE Index 2.7% Up .

8월 PCE 물가지수 2.7% 상승

Korea Daily 9/29/25(Mon)

- While the Fed is concerned most, August PCE increased by 2.7%, compared to a year ago. This is the highest increase for the last 16 months since April, 2024(2.8%).

- PCE increase is higher level, but it is not much over than the market anticipation by the economy experts. Therefore, it will not affect to the Fed’s course to cut the FFR further, anticipated the market.

- According to CME(Chicago Merchant Exchange), after August PCE index announced, the probability of rate cut of 0.5% in the FOMC in Dec becomes 64%, which is up from 61% a day before.

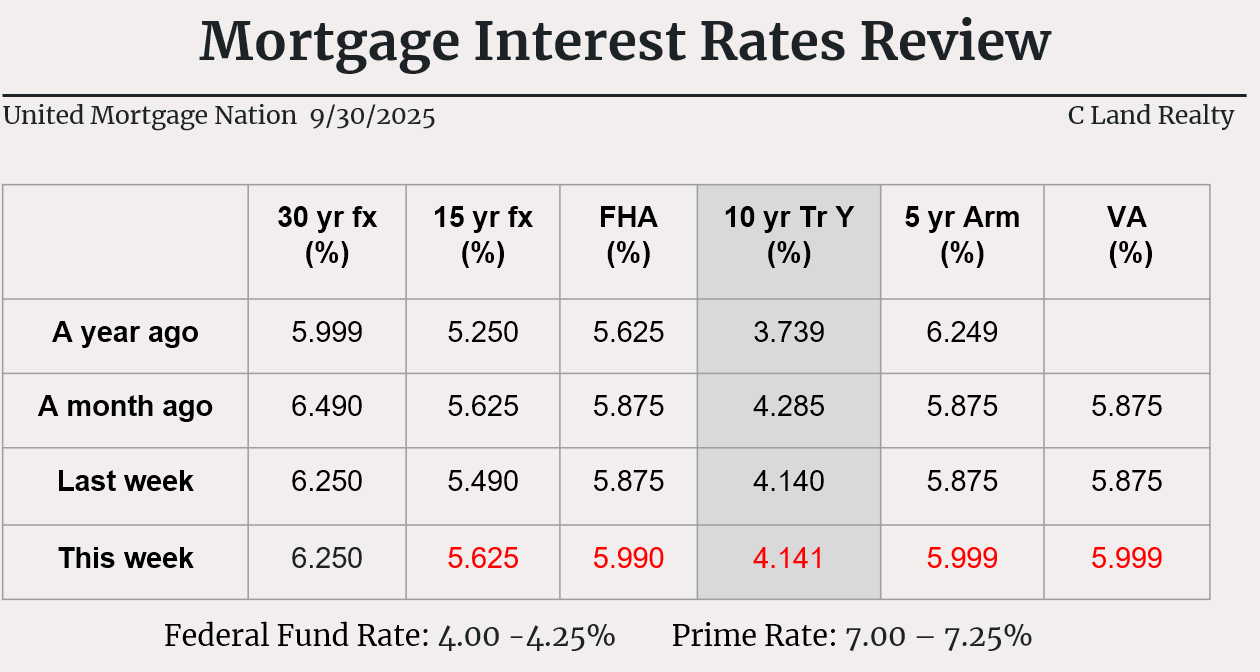

Fed Rate Cut Won’t Lower Borrowing Costs Right Away.

준비위원회 이자률 감소가 즉시 융자비용을 줄이진 못해

WSJ 9/30/25(Tue)

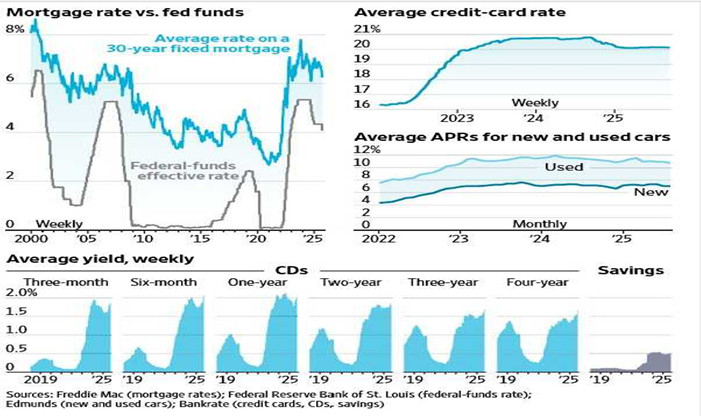

- The Fed lowered its benchmark rate on Sept. 17, its first trim this year, and signaled more cuts could be ahead.

- Mortgage rates tend to move loosely with yields on longer-term, 10-year Treasurys. Those yields rise and fall based on expectations for the economy. MBA estimated that the rates would actually increase to 6.5% by the end of the year, slightly lower than that by the end of 2026.

- Once the Fed cuts rates, cardholders typically see their interest rates adjusted within two billing cycles. But for those who carry a balance, a single rate cut by the Fed won’t make much of a dent on monthly minimum payments.

- The average rate for a new car has remained virtually unchanged at 7% from last year, according to Edmunds, a company that operates a car-buying and research platform. For used cars, the average rate was 10.7% in August, down from 11.3% the same time last year.

Debt Is Fueling Next Wave of AI Boom.

엄청난 부채가 AI 붐에 솟아 부어지고 있는…

WSJ 9/29/25(Tue)

- OpenAI is laying the groundwork for a network of data centers that will cost at least $1T over the next few years. As part of its push, the company signed a $300 billion 5-year contract this month under whichOracleis to set up AI computing infrastructure and lease it to OpenAI. (U.S. Budget is $6.75T in 2024)

- Oracle is highly leveraged. It had long-term debt of about $82B at the end of August, and its debt-to-equity ratio was about 450%. Alphabet’sratio was 11.5% in its latest quarter, and Microsoft ’swas about 33%.

- Numerous recent studies found AI isn’t gaining traction as quickly as its backers suggest. Only 3% of consumers are paying for it, according to one study. Projections of spending on AI data centers reaching trillions of dollars a year within the next few years seem highly optimistic.

- There is a decent chance that it all works out. But it is at least equally likely that many of today’s massive contracts get postponed or renegotiated because end demand for AI services doesn’t grow in line with the infrastructure build-out.

Oracle share price, past 6 months