Mortgage Interest Rates Review

United Mortgage Nation 8/13/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.249 | 6.250 | 6.750 | 4.184 | 7.249 | 7.249 |

| A month ago | 6.799 | 5.999 | 6.125 | 4.229 | 6.799 | 6.799 |

| Last week | 6.499 | 5.750 | 5.999 | 4.178 | 6.625 | 6.625 |

| This week | 6.625 | 5.875 | 5.999 | 3.909 | 6.625 | 6.625 |

Federal Fund Rate: 5.25 -5.50% Prime Rate: 8.25 – 8.50%

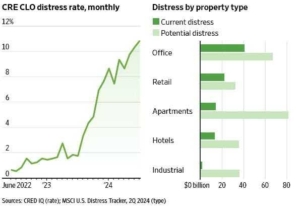

Apartment Loans Are in Bad Shape, Too

아파트먼트 건물 융자도 심각한 문제…

WSJ 8/9/24(Fri)

- “Survive until 25” has become a mantra for landlords who are hanging onto buildings by their fingernails and praying for rate cuts soon. While it is well understood that many offices are a lost cause, apartment loans are in surprisingly bad shape, too.

- More than $40 billion of office loans were in distress at the end of the second quarter based on data from MSCI, which is around three times the value of distressed apartment loans.

- But the pool of apartment mortgages that could get into difficulty in the future is larger—$80.95 billion are at risk of distress, compared with $66.87 billion for offices. These loans are flashing amber because occupancy rates are falling or the income generated by the buildings is barely enough to meet interest payments, says Alexis Maltin, a vice president at MSCI Research.

CRE loan distress rate & types

WSJ 8/9/24

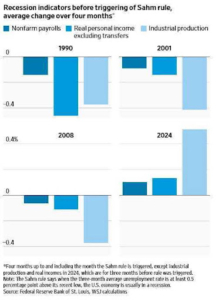

A Recession isn’t here, But Risks Grow

경기 침체는 아직, 그러나 위험률은 증가

WSJ 8/7/24(Thu)

- Unemployment is rising, stocks have fallen and long term bond yields are well below short-term interest rates. These are all telltale signs of recession. But a closer look suggests that while recession risk has risen, the U.S. isn’t in one now. The distinction is crucial because it means it isn’t too late to head off a downturn

- Two events are driving the recession talk. The first is the stock-market selloff, which wasn’t triggered by news of the U.S. economy, but by the Bank of Japan’s decision last Wednesday to tighten monetary policy.

- The second event came days later when it was reported that the U.S. unemployment rate had jumped to 4.3% in July from 4.1% in June and 3.4% last year, triggering one popular rule of thumb that says the U.S. is in recession.

Recession indicators before triggering Sahm Rule

WSJ 8/7/24

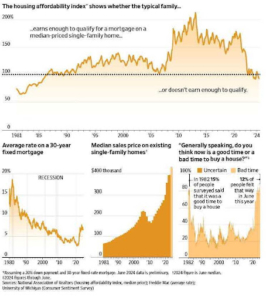

Home Affordability is worst since 2007

전국 주택구입 여건, 2007이후 최악

Korea Times 8/7/24(Wed)

- According to Attom, U.S. nationwide affordability of buying home is worst since 2007. Buying cost including mortgage payment, property tax, home insurance takes 35.1% of average income in 2nd Qt, 2024, the highest since 2007, while it was 32.1% a year ago.

- Depending areas, buying cost hit 43% in some areas in U.S. and usually the cost is supposed to 28% according the guideline. Usually the housing cost is over 30%, then the owner is considered as “house poor”.

- Especially in California, “house poor” owners are increasing while its median house price is over $900,000.

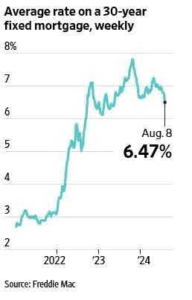

Mortgage Rates Hit Lowest level in Over Year

주택 모기지 이자률, 1년내에 제일 낮아…

WSJ 8/9/24(Fri)

- Mortgage rates in the U.S. fell to the lowest level in more than a year, raising hopes for relief in the nation’s battered housing market.

- The average rate on the standard 30-year fixed mortgage declined around a quarter percentage point to 6.47%, according to a survey of lenders released Thursday by mortgage-finance giant Freddie Mac, a low not seen since May 2023 and the sharpest weekly decline in around nine months.

- If sustained, lower mortgage rates could help shepherd some people back into a market that they have been priced out of in recent years. Home sales fell last year to their lowest level in nearly three decades, and they have been similarly sluggish in 2024.

30-year Mortgage Rates

WSJ 8/9/24

Don’t Bet on a Quick Drop In Mortgage Rates

아직은 빠른 주택 이자률 감소에 큰기대 못해…

WSJ 8/10/24(Sat)

- Bad news for the stock market can be good news for home borrowers. Sharp stock-market declines in recent sessions were accompanied by rallies in Treasurys and mortgage- backed securities. It was a classic “flight to safety” trade that in part reflects an outlook of lower interest rates and a weaker economy. And since mortgage rates quoted by lenders are partly priced off those bonds, they dropped too.

- Freddie Mac’s weekly survey for 30-year fixed-rate conventional mortgages dropped more than a quarter-point from the prior week to 6.47%.

- But with Treasury yields bouncing back over the course of this past week, it might be premature to expect a continuing plunge in weekly mortgage-rate measures— unless of course Treasury yields plunge again.

Home-Buying Market is Toughest Since ‘80s

주택 구입 시장, 80년대이후 가장 힘든 시기

WSJ 8/12/24(Mon)

- Today’s housing market is the most difficult in decades, a great frustration for millennials and Gen Zers looking for a starter home. Baby boomers can relate.

- Home-buying affordability dropped last fall to the lowest level since September 1985, and it fell near that level again in June. In 1985, millions of Americans were in their late 20s and early 30s, the prime first-time home-buying years. They also found themselves priced out of the market. But because buyers in the mid-80s had much more housing supply, homes became more affordable as mortgage rates fell in subsequent years.

- In September 1985, 72% of consumers said it was a good time to buy a home, according to the University of Michigan’s consumer sentiment survey. In June 2024, just 12% said the same.

Housing Affordability Index

WSJ 8/12/24

Korean Media misled public on commission change

한국 신문들, 부동산 수수료에 대한 잘못 보도

Stephen Lee 8/13/24(Tue)

- Some of Korean newspapers has misled public about the recent Realtor’s practice change on real estate commission fee structure.

- Korea Daily Newspaper(중앙일보) wrote “it has been determined that seller and buyer pay each party’s broker fee separately” which is not correct.

- Miju News(미주 경제) wrote “ Seller and Buyer must pay each portion by a half(양분해서 지불해야 한다)“, but later part of article says that it is expected somewhat to continue to practice as it was done so far”

- Korea Times(한국일보) understood and wrote correctly that commission payment can be negotiated.

YouTube Builder Susan Wojcicki died

유튜브를 일으켜 세운 여성 CEO, 암으로 별세

WSJ 8/12/24(Mon)

- Susan Wojcicki, an instrumental figure in the birth of Google who later oversaw the company’s YouTube platform, has died at the age of 56.

- Wojcicki played a central role in developing the technology systems that distribute advertising dollars around the internet. After joining Google as one of its earliest employees(16th), she led development of its AdSense product, a software widget that allowed the company to broker ads for millions of independent websites and became an important tool for the tech giant.

- Later, as YouTube CEO, Wojcicki oversaw the maturation of the site’s business model into an operation generating billions of dollars of revenue for video creators and Google’s parent company, Alphabet.

YouTube CEO died of lung cancer at 56(1968-2024)

WSJ 8/12/24