Mortgage Interest Rates Review

United Mortgage Nation 5/22/2024

|

30 yr fx (%) |

15 yr fx

(%) |

FHA

(%) |

10 yr Tr Y

(%) |

5 yr Arm

(%) |

7 yr Arm

(%) |

|

| A year ago |

6.599 |

5.750 | 5.875 | 3.549 | 6.599 | 6.599 |

| A month ago |

7.250 |

6.620 | 6.499 | 4.628 | 7.250 |

7.250 |

| Last week | 7.125 | 6.250 | 6.375 | 4.481 | 7.125 |

7.125 |

| This week | 6.999 | 6.375 | 6.375 | 4.437 | 7.125 |

7.125 |

Federal Fund Rate: 5.25 -5.50% Prime Rate: 8.25 – 8.50%

Plan for Apartment Complex Disapproved

Korea Times 5/22/24

- The zoning board of Palisades Park, NJ has dropped the proposal of constructing 6 story, 40 unit apartment complex on West Columbia Ave.

- The developer, DRC Development Corporation might escalate the proposal to the court in order to re-emphasize the need of low-income housing requirement.

- The pertinent lot is AA zoning for 1 -2 family zone and the zoning board opposed the plan due to traffic congestion around Rt 46 and view obstruction from neighborhood.

Sings of Softening Housing Market Emerge in

Florida and Texas

WSJ 5/17/24

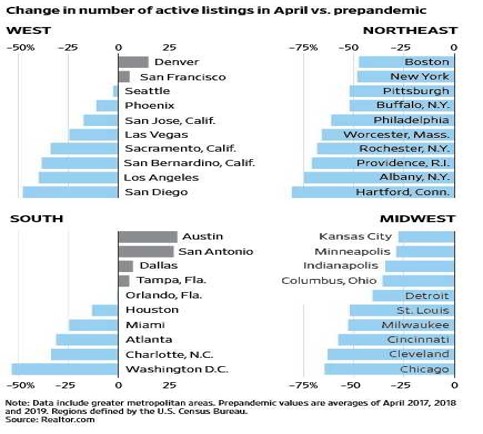

Yet the market is cooling and prices have started falling in some cities in Florida and Texas, where robust homebuilding activity in recent years has helped boost the number of homes for sale. The two states accounted for more than a quarter of all single family residential building permits every year from 2019 to 2023, according to Census Bureau data.

In 10 Texas and Florida metro areas, the inventory of homes for sale in April exceeded typical pre-pandemic levels for this time of year, according to Realtor.com. In eight of those markets, pending sales in April fell from a year earlier.

Recent national data suggest that more sellers are thinking about entering the market, as the crucial spring selling season reaches its peak period. More than two-thirds of consumers surveyed by Fannie Mae in April said it was a good time to sell a home, the highest level since July 2022.

Change in number of active listings in April

vs. pre-pandemic

WSJ 5/17/24

Housing Stymies Fed on Inflation

WSJ 5/13/24

주택시장이 연준의 이자률 조절은 막고 있어…

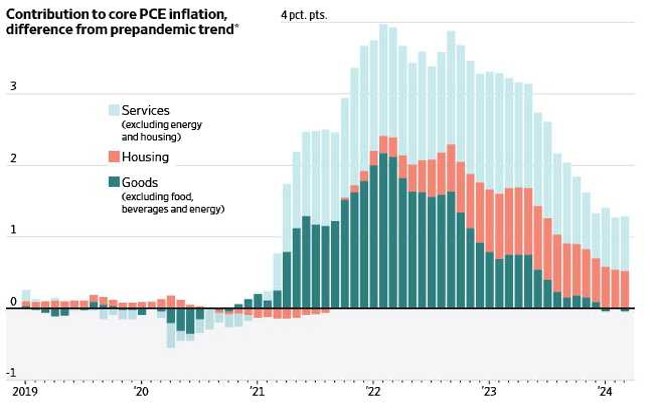

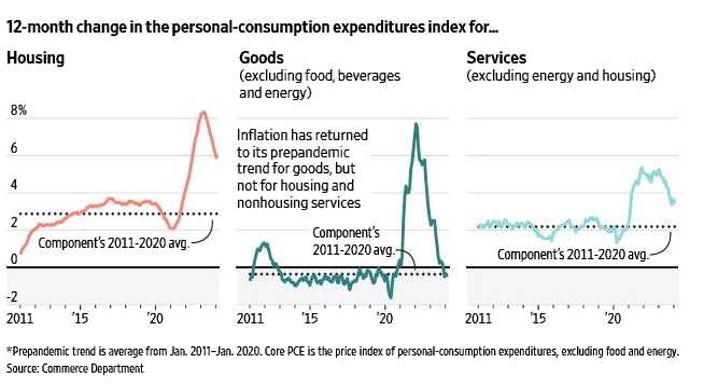

- The Fed has been waiting for that slowdown housing costs for 1½ years now, and it still hasn’t arrived. The slowdown might simply be delayed. But some analysts worry it isn’t going to happen because of changing dynamics in the housing market.

- Housing has played a large role in the inflation of recent years because its cost rose so much and carries such large weight. It is one-third of the consumer price index and around one sixth of the price index of personal-consumption expenditures, the Fed’s preferred inflation measure.

- Much of last year’s slowdown in inflation was because goods prices returned to their pre-pandemic trend. For inflation to get back to 2%, non housing services inflation has to drop to less than 3% from 3.5% now, and housing to around 3.5% from 5.8%.

Contribution to core PCE inflation

WSJ 5/13/24

12-month change in the personal-consumption expenditures index for Housing

WSJ 5/13/24

The Fed might drop the rates twice this year

Korea Times 5/22/24

연준, 금리 2회 인하. 인플레 2.6% 예상

- NABE (National Association for Business Economics: 전미 실물경제 협회) forecasted the Fed will drop the Fed fund rates twice this year by 0.5% — 0.25% each time. Also 43 members of NABE forecasted the inflation rate will be 2.6% toward the end of the year.

- Some economic experts said the Fed will drop the rates in September first time this year.

Red Lobster Files for Bankruptcy

WSJ 5/21/24

“레드 랍스터”, 파산선고 등록

- Red Lobster, the largest seafood restaurant chain in the U.S., filed for bankruptcy after failing to recover from dwindling traffic it suffered during the pandemic as menu prices crept higher. An unlimited shrimp deal also took a bite out of earnings.

- The company has 551 locations in 44 U.S. states left open, according to a court filing by Chief Executive Jonathan Tibus.

- The company’s earnings before interest, taxes, depreciation and amortization declined 60% and it had a net loss of $76 million in 2023. By late 2023, the chain’s cash reserves dwindled to less than $30 million, from $100 million in May of that year. Interest payments on nearly $300 million in debt also contributed to the company’s cash crunch, according to Tibus.