Mortgage Interest Rates Review

United Mortgage Nation 10/08/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.625 | 6.875 | 6.999 | 4.758 | 7.625 | 7.625 |

| A month ago | 6.499 | 5.625 | 5.750 | 3.810 | 6.625 | 6.625 |

| Last week | 5.999 | 5.125 | 5.625 | 3.794 | 5.999 | 5.999 |

| This week | 6.375 | 5.750 | 5.999 | 4.026 | 6.375 | 6.375 |

Federal Fund Rate: 4.75 -5.00% Prime Rate: 7.75 – 8.00%

Tenafly NJ, town tax increases more

테너풀라이 재산세 또 오른다

Korea Times 10/4/24(Fri)

- The budget item for scaling up the schools in Tenafly which will impose $76.1M tax burden has passed: 1,199 Yes and 1187 No resulted in only 12 Vote difference.

- With this increased tax budget, residents in Tenafly will have to pay additional $881 for the next 20 years.

- Tenafly residents will pay $$59.5M and The State government will pay $16.5M.

- The high school building is over 50 years now and the elementary schools are over 100 years.

Rockefeller Center Tests Office Market

록크펠라 센타가 오피스마켓의 시험대로

WSJ 10/4/24(Fri)

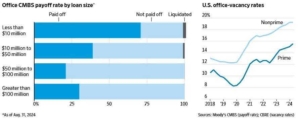

- If Rockefeller Center successfully refinances its debts, it won’t automatically unlock lending for other landlords. But it would be an early sign that investors are starting to separate the wheat from the chaff in America’s battered office market.

- The New York office and retail complex’s owner, Tishman Speyer, is looking for $3.5 billion of debt, according to media reports. Some of the cash is needed to pay off a roughly $1.7 billion commercial-mortgage- backed-securities loan that matures in May of next year.

- Trophy offices, usually defined as those built after 2015, have a brighter future than aging buildings. Tenants are voting with their feet when their leases expire and moving to modern properties that have good amenities. The national vacancy rate for prime offices was 15.5% at the end of the second quarter compared with 19% for nonprime, data from real-estates services company CBRE shows.

Office CMBS & Vacancy Rates

WSJ 10/4/24

The Great Florida Migration Unravels as Home Costs Spiral

플로리다로의 대이동, 거꾸로…

WSJ 10/8/24(Tue)

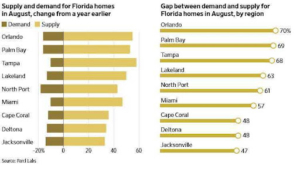

- Across much of Florida and especially along the western coast, a surplus ofinventory and dwindling buyer interest are slowing sales and keeping homes on the market longer. That is cooling off what had been one of the U.S.’s biggest housing booms this decade.

- Tropical storms and hurricanes, increasingly hitting the state’s western coast, are making matters worse. Now less than two weeks after Hurricane Helene hit, Tampa Bay is bracing for Hurricane Milton – Category 5.

- Tampa, Orlando and much of the Space Coast are all experiencing this Florida housing reversal. Inventory for single- family homes and condominiums in these areas was up more than 50% in August from the same month last year. At the same time, demand has decreased 10% or more in these areas, according to Parcl Labs, a real-estate data and analytics firm.

Supply & Demand in Florida

WSJ 10/8/24

Hiring Blows Past Expectations

노동시장이 다시 강화되어…

WSJ 10/5/24(Fri)

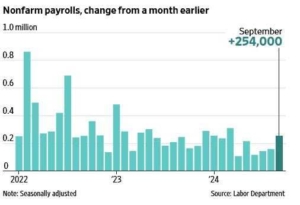

- The U.S. labor market strengthened in the weeks before Election Day, as job growth accelerated in September and the unemployment rate ticked lower.Employers added 254,000 jobs last month. That was significantly more than the 150,000 economists expected, and marked the largest monthly increase since March. The unemployment rate slipped to 4.1%.

- Inflationary pressures have eased markedly over the past two years, and the Fed’s focus has shifted more to hiring than price increases. That means the jobs market will play an outsize role in Fed officials’ decisions on the path of interest rates.

- The Fed’s next policy meeting is Nov. 6-7. Officials will see one more employment report before then, for October. That report, which will be released Nov. 1, could be less rosy. The month has already seen a major strike by dockworkers and a continuing strike at Boeing. Hurricane Helene could also muddy the October jobs numbers.

Nonfarm payrolls, change from a month earlier

WSJ 10/5/24

Labor market retrieved, possible no landing

급호전된 고용시장 … ‘노 랜딩‘ 가능성 높아

Korea Times 10/8/24(Tue)

- The possibility of no landing in economy increased suddenly since labor market in US still shows stronger than anticipated. So far, the debate has been the US economy will go through ‘soft landing’ or ‘hard landing’ in the very near future.

- Even though no landing means it is better than soft landing, but some are concerned that whether or not the inflation will revive, which will stop lowering Federal Fund Rate.

- Already some experts said no big cut in Nov and majority of economists anticipate a baby cut of 0.25, but some said no cut might be possible.

Open AI Valuation Nearly Doubles to $157B

Open AI 사의 가치가 $157B 으로 거의 2배

WSJ 10/3/24(Thu)

- OpenAI has raised $6.6 billion in new funding, capping a complex fundraising process that involved negotiations with multiple tech giants and large private investors at the same time it has been experiencing disruptive internal turmoil.

- Investors are valuing the startup behind ChatGPT at $157 billion, a total that puts it on par with the market capitalizations of publicly traded names such as Goldman Sachs, Uber Technologies and AT& T.

- OpenAI remains the best known company in the burgeoning AI market, thanks to the breakout success of ChatGPT, which has 250 million weekly active users and 11 million paying subscribers. Around one million business customers pay to use its technology. But the company is far from profitable, which made the new investment round critical. OpenAI is expected to lose around $5 billion this year on revenue of $3.7 billion. It is projecting revenue will grow to $11.6 billion in 2025.

Hyundai EV cars production starts in GA

현대전기차, 조지아 공장에서 생산 시작

Korea Times 10/8/24(Tue)

- HMGMA(HyunDai Motor Group Metaplant America) has started producing HyunDai EV cars, announced AJC(Atlanta Journal Constitution) on 7th, which will mark the milestone of designating HMGMA as a EV Hub of GA. The AJC also reported that HyunDai had a private opening ceremony for their employees.

- HyunDai announced HMGMA plan in April, 2022 and had a ground breaking ceremony in Oct same year. The HyunDai’s investment in this factory was $7.6B. Yet this factory is not in full operation, which was planned in Oct.

- Originally they planned to produce EVs only, but now they have modified to produced Hybrid as well.