Mortgage Interest Rates Review

United Mortgage Nation 1/24/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.249 | 5.125 | 5.750 | 3.484 | 6.249 | 6.249 |

| A month ago | 6.899 | 6.375 | 6.299 | 4.363 | 6.875 | 6.875 |

| Last week | 6.625 | 5.750 | 5.999 | 4.013 | 6.625 | 6.625 |

| This week | 6.699 | 5.875 | 5.999 | 4.094 | 6.625 | 6.625 |

Federal Fund Rate: 5.25% -5.50% Prime Rate: 8.25%-8.50%

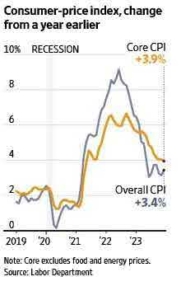

Inflation Ticks Up After Cooling

WSJ 1/12/24

12월 인플레이션 지수 상승

- Inflation’s cool-down from historic highs keeps the Federal Reserve on track to hold rates steady later this month and contemplate cutting them later this year. But U.S. consumers aren’t in the clear yet. The consumer-price index increased 3.4% from a year earlier in December, the Labor Department said Thursday. The acceleration from November’s 3.1% advance shows inflation isn’t fully beaten..

- People paid more for rent, auto insurance and dentist visits in December, but less for furniture, toys and sporting goods. Overall prices climbed 0.3% from the prior month versus a 0.1% gain in November. Core prices, which strip out volatile food and energy items, rose 0.3% in December from the prior month, the same as November, and increased 3.9% from a year earlier, a slight slowing.

Consumer-price index, change from a year earlier

WSJ 1/12/24

Bankrupt WeWork Wrestles to Amend Leases

WSJ 1/23/24

파산한 “위웍”, 리즈 변경 쉽지 않아…

- Bankruptcy law allows companies to throw out unfavorable contracts and leases, and WeWork received court approval to reject dozens of leases since filing for bankruptcy in early November. But the company is looking to stay in many of its locations with better terms, and the threat of lease rejections has motivated landlords to come to the table to negotiate.

- Some landlords have been told by lenders they would need to put more equity in their properties to keep the loan if they make concessions to WeWork. Meanwhile, landlords are asking WeWork to share more detailed restructuring plans to determine whether additional equity investments would make financial sense.

NJ, 2nd to the Worst of Living Condition after Retirement

Korea Time 1/24/24

뉴저지 은퇴후 살기 나쁜주 2위 오명

- Wallethub reported that Florida is #1 state for living after retirement, considering living cost(#4) and quality(#1), healthcare(#29), etc.

- NJ is #49 among 50 states in the U.S. in terms of living cost and # 35 in terms of living quality and #20 in healthcare.

- NY is #50 in terms of living cost .

- Overall, Colorado is #2, and Virginia is #3.

Foreclosure in 2023 increased 10% from last year

Korea Times 1/24/24

주택차압,전년대비 10% 증가

- Numbers of house foreclosure increased 10% compared to 2022, to 357,062 ( NOD, REO) which is 0.26% of total sales in U.S. But still it stays below pre-pandemic era(0.36%), according to Atom, Real Estate Data provider.

- The numbers of NOD(Notice of Default) increase 9% compared to 2022 to 272,222 while REO declined little bit.

- NJ is #1, and Illinois, Delaware, Maryland, Ohio are in the upper ranking.

More Youngsters living with parents to save down payments

WSJ 1/24/24

다운페이먼트 마련 위해 부모와 사는 캥러루족 증가

- NAR reported that youngsters living with their parents increased and the first home buyer in 2022 who moved out of their parents’ house and families’ was 27% while it was 23% in 2023.

- Living together will be a trend until more housing supply provided.

– Saving down payment for purchasing house.

– Un-avoidable situation under the hiking living cost.

– Waiting for a good time to buy while living with parents.

– Has to give up convenience in order to have “my own house”

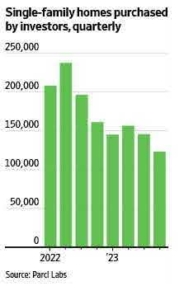

Even for Property Investors, Housing Market is Too Pricy

WSJ 1/24/24

대단위 투자자들에게도 집값이 너무 비싸

- Investor purchases of single- family homes tumbled by 29% last year as higher interest rates and record home prices drove off even deep-pocketed investment firms.

- Businesses large and small acquired some 570,000 homes in 2023, down from 802,000 in 2022, according to national research from Parcl Labs, a real-estate data and analytics firm. Fourth-quarter investor purchases, at 123,000, represented the lowest quarterly total in the eight quarters tracked by Parcl.

- In a separate analysis of sales for the first nine months of last year, Realtor.com said 2023 was on track for the largest drop in investor buying activity in at least 20 years.

Single-family homes purchased by investors, quarterly

WSJ 1/24/24