Mortgage Interest Rates Review

United Mortgage Nation 9/24/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.490 | 6.625 | 6.750 | 4.542 | 7.490 | 7.490 |

| A month ago | 6.499 | 5.625 | 5.750 | 3.810 | 6.625 | 6.625 |

| Last week | 6.125 | 5.250 | 5.750 | 3.621 | 6.249 | 6.249 |

| This week | 5.999 | 5.250 | 5.625 | 3.739 | 6.249 | 6.249 |

Federal Fund Rate: 4.75 -5.00% Prime Rate: 7.75 – 8.00%

Landlord might pay Broker Fee …

‘브로커 피 집주인 부담’ 조례안에 힘 실렸다

Korean Daily 9/23/24(Tue)

- While brokerage industry is opposing heavily, the local ordinances that landlord pays broker fees for tenants might be inacted as early as this Fall in NYC, according Crains.

- Among 51 city councilmen, 33 members are favoring to this proposal. Only variable is that the Mayor Adams will veto or not. Those councilmen favoring this proposal already start review the act for the Fall session.

- Brokerage industry is objecting this proposal, making argument that this act will trigger landlord to increase more rent. After all, it will make tenant more difficult to get their places.

Fed Goes Big With Half-Point Rate Cut

준비위원회, 기준금리 0.5% 내림

WSJ 9/19/24(Thu)

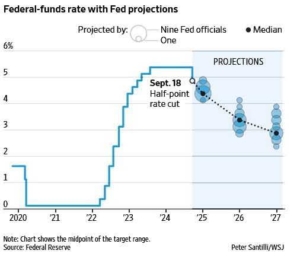

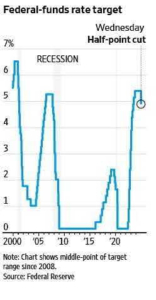

- The Federal Reserve voted to lower interest rates by a half percentage point, opting for a bolder start in making its first reduction since 2020. =

- Eleven of 12 Fed voters backed the cut, which brings the benchmark federal-funds rate to a range between 4.75% and 5%. Quarterly projections released Wednesday showed a narrow majority of officials penciled in cuts that would lower rates by at least a quarter point each at meetings in November and December.

- Some Republicans have been upset that a rate cut might boost sentiment ahead of the November election. Powell has said the Fed doesn’t take political considerations into account.

Federal-funds Rate target

Homeowners Face a Choice: Refinance, or Wait

주택소유자, 재융자 할까, 아니면 기다릴까?

WSJ 9/20/24(Fri)

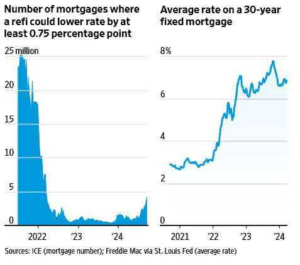

- Those who bought homes in the past few years have a call to make after the Federal Reserve’s hefty rate cut: Look to refinance their mortgages now, or wait for a better deal in a future cut.

- The decline is offering many homeowners a chance to swap their current mortgage for one with a lower rate. Refi applications have more than doubled over the last seven weeks, according to Fannie Mae.

- With rates just above 6%, some 4.2 million borrowers could lower their rates by at least 0.75 percentage point in a refinancing, the most since early 2022, according to Intercontinental Exchange. The average refi candidate with a high credit score and significant home equity would save $299 a month by refinancing, ICE said.

Re-fi could lower rate

WSJ 9/20/24

Fed Cut Interest Rates Too late for Many Real-Estate Owners

기준금리하강이 많은 부동산 소유주에게는 늦은 상태

WSJ 9/24/24(Tue)

- Commercial real-estate owners are cheering as interest rates finally start to fall. Yet relief is coming too late for many highly indebted property investors.

- Daniel Moceri, a buildingsecurity entrepreneur turned developer, and his partners completed the 20-story tower in January 2020The interest rate for the loan backing the property shot up to more than 10%. Moceri lost the property to lenders in July.

- Tides Equities, a privately held company based in Los Angeles, is one of the biggest apartment landlords in the Southwest.Then interest rates skyrocketed. More recently, rent growth declined in some of the cities where Tides invested. Tides told its investors last year that its tenants were struggling to pay the company’s higher rents.An affiliate of lender Rialto Capital Advisors took back the property from Tides this month.

Home Sales Slip as Prices Remain Elevated

가격이 상승되어있는상태로, 주택거래 미지근…

WSJ 9/20/24(Fri)

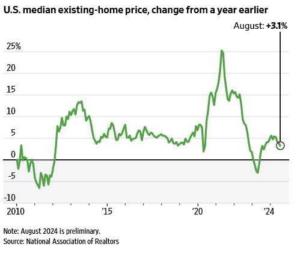

- U.S. home sales fell in August as the recent decline in mortgage rates failed to offset home prices that remain near record highs.

- Sales of previously owned homes in August fell 2.5% from the prior month to a seasonally adjusted annual rate of 3.86 million, the National Association of Realtors said Thursday, the fifth time sales have declined over the past six months.

- Those buyers may not get much more relief soon, said Lawrence Yun, NAR’s chief economist. The Federal Reserve cut short-term interest rates by half a percentage point Wednesday. But the mortgage market has already priced in expectations for additional Fed rate cuts, which means mortgage rates might not fall further in the coming months, he said.

US median home prices, change from a year earlier

WSJ 9/20/24

History Is On Side of Rate Cuts

역사는 기준금리내림을 선호하는 쪽으로…

WSJ 9/24/24(Tue)

- The Federal Reserve’s big interest-rate cut last week is rippling through markets. First, the good news: Since the 1980s, investments such as stocks and corporate bonds have tended to perform well in the 12 months after the Fed begins to cut rates. When growth holds up, or gets boosted by rate cuts, corporate profits tend to be strong. But if the cuts aren’t enough to stave off a recession, investments of all kinds tend to suffer sharp declines.

- Treasury: The yield on the 10-year Treasury note, a benchmark for mortgage rates and other borrowing costs across the economy, has historically climbed moderately while the Fed is cutting rates. While that might seem counterintuitive, the 10-year yield reflects investors’ expectations for where rates will be in the future. If the economy is doing well, the Fed might not have to cut as much as investors expected. But there are some notable exceptions.

- Stocks: Typically, the start of a rate-cutting cycle marks a period of uncertainty for companies and investors. As time goes on, it usually becomes clearer whether the economy is going to enter recession or not. Many small companies get an extra benefit because they tend to have more floating rate debt than their larger peers—meaning that rate cuts directly lower their borrowing costs. As a result, the Russell 2000 index of small and medium-size businesses has often outperformed the S& P 500 after the Fed starts cutting rates.

- Dollars: The dollar tends to weaken in a rate-cutting cycle because it becomes less attractive to foreign investors who are choosing between different currencies.

- Gold: Gold, often perceived as a haven and a hedge against inflation, tends to benefit from rate reductions. That is because it pays no income, which investors usually mind less when rates are lower.

Shein’s Business Model Comes Under Threat

“샤인” 사의 사업 모델, 위기에 봉착

WSJ 9/24/24(Tue)

- Shein has used a nimble supply chain and duty-free shipping to send Dresses and T-shirts for as little as $2 in squishy bags directly from China to hundreds of millions of shoppers. The company had about $32 billion in sales and $1.6 billion in profit(~5%) in 2023, some said.

- Now, a business model is confronting a ripple of challenges, not just in the U.S., where Shein’s plans for a multibillion-dollar stock listing has collapsed, but also around the world.The Biden admin said it will propose new rules that would subject about 70% of textile and apparel shipments from China to tariffs they have avoided under the de minimis exemption($800). Regulations targeting companies’ environmental footprint is also a thorny issue, which relies on air shipping and synthetic materials.

The Shein pop-up at Forever 21’s Times Square store