Mortgage Interest Rates Review

United Mortgage Nation 9/17/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.125 | 6.499 | 6.625 | 4.286 | 7.125 | 7.125 |

| A month ago | 6.625 | 5.875 | 5.999 | 3.909 | 6.625 | 6.625 |

| Last week | 6.499 | 5.625 | 5.750 | 3.810 | 6.625 | 6.625 |

| This week | 6.125 | 5.25 | 5.750 | 3.621 | 6.249 |

6.249 |

Federal Fund Rate: 5.25 -5.50% Prime Rate: 8.25 – 8.50%

Shrinkflation makes home small, but still high prices

주택도 슈링크플래이션 심화 가운데, 집값은 여전히

Korea Daily 9/17/24(Tue)

- Residential market has shown shrinkflation which means house size becomes smaller, but owner pays more housing expenses.

- According to USA Today, as of June 2024, nationwide median house size Is reduced by 128 sf, but median house price is increased by $125,000, compared to 5 years ago.

- The reasons are 1)inflation 2) construction cost increase 3)continuous economic instability, etc.

- Mostly, 7 out 10 top area with shrinkflation are Southern area including North Carolina, Texas due to the recent influx of population.

Housing Prices Rise, But Momentum Slows

주택가격 상승속도에 감속이 시작…

WSJ 8/28/24(Thu)

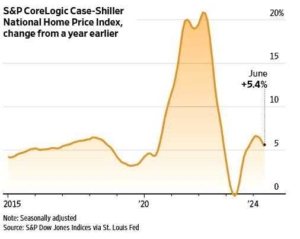

- U.S. home prices lost a little momentum in June, but the rate of on-year increase remains high. The S& P CoreLogic Case-Shiller National Home Price Index rose 5.4% on year in June.

- That was down from 5.9% in May, continuing a recent slowdown trend. But that still marks the highest rate of growth recorded for the month of June, and houses are on average twice as expensive now as they were 50 years ago, adjusted for inflation, S& P Dow Jones Indices said.

- Americans have repeatedly cited the high cost of housing as a top concern, and both parties have proposed plans to address it. Democratic presidential candidate Kamala Harris this month unveiled a plan to add three million more homes, while the Republican Party has proposed opening up more federal land for building.

CoreLogic Case-Shiller Index

WSJ 8/28/24

Inflation Slows to 3-Year Low

인플레이션, 3년만에 가장 낮아…

WSJ 9/12/24(Thu)

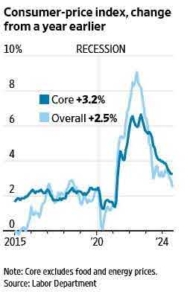

- Inflation eased in August to a new three-year low, teeing up the Federal Reserve to begin gradually reducing interest rates next week.

- The consumer-price index climbed 2.5% from a year earlier, according to the Labor Department, decreasing from 2.9% in July and extending its cooling streak to five months. Core inflation, a measure that excludes volatile food and energy costs, held about steady at 3.2%.

- Many analysts believe that price increases for housing will gradually slow down, following the path of inflation in other goods and services, as more renters sign new leases. That would help weigh down annual increases in overall consumer prices toward the Fed’s longstanding 2% target.

CPI, change from a year ago

WSJ 9/12/24

Mortgage rates declined, but residential market still slow

모기지이자률 하강하지만, 주택시장은 여전히 관망…

Korea Times 9/17/24(Tue)

- The 30-year fixed mortgage rate dropped to 6.2% which is the lowest in 18 months, but residential market recovery is still slower than expected. Sam Carter, chief economist of Freddie Mac said that 30-year fixed mortgage rates declined 0.5% for the last 6 weeks due to more stable economic statistics. However, residential market shows “wait and see” even though the mortgage environment has been improved due to still high home prices and low inventory.

- While US median income is $74,580, the US median home price is $422,600. With 20% downpayment, if home owner wants to keep the PITI under 30%, the mortgage rate has to come down to 5.25%.

- LA, Cal is the worst: median income is $83,000, but median home price is 855,000.

0.25% vs 0.5% – The Fed will decide today and tomorrow

준비위원회 FOMC 에서 0.25% or 0.5% 결정

Korea Times 9/17/24(Tue)

- The FOMC is being held today(17th) and tomorrow(18th) and they will have to decide either baby cut(0.25%) or big cut(0.5%).

- The growth of employment for non-agriculture was 142,000 in June while the expectation was 160,000 and unemployment rate becomes 4.2% which is within the range of the expectation.

- Some say more concern about instability of economy will be triggered if the Fed drops 0.5% suddenly and rather 0.25% in Sep and another 0.25% in Dec will induce more stable economy.

- Some others say we need 0.5% now in order to boost up the slow economy before it is too late.

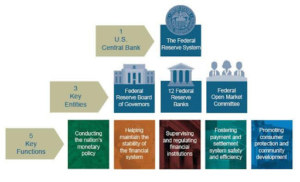

What is the Federal Reserve System?

Trump Allies are Assessing Plans to Privatize Fannie and Freddi

트럼프 측근, 패니와 프레디를 민영화 할 계획을…

WSJ 9/14/24(Sat)

- Former Trump administration figures and bankers have been discussing plans on ending U.S. government control of the mortgage-finance giants should Trump win the election. The talks have been under way since at least this past spring and include reaching out to investment managers for advice on how to get the deal done.

- The government’s stakes in Fannie and Freddie could be valued at hundreds of billions of dollars, bankers estimate. That could allow the government to sell more than $100 billion of securities in one swoop, some bankers say.

- Fannie and Freddie purchase and securitize a huge portion of loans in the U.S. residential and commercial mortgage markets. Nearly 40% of the $435 billion of residential loans originated in the second quarter were sold to Fannie or Freddie, according to Inside Mortgage Finance.

Amazon Tells Staff to Work in Office Full-Time

아마존, 사원들에게 사무실로 전원 복귀하라고

WSJ 9/17/24(Tue)

- Amazon wants employees in the office five days a week. On Monday, CEO Andy Jassy said Amazon believes there are significant advantages to having employees in the office full-time.

- Like many companies, Amazon let some employees work from home because of the Covid-19 pandemic. Amazon staff were required to be in the office at least three days a week since May 1, 2023. The return-to-office requirement will take effect in early January 2025.

- “Major tech companies will now think about their policy again, potentially, in light of Amazon making this change,” Sadow said. He said it is also likely to trickle down to the decision makers at smaller companies that look up to the tech giant. “It will cause a bit of churn and some meaningful reflection, I think, in a lot of technology companies,” he said.