Mortgage Interest Rates Review

United Mortgage Nation 7/23/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.875 | 5.875 | 6.250 | 3.894 | 6.875 | 6.875 |

| A month ago | 6.899 | 6.125 | 6.249 | 4.254 | 6.899 | 6.899 |

| Last week | 6.799 | 5.999 | 6.125 | 4.229 | 6.799 | 6.799 |

| This week | 6.875 | 6.125 | 6.125 | 4.260 | 6.875 | 6.875 |

“Bando” Construction purchased a building in Times Square

반도건설, 타임스 스퀘어 건물 일부 인수

Korea Times 7/19/24(Fri)

- “Bando” Construction Co has purchased a part of a building at 2 Times Square, NY — 1st and 2nd floor (25,600 sf) on Broadway in Times Square, Manhattan at $100M.

- The Times Square has about 130M foot traffic annually. Bando is planning to have a retail mall with K-Food, K-contents, etc.

- The building is located at the intersection of Broadway and 7th Subway, and is well known for huge electronic bulletin boards such as Samsung and Coca Cola, etc. Currently these two floors has tenants such as Olive Garden, Lids(Sporting goods), and a hotel is occupied between 3rd floor to 25th floor – no vacancy in the building.

Is the Worst Over for New York Offices?

맨하탄 오피스 시장, 최악은 지났나…

WSJ 7/19/24(Fri)

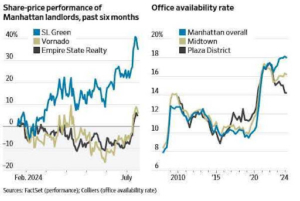

- Manhattan landlord SL Green has been one of the top-performing property stocks this year despite stiff competition for tenants.

- Manhattan’s biggest office landlord SL Green reported good second-quarter results after the market closed on Wednesday. Analysts covering the stock expected funds from operations to reach $1.65 a share in the quarter, but the company managed $2.05. Its portfolio performed better than anticipated and its Summit observation deck at One Vanderbilt is proving popular.

- SL Green is on track to pass two important milestones. It wants to lease 2 million square feet of space in 2024 and has already found tenants for 1.4 million square feet. The company also expects its occupancy rate to recover to around 91.5% this year.

Manhattan Landlords Performance & Office availability

WSJ 7/19/24

Zombi Mortgage arises while home price soaring

집값 상승에 “좀비 모기지“ 우려

Korea Daily 7/23/24(Tue)

- In around 2008, many home owners received junior mortgages beyond their 1st mortgage loans. While going through financial-crisis, many of them received “forgiven” notice from those lenders for their junior mortgages and there was no tracing and bothering any more.

- However, most home loans are “re-course loan” which means debtor has a legal right to pursue to collect their debt even after they released the lien against the property because they are personally liable to the debt.

- Those who bought the those unpaid (forgiven) mortgage notes at less than a dollar have started collecting debts by charging unbelievable interests and fees and possible foreclosure filing.

Why Fed Should Cut Interest Rates Now

지금 이자률을 내려야 하는 이유…

WSJ 7/19/24(Fri)

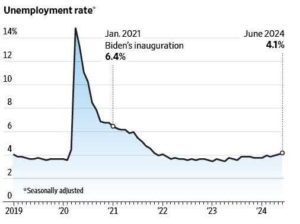

- Fed has succeeded. Inflation, by its preferred gauge, has fallen from 4.3% then to an estimated 2.6% now, the steepest decline since 1984, and within shouting distance of the Fed’s 2% target. Meanwhile, the unemployment rate has risen to 4.1% from 3.6%, an increase seldom seen outside recessions.

- Risk for waiting: There are warning signs. Historically, when unemployment rises this much, it tends to keep going up.

- Risk of cutting: The biggest risk to cutting now is that inflation might not be defeated. Yet a reacceleration looks quite unlikely.

- Right now, odds are the Fed won’t cut in two weeks but will signal it is ready to do so in September. That should keep markets calm. But an actual and an expected cut aren’t the same thing.

EV Prices Are Being Slashed, Testing Appetite of Consumers .

전기차 가격 저하로 소비자들 자극…

WSJ 7/23/24(Tue)

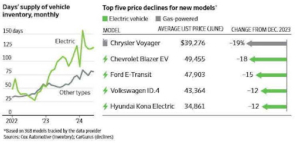

- Now EVs are among the biggest bargains on the dealership lot. Many electric models have never been cheaper, as automakers splurge on financing deals and cash incentives to sway consumers. The steeper discounts will serve as a test of Americans’ appetite for going electric after months of slowing demand.

- Still, it won’t come cheap for the car industry: Discounts and deals make EVs that have already drained billions from legacy automakers’ bottom lines even less profitable.

- Over the past year, weaker demand for battery-powered cars and trucks has left dealers with too much stock, triggering more discounts and cheap lease offers.

EV Supply and Price

WSJ 7/23/24

Voters’ Economic Discontent Shadows Biden Successor

서민들의 경제에 대한 불만이 바이든 후계자를 어렵게…

WSJ 7/23/24(Tue)

- When the public thinks of Biden’s economic record, they focus on something else: Inflation, which in 2022 hit a 40-year high before receding. Inflation endangered Biden’s re-election even before concerns about his age emerged.

- Trump’s own rhetoric still emphasizes tax cuts and tariffs, neither of which are particularly popular. Economists believe his plan to raise tariffs, deport unauthorized immigrants and cut taxes will raise inflation, interest rates and deficits.

- No one knows if they are right. But the more the Democratic nominee can talk about the future under Trump rather than the past under Biden, the better his or her chances will be.

Inflation & Unemployment in Biden Era

WSJ 7/23/24

IMF Warns Tariffs Pose Inflation Risk

IMF가 관세장벽정책이 인플레이션 상승시킬것을 경고

WSJ 7/17/24(Wed)

- A fresh wave of tariffs could revive inflation and pressure central banks to keep their key interest rates high, the International Monetary Fund warned Tuesday.

- Donald Trump has proposed a 10% tariff on all U.S. goods imports and a 60% tariff on imports from China. Many economists believe that would push U.S. inflation higher in 2025.

- Investors preparing for the possibility of a Trump victory in November also expect to see a rise in U.S. government borrowing as taxes are cut. “It is concerning that a country like the United States, at full employment, maintains a fiscal stance that pushes its debt-to-GDP ratio steadily higher, with risks to both the domestic and global economy,” said IMF chief economist.

Tesla to use Humanoid Robots to Help Make Cars

테슬라 사, 인간로봇 자동차 제작에 투입한다…

WSJ 7/23/24(Tue)

- Elon Musk said Monday morning that Tesla would use the robot for internal use first and then aim to produce it for other companies in 2026. Tesla, an EV maker, has been working on the robot for several years as part of its efforts to expand into robotics and artificial intelligence.

- Musk said Tesla aimed to produce the robots in larger quantities for 2026. He has said the company wanted the robots to have a price point below $20,000. The robots are expected to have conversational capabilities and include safeguards to prevent wrongdoing.

- Tesla shares rose 5% on Monday. The stock has risen roughly 75% since late April, a sharp rebound after a steep decline in the beginning of the year.

Humanoid by Tesla

WSJ 7/23/24