Mortgage Interest Rates Review

United Mortgage Nation 6/5/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.875 | 5.875 | 6.250 | 3.700 | 6.875 | 6.875 |

| A month ago | 7.375 | 6.500 | 6.625 | 4.644 | 7.375 | 7.375 |

| Last week | 6.999 | 6.375 | 6.375 | 4.437 | 7.125 | 7.125 |

| This week | 6.999 | 6.250 | 6.249 | 4.491 | 6.999 | 6.999 |

Federal Fund Rate: 5.25 -5.50% Prime Rate: 8.25 – 8.50%

Values Plummet in This Billionaires’ Row Tower

맨하탄 432 Park Ave 콘도 가격 추락

WSJ 5/31/24

- When 432 Park Ave launched sales to much fanfare in 2013, the condominium was hailed as one of Manhattan’s most prestigious addresses. The sleek, roughly 1,400-foot-high tower on Billionaires’ Row was briefly the tallest residential building in the Western Hemisphere.

- In a 2021 lawsuit, the condominium board alleged that the 125-unit building represented one of the worst examples of developer malfeasance in the history of New York City, with noise issues, leaks and malfunctioning elevators.

- Since news of the dispute broke in February 2021, 11 deals have closed at 432 Park. On average, those deals closed for 3.7% less than what the sellers originally paid for their units, and for those publicly listed, a discount of 27.4% from the highest asking price, property records show.

432 Park Ave, located on Billionaires’ Row

WSJ 5/31/24

NYC resumed Section 8 and 150,000 applied

뉴욕시 Section 8 접수 시작하자 150,000명 지원

WSJ 6/4/24

- NYC’s NYCHA began to resume the Section 8 applications in 15 years, which was hold since Dec 2009.

- In 12 hours after they began accepting the application through apply.section8.nycha.info, 150,000 applications received.

- The eligibility is 1) income is under $54,350 for single family and $77,650 for 4 family members and 2) one of family members must be a legal status, 3) passing criminal background checking.

No Down Mortgage Program began

집값 비싸서 다운페이 없는 모기지 출시

Korea Daily 5/23/24

- UWM(United Wholesale Mortgage) announced it will start “No-Down” mortgage program and said they received thousands application after 2 weeks since they began the program. So far, no other mortgage lenders are providing “No-Down” program.

- The eligibility for the program is 1) one of borrowers mist be the first home buyer and 2) the income must be under 80% of AMI(Area median Income) in the area.

- The lender gives 97% loan as the 1st mortgage and 3% or $15,000 would be the 2nd mortgage. The 2nd loan doesn’t incur interests, but it has to be paid off when the house is sold or re-financed.

Real-Estate Slump Jolts Government Pension Plans

부동산 불경기가 정부 연금에 악영향…

WSJ 6/1/24

- Government pension plans are getting hit by the commercial real-estate meltdown and many fear the bleeding is far from over.

- Canada’s national pension plan said in May that it is selling stakes in Manhattan and San Francisco office towers for $225 million less than it paid for them. In April, California’s government worker pension fund said it had unloaded a Sacramento property it had been trying to develop for almost two decades. In March, consultants warned California’s teacher pension that office holdings would continue to drag down returns, even after a 9% real estate loss in 2023.

- Pensions, like sovereign wealth funds, university endowments and family offices, generally either buy properties outright or invest through private fund managers.

Fed’s Preferred Inflation Gauge Holds Firm in April

준비 위원회, 4월에도 희망적고정 자세

WSJ 6/1/24

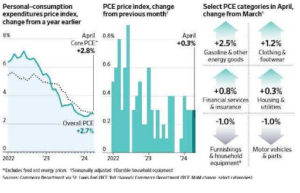

- The Fed’s preferred inflation gauge rose 2.7% in April from a year ago, holding the line in the central bank’s fight against inflation. The PCE, was in line with the expectations of economists polled by WSJ.

- The Core index without volatile food and energy prices, rose 2.8% during the past 12 months. That was slightly higher than the 2.7% economists had expected. The benchmark 10-year Treasury yield settled at 4.512% Friday, down from 4.553% on Thursday.

- While expected several interest-rate cuts when the year began, a streak of firmer-than-expected inflation data to start the year made the justification for those cuts appear to be shaky. More recent data, however, has sparked renewed optimism that rate cuts might be in store before the year ends.

PCE Price Index in April

WSJ 6/1/24

Inflation Isn’t the Fed’s Only Worry

인플레이션만이 준비위원회의 걱정은 아닌…

WSJ 6/3/24

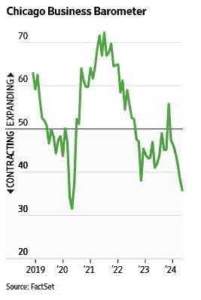

- The U.S. economy continues to lose momentum. Growth has yet to slow to the point that it would be a concern, but it might soon if current trends continue. It seems the cumulative impact of years of inflation is catching up with consumers and eroding their savings cushion.

- Incomes rose 0.3% from the preceding month, in line with expectations and down from 0.5% growth in March. Personal spending rose just 0.2%, below expectations and slowing from 0.7% in March. In real, inflation-adjusted terms, consumption and disposable incomes both fell 0.1%.

- All those readings came on the heels of a downward revision in first-quarter gross domestic product growth on Thursday, to an annualized 1.3% from an earlier estimate of 1.6%.

Chicago Business Barometer

WSJ 6/3/24

WeWork Exists Bankruptcy, Predicts First Profit in 2025 .

위웍, 2025에 첫 이익금 예상

WSJ 5/29/24

- U.S. Bankruptcy Court Judge John Sherwood in Newark, N.J., approved a restructuring plan for WeWork, giving a second chance to the flex-office business once valued at $47 billion before it filed for chapter 11 last year. WeWork now has “a prospect of being a viable, successful company,” he said from the bench.

- It will become a new run at the co-working business as a smaller, private company under new ownership.

- The decision means that WeWork will survive a historic downturn in the commercial real-estate market that had threatened to shut down the business entirely. WeWork is also further distancing itself from Adam Neumann, the charismatic co-founder who drove the company’s aggressive expansion before his ouster in 2019.