Mortgage Interest Rates Review

United Mortgage Nation 12/17/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.899 | 6.375 | 6.299 | 4.363 | 6.875 | 6.875 |

| A month ago | 6.875 | 6.125 | 6.250 | 4.308 | 6.875 | 6.875 |

| Last week | 6.375 | 5.625 | 5.875 | 4.193 | 6.500 | 6.500 |

| This week | 6.499 | 5.750 | 5.999 | 4.409 | 6.500 | 6.500 |

Federal Fund Rate: 4.50 -4.75% Prime Rate: 7.50 – 7.75%

NYC Office Rebound Lifts Big Landlord

전국 모기지 금리, 6.69%로 하락

WSJ 12/11/24(Wed)

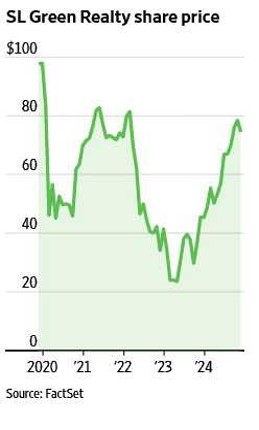

- The largest owner of New York City office space suffered a surge in vacancy when the pandemic emptied out the city’s office canyons and the firm struggled to find new tenants. Its shares plunged in 2020, then again after interest rates spiked in 2022.

- Now, few investors are benefiting more from the office market’s budding recovery than SL Green. White-collar workers are spending more time in offices. These tech, financial services, consulting and law firms are seeking primarily high-end buildings in desirable locations, like many of the ones SL Green owns.

- One Vanderbilt, its 1,401foot trophy office building with a popular observation deck near Grand Central Terminal, is fully leased. The firm last month sold a stake in the building that valued the property at $4.7 billion, making it the most valuable office tower in the U.S.

SL Green Realty share price

WSJ 12/11/24

Popular observation deck at One Vanderbilt, 1401 ft office building

WSJ 12/11/24

Next year World Korean Business Convention will be held in Duluth, GA

내년 세계한인비지니스대회 미국 아틀란타에서 열린다

Korea Times 12/16/24(Tue)

- Oversea Korean Association (동포청 : 청장 이상덕) has decided that the 23th World Korean Business Convention ( former “HanSang” Convention) will be at “Gas South” Convention Center in Duluth, GA, next door to C Land Duluth Office at 2385 Satellite Blvd, Duluth, GA.

- The 22nd WKBC held in JunJoo(전주) in Korea gathered about 1000 people, and the 21st WKBC held in Orange county, LA gathered about 7000 people.

- Kyung Chul Lee, the president was planning to open the 1st U.S. Korean Business Convention(미주 한인비지니스 대회) in Gas South convention center and now will be changed to the 23th WKBC in April 2025.

Inflation Worries Ding Stocks;

Bond Yields Post Big Weekly Gain

주식가 하강에, 국채 수익률 상승

WSJ 12/14/24(Sat)

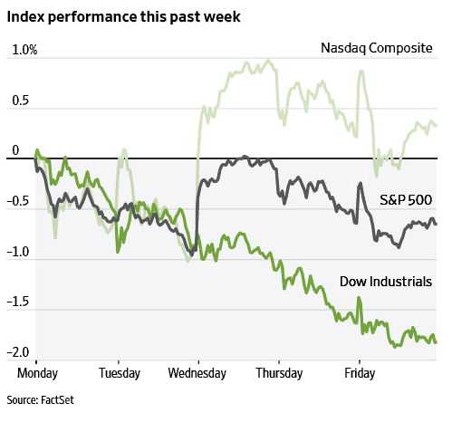

- U.S. stocks fell Friday in light but broad-based selling by investors worried about persistent inflation and the upward move in bond yields.

- The Dow Jones Industrial Average fell 0.2%, slipping for a seventh-straight session, its longest such streak since February 2020. The S& P 500 dropped slightly. The tech-heavy Nasdaq Composite eked out 0.1% gain.

- Rising bond yields, and nagging concerns over inflation, are giving equity investors pause in the final weeks of what has been a banner year for stocks.

- The 10-year Treasury note yield finished the week one-quarter percentage point higher at 4.398%. It was the largest weekly gain since October of 2023 and ended a period of mostly steady declines since the presidential election. Bond yields rise when prices fall, often reflecting investor expectations that interest rates will increase.

Index performance this week

WSJ Inde12/16/24

Morgan Stanley bets January drop after December drop

모건 스탠리 보고서: 12월 이자 감소 이어 1월에도 감소

Korea Times 12/11/24(Wed)

- Investment bank, Morgan Stanley forecasted FFR drop in January next year after the drop in December this year, consequently traders in the market do so and increased bets on commodity and swap as well.

- The Fed, FOMC meeting will held on Dec 17-18 this year and Jan 28-29 in 2025.

- The market see the probability of dropping FFR in Dec 17-18 FOMC meeting is almost 80 % this week, while it was 64% in Nov, before the labor market statistics announced in Nov.

Productivity Boom Propels Economic Growth in U.S.

생산성 증가가 미국의 경제 성장을 추진해…

WSJ 12/6/249Fri)

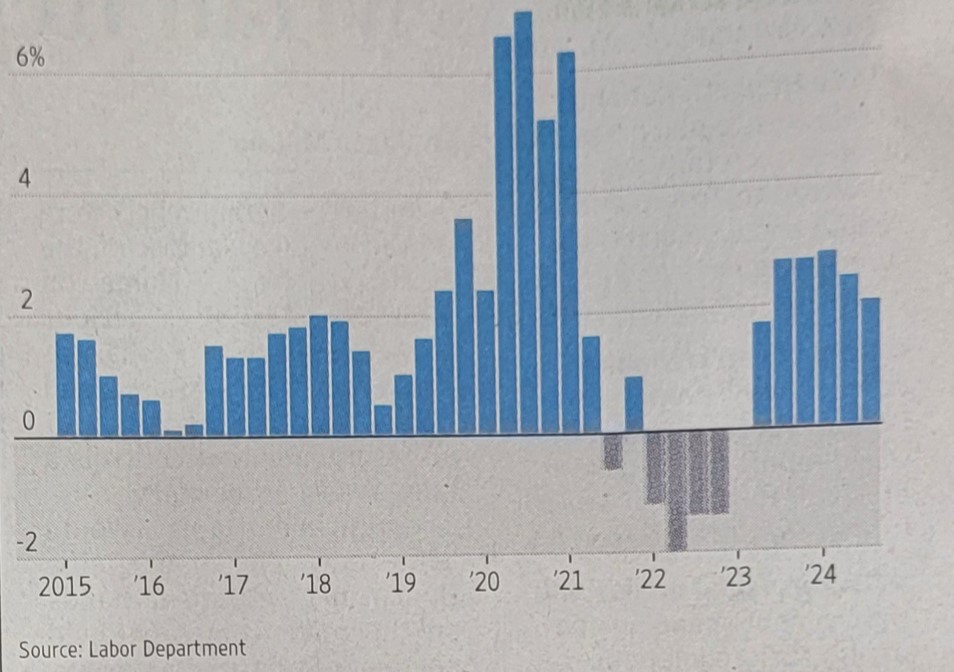

- Inflation and the labor market are both cooling, but a subtle force has powered strong U.S. economic growth nonetheless. Americans keep finding ways to get more done at work.

- As a result, many businesses have been able to do more with less and up their revenue without passing on higher costs to customers – process that makes this trend, called productivity growth, a key ingredient for a low-inflation economic boom.

- Over the past two years, better productivity growth has helped the U.S. power past similar economies such as the European Union’s and Canada’s.

- So far this year, the quarterly productivity of U.S. workers has grown by at least 2% compared with a year earlier. Over the past five years, quarterly year-over-year productivity growth has averaged 2.1%, a sharp improvement from growth over 10 years prior.

Quarterly U.S. productivity,

change from a year earlier

WSJ 12/6/24

CEOs are Taking a Rosier View of Next Year

기업주들, 내년을 좀 더 긍정적으로 예상…

WSJ 12/17/24(Tue)

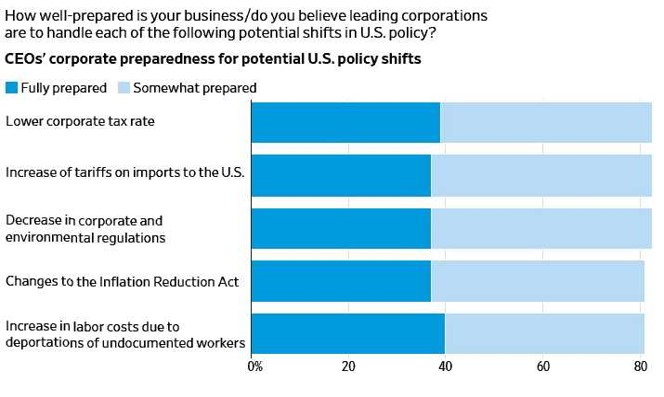

- CEOs of the world’s biggest companies are more optimistic about the economy than they have been in years.

- The enthusiasm is being driven in part by the prospect of President-elect Donald Trump’s return to the White House, with many chief executives expecting their businesses to benefit from lower corporate taxes and less regulation, according to a new survey.

- Overall, 77% of chief executives said they expect the global economy will improve in the first half of next year, according to the survey of more than 300 public-company CEOs by advisory firm Teneo. That compares with 45% who made a similar forecast last year.

- A little more than 50% of that group expect the economy to improve in the next six months, up from 16% in 2023 and 6% in 2022.

CEOs’ corporate preparedness for potential U.S. policy shifts

WSJ 12/17/24

Economists forecast Not much drop on FFR

트럼프 리스크에…연준 금리 많이 못 내릴듯

Korea Times 12/17/24(Tue)

- According to Financial Time’s report from the survey through 47 seasonal economists, majority of economists say the Fed will not to be aggressive next year and FFR would be around 3.5% toward the end of 2025 while previous September survey said it would be below 3.5%.

- If FOMC current meeting(Dec 17 – 18) would drop FFR by 0.25% again, then it becomes 4.25% – 4.5%.

- More than 60% of economists participated in this survey say that Trump 2.0 will affect the economy growth negatively – Heavy tariff, Illegal Immigrants Deportation policy, Lowering Tax, and Deregulations, etc.