MARKET TREND SERIES

“The Insurance Crisis Continues to Weigh on Homeowners”

Excerpted from JCHS/edited by Stephen Lee with CRI

A Study by Havard Joint Center for Housing Study

Rising Home Prices and Homeowners Insurance Costs are Dual Affordability Stressors

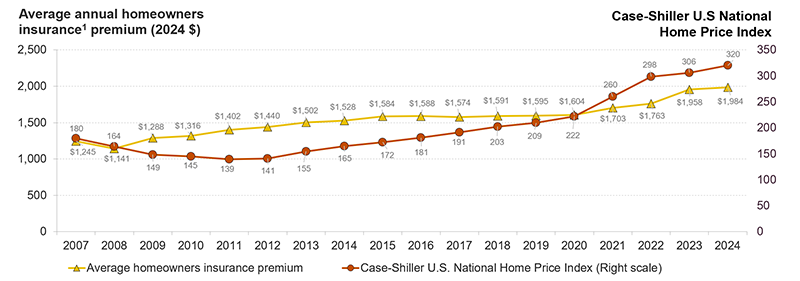

Insurance has grabbed headlines lately for good reason. As home prices remain elevated at historically high levels, rising insurance premiums are also contributing to the growing costs of homeownership and property management. From the Great Recession to the present, homeowners insurance prices have increased 74 percent while home prices have increased more than 40 percent, even after adjusting for inflation. Real premiums have risen approximately 20 percent between 2020–2023 alone (Figure 1). Premiums are increasing for both homeowners insurance and for hazard-specific insurance.

Homeowners insurance premium & House prices

HJCHS 12/9/24

- Insurance functions like a glue that helps the housing finance system stick together. For example, access to homeowners insurance and mortgage insurance facilitates a prospective homebuyer’s access to mortgage credit. After a disaster, a homeowners insurance claim payout can smooth the financial shock from covered damages and help the homeowner rebuild. In short, insurance helps make homeownership possible and preserves hard-earned home equity when hazards strike.

- Given its important role in housing markets and the broader economy, property insurance underwriting has evolved to become a highly regulated industry. However, unlike the housing finance system that is largely regulated at the federal level, property and casualty (P&C) insurance has been regulated by states

- In 2022, an estimated 12 percent of homeowners did not have homeowners insurance. This occurs at the same time the share of homeowners without a mortgageand associated lender insurance requirements remains above 40 percent. These figures do not take into account the sizable share of renters who lack renters insurancecoverage for their homes’ contents.

- As a result of market conditions, private insurers have faced unprofitability, insolvencies, and/or exited markets altogether in states like California, Louisiana, and Florida. Some industry analysts question whether the homeowners line of business is profitable at all, following years of underwriting losses and rising replacement costs.

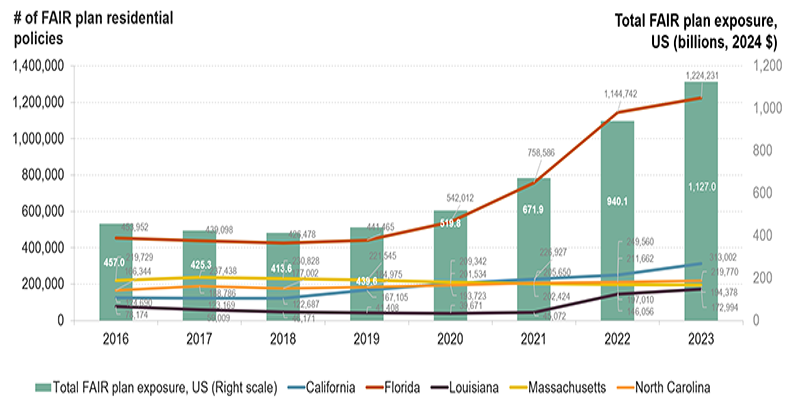

A growing Number of Residential Policies are Moving Into Residual Markets

- More than two-thirds of states have created Fair Access to Insurance Requirements (FAIR) plans to function as insurers of last resort.

- The total amount of asset value insured by state FAIR plans has eclipsed one trillion dollars, and the number of residential policies in the two largest state programs (Florida and California) has more than doubled since 2018.

While the governance and financial structures of FAIR plans vary, they generally benefit from state-derived authority to levy assessments on firms and policyholders to fund claims in the event of insolvencies. These FAIR plans are often referred to as the residual market.

- While state authorities generally want to depopulate these programs in order to limit the financial exposure of their constituencies, the residual market has continued to grow in recent years, which is an indicator of private insurance market health and systemic public financial risk.

FAIR Plan

National Flood Insurance Program (NFIP) Residential Coverage is Declining

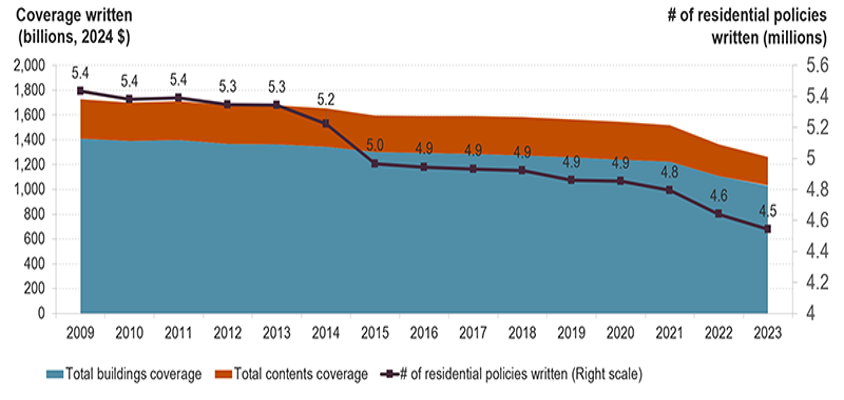

Today, homes located in Federal Emergency Management Agency (FEMA)-defined regulatory floodplains are required to purchase a flood-specific insurance policy (separate from a homeowners insurance policy) in order to access a federally-backed mortgage. The NFIP was established in 1968 to address limited coverage availability in the private market and functions like a large federal residual market for flood insurance.

The number of residential policies written by the NFIP, however, has declined from 5.4 million in 2009 to 4.5 million in 2023, with accompanying decreases in coverage.

National Flood Insurance Program (NFIP) Residential Coverage is Declining

- Similar to homeowners insurance markets, the NFIP has the difficult task of balancing affordability and actuarial soundness. Low uptake among homeowners in flood-prone areas, including limited compliance with mandatory NFIP purchase requirements, highlights a flood-specific aspect of the homeowner protection gap. At the programmatic level, NFIP insolvency has been averted through Congressional action allowing NFIP to take on additional debt from the US Treasury and tens of billions of dollars of NFIP debt has been cancelled.

Conclusion

- Innovative developments in the insurance field, including technological advancements, non-profit partnerships, new parametric products, and user-friendly tools from FEMA, are providing reason for optimism. However, property insurance is not a panacea and does not directly mitigate nor avoid physical damage. Protective infrastructure along with home mitigation improvements like fireproofing landscapes and home elevations will be needed to buy time. Mortgage and lending practices, as well as local land use regulations that incentivize vulnerable development in exposed areas, must also change. Ultimately, as the costs from climate change-fueled hazards and other covered perils continue to mount, insurance will be a key mechanism for strengthening household financial resilience for some time.