Mortgage Interest Rates Review

United Mortgage Nation 8/27/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.375 | 6.750 | 6.999 | 4.342 | 7.375 | 7.375 |

| A month ago | 6.875 | 6.125 | 6.125 | 4.260 | 6.875 | 6.875 |

| Last week | 6.499 | 5.625 | 5.875 | 3.864 | 6.625 | 6.625 |

| This week | 6.499 | 5.625 | 5.750 | 3.810 | 6.625 | 6.625 |

Federal Fund Rate: 5.25 -5.50% Prime Rate: 8.25 – 8.50%

More NY Residents are apt to be evicted

뉴욕주민 30% 가 강제퇴거 가능성 높아

Korea Daily 8/22/24(Thu)

- According to US census(HPS) monthly data, 29.3% of NY renters above 18 years old between 6/25 through 7/22 could not pay their rent or mortgage, and so they could possibly face eviction or foreclosure within next a few months, while 16.6% of NJ resident could do so.

- NY is 6th highest of potential eviction or mortgage in US.

- Also 40% of NY are facing trouble to pay House Expenses – minimum payment for survival, and it is 10th highest state in US.

- 25% of NY residents are troubling pay utilities.

- 12.9% of NY residents are troubling with food supply, which is 7th highest in US.

SALT deduction limit will be nullified in 2025

비방세(SALT) 공제 상한 2025이후 폐지 공언

Korea Daily 8/22/24(Thu)

- US Congressman, Chuck Schumer(Dem), majority leader pronounced that he will not extended “SALT deduction limit” executive order which will be ended by the end of 2025.

- Currently, SALT deduction will limit up to $10,000 which was Trump’s executive order order to cover shortage of tax collection.

- NY State announced that the NY residents would pay more tax : $121B between 2018 and 2025 due to the SALT deduction limit to $10,000.

- Also he said he would end the SALT deduction limit, and he would agree that K Harris will not increase income tax under $400,000.

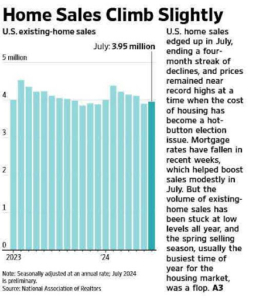

Home Sales Climb Slightly

7월의 기존 주택판매 소폭 상승

WSJ 8/23/24(Fri)

- U.S. home sales rose slightly in July, ending a four-month streak of declines, and prices remained near record highs at a time when the cost of housing has become a hot-button election issue.

- Sales of previously owned homes in July rose 1.3% from the prior month to a seasonally adjusted annual rate of 3.95 million, NAR said Thursday. That was the lowest level for any July since 2010. On an annual basis, existing-home sales, which make up most of the housing market, fell 2.5%.

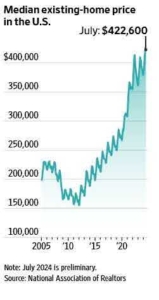

- Prices slipped from a month earlier but held near the record high reached in June. The supply of homes for sale nationally is rising but remains below normal historical levels. The national median existing home price in July was $422,600, a 4.2% increase from a year earlier.

Home Sales & Prices

A Make-or-Break Moment for the Economy Has Arrived

경제를 살리느냐, 죽이느냐의 시점이…

WSJ 8/23/24(Fri)

- There’s a saying that economic expansions don’t die of old age: They’re murdered by the Federal Reserve. Jerome Powell has spent the past two years determined to beat inflation even if it resulted in recession. Now he’s on the brink of winning the battle, but the next few months will be crucial.

- If he succeeds and maneuvers the economy to a soft landing that brings inflation down without a big rise in unemployment, it’ll be a historic achievement. If he fails, the economy will slide into recession anyway under the weight of higher interest rates—and he’ll have proved the old maxim about the Fed.

- If the economy enters a sharper slowdown, they could cut rates in larger half-point increments to get interest rates closer to 3% by next spring. (The Fed’s benchmark rate is currently set between 5.25% and 5.5%.)

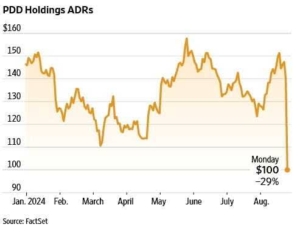

Temu Parent’s Shares Plunge as Sales Growth Slows

‘테무’ 모기업, 주식가 하강

WSJ 8/27/24(Tue)

- Stock in PDD Holdings sank after sales growth at Temu’s parent company undershot expectations and management warned of challenges ahead. PDD’s American depositary receipts were down 29% to $100 a share on Monday. The stock is down nearly 32% year to date.

- PDD had once threatened to outpace rival Alibaba as the most valuable Chinese e-commerce stock. Alibaba still leads the pack by market cap with a valuation close to $199 billion at the close on Friday, while PDD sat closer to $186 billion.

- WSJ in June reported that Amazon. com plans to launch a service focused on shipping cheap fashion wear, household goods and other products directly from warehouses in China in response to competition from low-cost e-commerce platforms including Temu and Shein.

PDD Holdings ADRs

WSJ 8/27/24

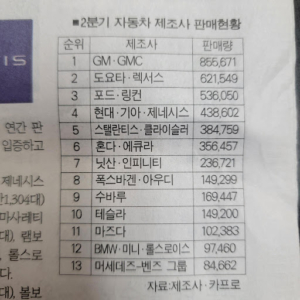

Automobile Sales Competition getting tough

지동차 시장 ‘지각변동‘- 경쟁 치열

Korea Times 8/27/24(Tue)

- Competing for 300M US car sales, fierce competition arises among top performers: GM and Toyota are the first two usually. The contenders are Hyundai, Ford, and Stellantis(Former Chrysler) for the 3rd place in 2nd Qt.

- Hyundai(Hyundai, Kia, Genesis) who sold 438,602 in 2nd Qt keep trying to catch up Ford who sold 536,050 in the same period.

- In 2nd Qt, Hyundai sold 214,719 which was 2% up from a year ago. Kia sold 206,839 which was down 2% from a year ago.

- Among Hyundai brands, Ioniq 5 sales increased 17%, Santa Fe Hybrid sales increased 90%, Tusan Hybrid sales increased 28%, and Palisades sales increased 57% in 2nd Qt.

2nd Qt Auto Sales in US

Korea Times 8/27/24

Musk will move X HQ to Texas from California

머스크 엑스 ‘본사 이전‘ 막바지

Korea Times 8/27/24(Tue)

- Elon Musk recently announced that he was relocating the companies SpaceX and X(Formally Twitter) from their current HQ in California to Texas.

- The news has placed a soptlight on the rise in big tech shifting its operations to the Lone Star state, with Austin emerging as a main hub. Known as the ‘Silicon Hills’ and the ‘Third Coast’, there are 5,500 startups and tech companies just in the greater Austin area – Texas’s state capital). The city is emerging as a strong competitor to Silicon Valley for workers, as Austin’s blend of tech, art and unique culture has attracted many away from the more expensive San Francisco Bay Area.

- He move Tesla’s HQ to Austin in 2021, and has exchanged his residence in California for one in Texas.