Mortgage Interest Rates Review

United Mortgage Nation 6/3/2025

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 7 yr Arm (%) | VA

(%) |

|

| A year ago | 7.250 | 6.375 | 6.625 | 4.614 | 7.250 | |

| A month ago | 6.899 | 6.125 | 6.250 | 4.347 | 6.899 | 6.125 |

| Last week | 6.875 | 6.125 | 6.250 | 4.485 | 6.500 | 6.250 |

| This week | 6.875 | 6.125 | 6.250 | 4.468 | 6.500 | 6.375 |

Federal Fund Rate: 4.25 -4.50% Prime Rate: 7.25 – 7.50%

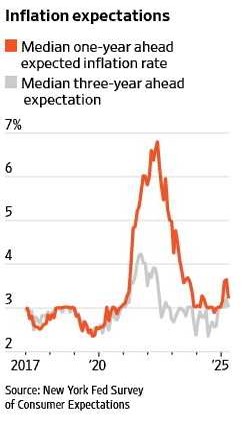

Inflation Expectations Fall in Survey

여론 조사에, 인플레이션 감소로…

WSJ 6/10/25(Tue)

- Consumers anticipate less inflation over the next year than they did a month ago, the New York Fed found in its latest monthly survey.

- Over the next 12 months, consumers expect prices to rise 3.2%, down by 0.4 percentage point from a month ago, according to the May edition of the New York Fed’s survey of consumer expectations.

- Three-year inflation expectations fell to 3%, from 3.2% in April. Five-year inflation expectations dropped to 2.6%, from 2.7% a month before.

- Lower inflation expectations are good news for Federal Reserve officials aiming to keep year-over-year price increases around their 2% target. When expected inflation, especially in the long term, rises well above target, consumers might respond by ramping up spending and demanding wage increases, kicking off a self-fulfilling prophecy.

Inflation Expectation

WSJ 6/9/25

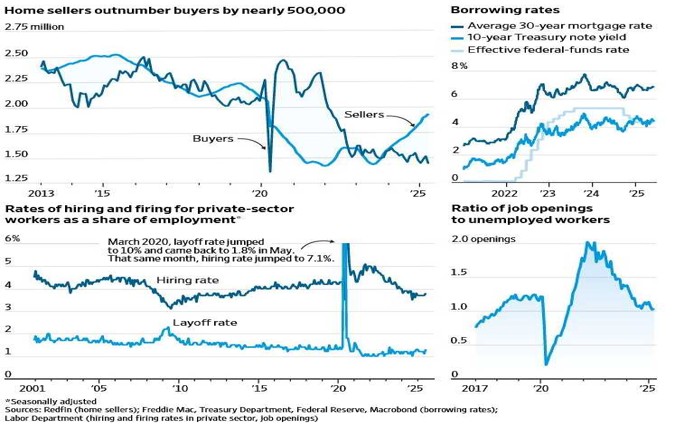

Economy Heads Toward Uncertain Summer

미국 경기, 불투명한 여름으로…

WSJ 6/9/25(Mon)

- Firms freeze hiring and investments to deal with shifting Trump tariff policies.

- The U.S. economy, which weathered false recession alarms in 2023 and 2024, is entering another uncomfortable summer.

- Job growth held steady in May, with the economy adding 139,000 jobs. The unemployment rate has stayed in a tight range, between 4% and 4.2%, over the past year.

- But there are cracks beneath the surface. Businesses are warning that constantly shifting trade policies are interfering with their ability to plan for the future, leading to hiring and investment freezes. Three risks are:

1)The U.S. labor market has been in an uneasy equilibrium

2)Consumers could finally push back against rising costs, forcing companies to tighten their belts.

3)Financial-market shocks or abrupt sentiment changes remain a wild card.

Uncertain Summer

WSJ 6/9/25

No, AI Robots Won’t Take All Our Jobs

AI 가 모든 일자리를 다 없애진 않을거…

WSJ 6/6/25(Fri)

- Anthropic CEO Dario Amodei said last week that artificial intelligence could eliminate half of all entry level white-collar jobs within five years and cause unemployment to skyrocket to as high as 20%.

- Customers would then be able to spend less money on insurance and more on other things, such as vacations, restaurants or gym memberships. They get spent, thereby creating more jobs.

- Further, there is a great deal of work that only humans can do. Self driving school buses will still need an adult to watch the kids. As for police, AI robots won’t be arresting criminals anytime soon. It’s a similar story for fish and game wardens, fashion models, priests, stonemasons, plumbers and flight attendants. Most occupations involve working with other people, with things or with ideas that are too complex for AI to handle alone. People in the last category include legislators, CEOs, antitrust attorneys and so on.