Mortgage Interest Rates Review

United Mortgage Nation 12/10/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA (%) | 10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.899 | 6.375 | 6.299 | 4.363 | 6.875 | 6.875 |

| A month ago | 6.875 | 6.250 | 6.375 | 4.256 | 6.875 | 6.875 |

| Last week | 6.799 | 5.999 | 6.250 | 4.269 | 6.875 | 6.875 |

| This week | 6.499 | 5.875 | 6.125 | 4.196 | 6.750 | 6.750 |

Federal Fund Rate: 4.50 -4.75% Prime Rate: 7.50 – 7.75%

NYC, Rental Broker Fee will be paid by Landlord

뉴욕시 렌트 ‘브로커 피‘ 집주인 부담 확정

WSJ 12/5/24(Mon)

- Following the decision of paying the rental broker fee by landlord by city council on 13th November, the mayor Adams declared that he will not use Veto right, which can be exercised within 30days after the city council’s decision.

- Since the decision was made by majority of the council members, the mayor Adams judged his Veto right will not create meaningful impact.

- This ordinance specifies that whoever hires the broker must pay the broker fee, and landlord must spell out the list of fees that tenant has to pay on the lease agreement.

- When violated, any penalty can be imposed, or law suite can be filed against landlord.

Investors Raise Bets on Rate Cut, While South Korean Won Tumbled

투자자들, 이자률 감소에 기대하는 한편 한국통화 가치 하락

WSJ 12/4/24(Wed)

- Fed-funds futures indicate traders now see a 72% chance of another 0.25 percentage point interest-rate cut in December, up from 59% a week ago. That would mark a third consecutive decrease, and would take rates down by a total of one percentage point for the year.

- New York-listed South Korean securities fell and the won tumbled after South Korean President Yoon Suk Yeol declared martial law, a move that was later rejected by its Parliament.

- The 10-year Treasury yield inched higher, settling at 4.221%. Yields fell in early trading, with traders seeking safe assets after the declaration of martial law in South Korea. But they turned upward after the job-openings data.

Mortgage rates declined to 6.69%

전국 모기지 금리, 6.69%로 하락

Korea Times 12/9/24(Mon)

- 30-year fixed mortgage interest rates declined to 6.69% while 15-yeafixed mortgage interest rates lowered to 5.96%, announced Freddie Mac this week, which is the lowest since Oct this year.

- Residential market hit the worst period since 1995 due to high home prices and mortgage rates.

- Meanwhile, mortgage applications increased 2.8% from the last week even though mortgage rates has gone up for the last 3 – 4 weeks so far, which is the highest since January this year.

Mortgage denial due to the DTI

많은 모기지 승인 불가요인이 소득대비 부채비율(DTI)

Korea Daily 12/9/24(Mon)

- CNBC reported that about 40% of mortgage denials are due to DTI(Debt To Income) ratio according to 2024 NAR statistics. The poll was performed to 5,390 purchasers from July 2023 through June 2024.

- Other reasons of mortgage denials include low credit scores(23%), unverifiable income(23%), not enough cash for downpayment(12%), etc. Also NAR announced 26% of purchases used all cash which was the record high.

- Even higher income group still can be difficult if DTI is high, i.e. expenses are relatively higher. Typically 35% and lower of DTI means healthy economic life.

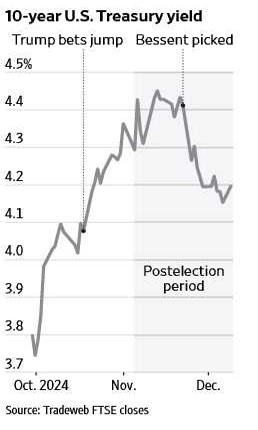

Election & Its Aftermath Driving Large Swings in Yields on Treasuries

선거와 그후의 사건들로 국채이자률이 큰 변동

WSJ 12/10/24(Tue)

- Things are getting political in the $28 trillion U.S. Treasury market. Treasury yields, a crucial driver of borrowing costs across the U.S. economy, typically fluctuate with traders’ bets on short-term interest rates set by the Fed.

- Bond-market bets on a Trump victory intensified after a series of good polls for the former president. Yields peaked after the election, but reversed after Trump’s pick of the longtime investor Bessent as Treasury secretary, viewing Bessent as a safe pair of hands who could temper Trump’s populist impulses.

- Now traders say Trump’s agenda of mass deportations, higher tariffs, lower taxes and looser regulations could put upward pressure on inflation and interest rates, driving down bond prices and sending yields higher.

- Higher Treasury yields mean steeper borrowing costs for businesses and consumers.

- But yields often rise because investors are optimistic that a strong U.S. economy can withstand high interest rates.

10-year U.S. treasury Yield between Trump & Bessent

WSJ 12/10/24

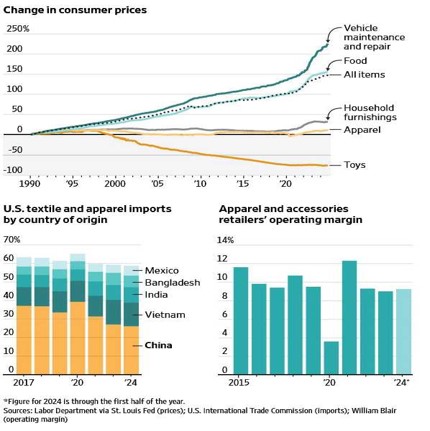

Tariffs Could Pinch Retailers This Time

이번에 관세 부과는 좀 고통이…

WSJ 12/10/24(Tue)

- Many retailers came through relatively unscathed by Donald Trump’s tariffs imposed during his first presidential administration. This time around, though, tariffs have the potential to bite more.

- The president-elect has proposed a universal tariff of 10% to 20% on all imports to the U.S. and a tariff of 60% or more on goods from China. Somewhat confusingly, Trump also has separately threatened 25% tariffs on goods from Canada and Mexico and an additional 10% tariff on China over immigration and drug issues

- The National Retail Federation said in a report that Trump’s proposed tariffs would be too large for U.S. retailers to absorb.

- One offset could be Trump’s proposed corporate tax cuts, which could benefit all U.S. companies’ bottom lines.

Change in consumer prices/Imports/Operating margins

WSJ 11/30/24

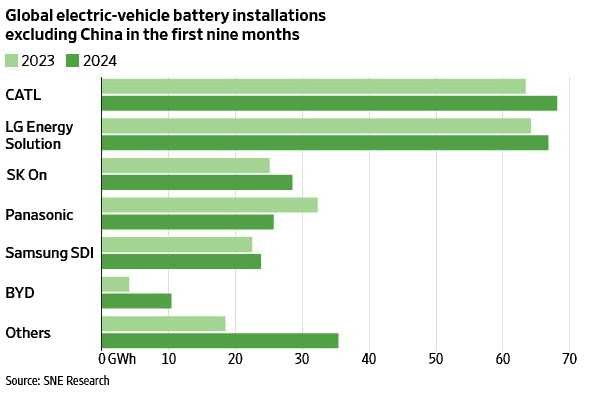

Battery Makers in South Korea Have Bright Future

한국 배터리 업체, 여전히 밝은 전망

WSJ 12/5/24(Thu)

- South Korean battery makers benefited from President Biden’s signature climate bill, the IRA. Donald Trump’s reelection brought some uncertainties to them, but it may not be all bad.

- These makers of batteries for electric vehicles have seen their shares plunge since Trump was elected. Samsung SDI ’sshare price dropped 23% in the past month while LG Energy Solution’s lost 9%. On the campaign trail, Trump railed against subsidizing the purchase of electric vehicles and has even said he may repeal the IRA.

- A wholesale repeal of the IRA seems unlikely. Samsung SDI and Stellantis ,for example, are investing more than $3.2 billion on a plant in Indiana. LG partnered with Hyundai Motor to spend $7.6 billion building manufacturing facilities for EVs and batteries in GA.

- Korean stocks generally face new political risks after the aborted declaration of martial law. But Western countries need to get their batteries from somewhere, and South Korea is likely to remain a politically favorable choice compared with China.

EV battery installations excluding China in the first 9 months

WSJ 12/5/24